- United States

- /

- Building

- /

- NYSE:AWI

Armstrong World Industries (AWI): Evaluating Current Valuation After a Recent Pullback in Share Price

Reviewed by Simply Wall St

See our latest analysis for Armstrong World Industries.

Armstrong World Industries may be cooling off this week, but the longer view shows real momentum. The stock’s 38.2% year-to-date share price return and a total return of 39.4% over the past year both point to strong, sustained performance, well beyond short-term dips. With steady financials and a history of delivering for shareholders, the recent price pullback could reflect shifting investor sentiment more than any major change in business fundamentals.

If this solid track record has you curious about what else is on the move, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership.

The real question for investors now is whether Armstrong World Industries is trading below its true value, or if recent gains mean the market has already factored in the company’s future growth potential and prospects.

Most Popular Narrative: 3.6% Undervalued

With Armstrong World Industries' most-watched narrative setting fair value at $200.89 and the stock last closing at $193.59, analysts see the shares pricing in upside potential despite market volatility. The prevailing narrative builds its case on robust earnings forecasts, strategic innovations, and momentum in future margins.

Ongoing strategic acquisitions (e.g., 3form, Zahner) and successful integration are broadening Armstrong's addressable market to capture additional spaces within commercial buildings and accelerate cross-selling opportunities. This supports both revenue growth and improved net margins through scale and operational synergies.

Want to know what’s fueling this optimism? There’s a bold vision for growth and ambitious profitability targets driving this narrative. The fair value hinges on forward-looking bets about operating leverage, new customer markets, and margin expansion. Get the details behind these headline-driving assumptions in the full narrative.

Result: Fair Value of $200.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still risks to watch for, such as sluggish commercial construction activity or persistent cost pressures. These factors could challenge Armstrong's growth momentum.

Find out about the key risks to this Armstrong World Industries narrative.

Another View: The Market Multiple Challenge

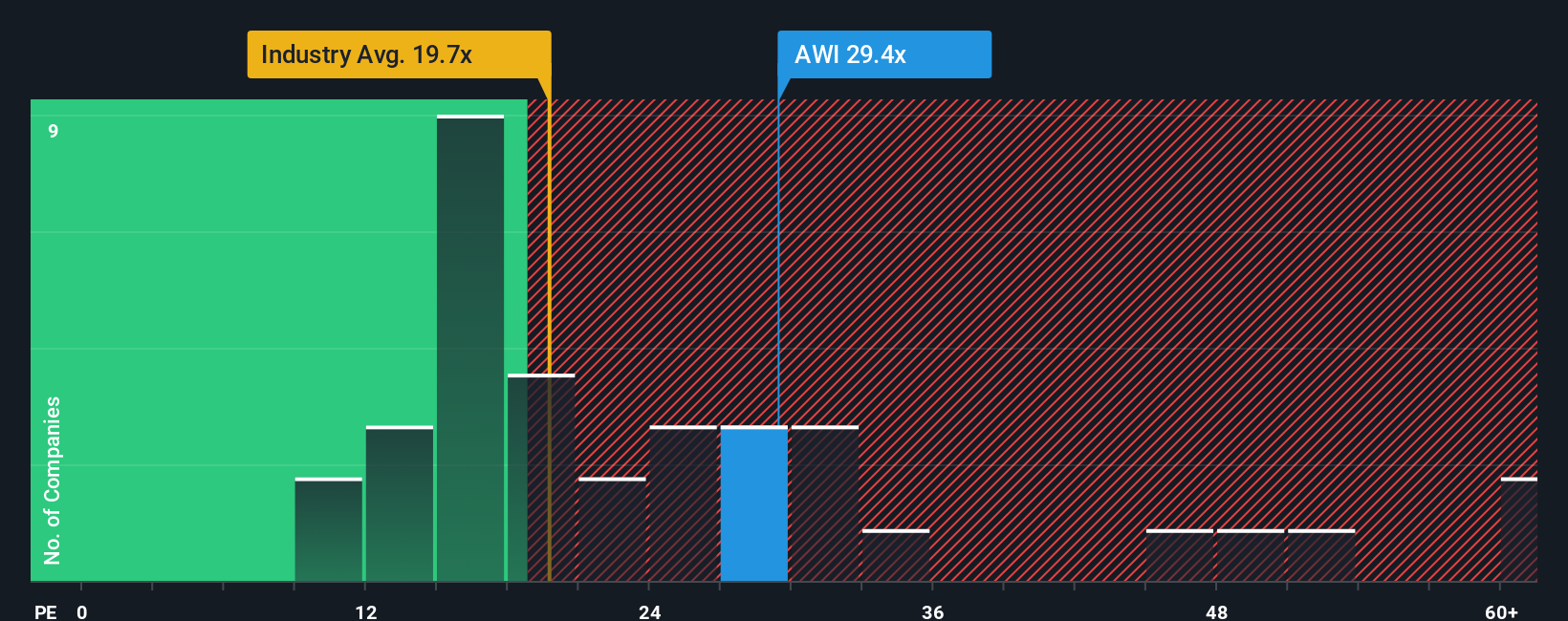

Taking a step back, valuation based on price-to-earnings multiples tells a different story for Armstrong World Industries. The current multiple stands at 28.3x, higher than both the industry average of 19.9x and the fair ratio of 21.8x. This means investors are paying more for each dollar of earnings compared to peers and what our fair ratio analysis suggests. High multiples can flag elevated expectations. What happens if growth falters or the market mood shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Armstrong World Industries Narrative

If you have a different perspective or want to dig into the numbers yourself, it only takes a few minutes to shape your own narrative. Do it your way.

A great starting point for your Armstrong World Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunity is everywhere if you know where to look. Don’t limit yourself—expand your horizons now with these powerful strategies and get ahead.

- Unleash the upside potential of growth by scanning these 26 AI penny stocks, bringing artificial intelligence to the forefront of innovation.

- Capture resilient income by reviewing these 21 dividend stocks with yields > 3%, with high yields designed to build wealth over time.

- Tap into major price bargains with these 863 undervalued stocks based on cash flows and maximize your portfolio’s future potential before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWI

Armstrong World Industries

Engages in the design, manufacture, and sale of ceiling and wall solutions in the Americas.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives