- United States

- /

- Electrical

- /

- NYSE:ATKR

Atkore (ATKR): Assessing Valuation as Investor Sentiment Shifts Following Recent Share Price Moves

Reviewed by Kshitija Bhandaru

Atkore (ATKR) has recently attracted attention from investors, as its stock performance over the past month contrasts with steeper declines observed in the past three and twelve months. The company’s returns hint at some shifting sentiment worth exploring.

See our latest analysis for Atkore.

While Atkore’s most recent 30-day share price return of 5.6% hints at some short-term momentum, the broader story revolves around a year-to-date share price decline of 23.1% and a 1-year total shareholder return of -24.5%, signaling investors are still weighing the balance between growth potential and shifting market risks. After several years of outperformance, with a 5-year total return still an impressive 170.9%, the recent softness suggests that confidence is regrouping as the market reassesses valuation and future prospects.

If you want to see what other fast-moving companies are catching attention lately, now’s the perfect moment to broaden your watchlist and discover fast growing stocks with high insider ownership

With shares still trading below recent highs but just a shade under analyst targets, investors are left to weigh whether Atkore is truly undervalued at this time or if the market is already factoring in its future growth prospects.

Most Popular Narrative: 1.6% Undervalued

With Atkore’s most widely followed narrative setting a fair value just above the latest close, debate is heating up over analyst growth assumptions versus current market pricing. The narrow discount raises a closer look at the reasons behind this valuation call.

Robust investment trends in data centers and solar infrastructure, driven by demand for cloud/AI and renewable energy, are expected to deliver above-GDP growth in those verticals, expanding Atkore's addressable market and underpinning long-term revenue growth.

What’s fueling this price target? The narrative points to significant expectations around margin recovery and accelerating profit growth, but the exact numbers behind the scenes are surprising. Interested in whether the projected turnaround is rooted in resilient sectors or over-optimism? Explore the full narrative to see what could influence this stock’s rebound.

Result: Fair Value of $63.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing input cost volatility and unpredictable project timing could challenge Atkore’s earnings stability and raise questions about the optimistic growth outlook.

Find out about the key risks to this Atkore narrative.

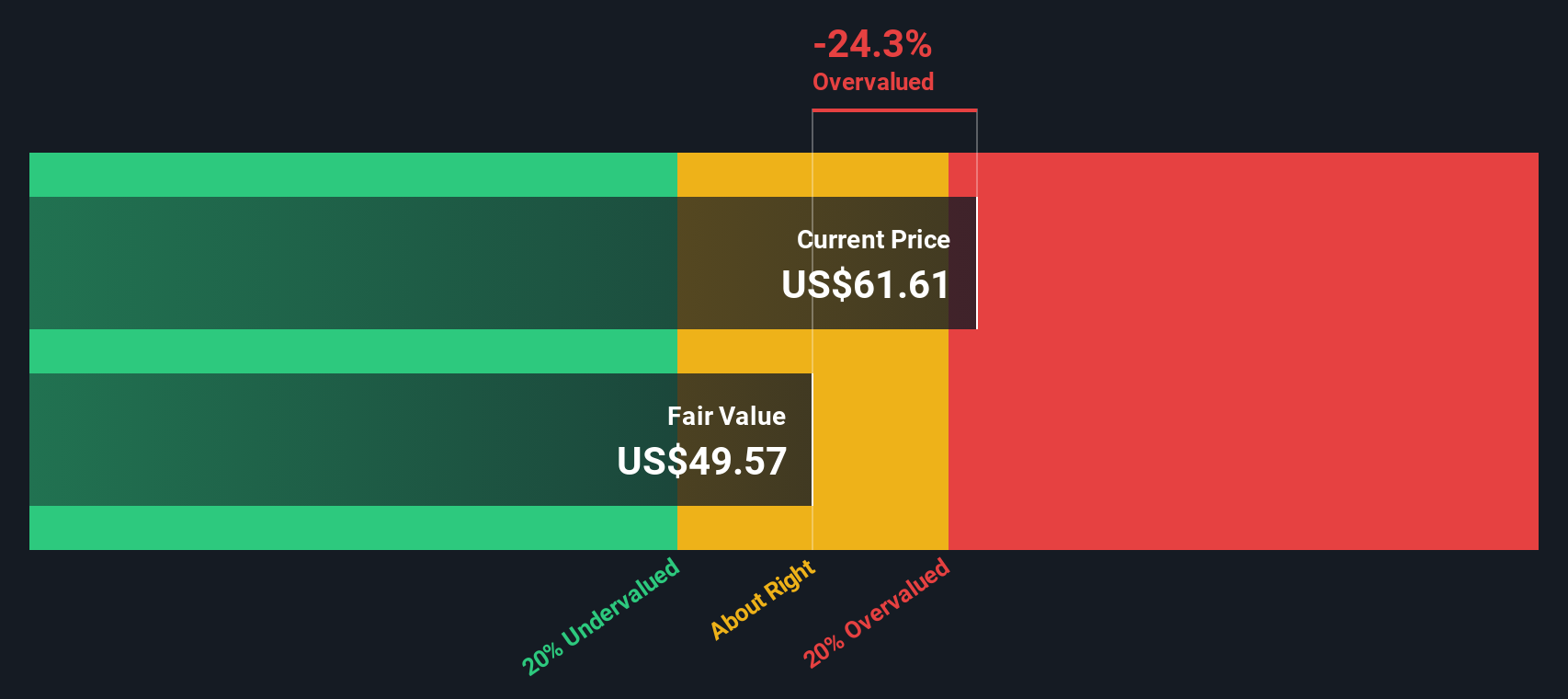

Another View: Discounted Cash Flow Model Tells a Different Story

Taking a step back from analyst price targets and industry comparisons, our DCF model estimates Atkore's fair value at $49.93 per share. This figure is below the current share price. This suggests that, under conservative cash flow assumptions, the market may be pricing in more optimism than the fundamentals support. Could investors be overestimating how quickly earnings will rebound?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Atkore for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Atkore Narrative

If you think the numbers tell a different story or want to dig into the data first-hand, you can craft your own Atkore narrative in just a few minutes. Do it your way

A great starting point for your Atkore research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let potential opportunities slip by. These handpicked ideas could spark your next winning move. Try them now to stay ahead of the curve.

- Capture impressive returns by scanning these 898 undervalued stocks based on cash flows showing the most compelling bargains relative to their future cash flows.

- Unlock stable income streams by evaluating these 19 dividend stocks with yields > 3% that consistently yield over 3% and add resilience to any portfolio.

- Tap into explosive growth potential through these 25 AI penny stocks positioned at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATKR

Atkore

Engages in the manufacture and sale of electrical, mechanical, safety, and infrastructure products and solutions in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives