- United States

- /

- Electrical

- /

- NYSE:ATKR

Atkore (ATKR): Assessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Atkore (ATKR) shares have seen some movement lately, attracting interest from investors looking for actionable signals. With recent price shifts over the past month, many are curious about what might come next for this industrial supplier.

See our latest analysis for Atkore.

Atkore’s share price has climbed 12.8% over the past month and is showing signs of renewed momentum. However, total shareholder return over the past year remains down around 21%. After strong gains in prior years, this recent bounce may hint that sentiment is shifting as investors reconsider risk and growth potential at current levels.

If you’re looking for more companies showing impressive momentum, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With the share price climbing but still lagging its highs, investors face a familiar debate: is Atkore’s recent rally the start of a turnaround, or is the current price already factoring in anticipated growth?

Most Popular Narrative: 8% Overvalued

With Atkore’s last close price sitting above the most widely-followed consensus fair value estimate, the current rally appears to have priced in more optimism than analysts’ expectations support. The fair value projected by the leading narrative suggests investors may be anticipating stronger growth or a smoother recovery than what is currently forecast.

Robust investment trends in data centers and solar infrastructure, driven by demand for cloud/AI and renewable energy, are expected to deliver above-GDP growth in those verticals. This would expand Atkore's addressable market and support long-term revenue growth.

Curious which bold projections sit beneath this premium valuation? Find out how a profit margin leap, earnings surge, and shifting industry multiples combine to shape Atkore's consensus price target. This underlying logic might surprise those expecting a simple rebound story.

Result: Fair Value of $66.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant price declines for key products and volatile input costs could quickly undermine Atkore’s recent progress and challenge its long-term growth story.

Find out about the key risks to this Atkore narrative.

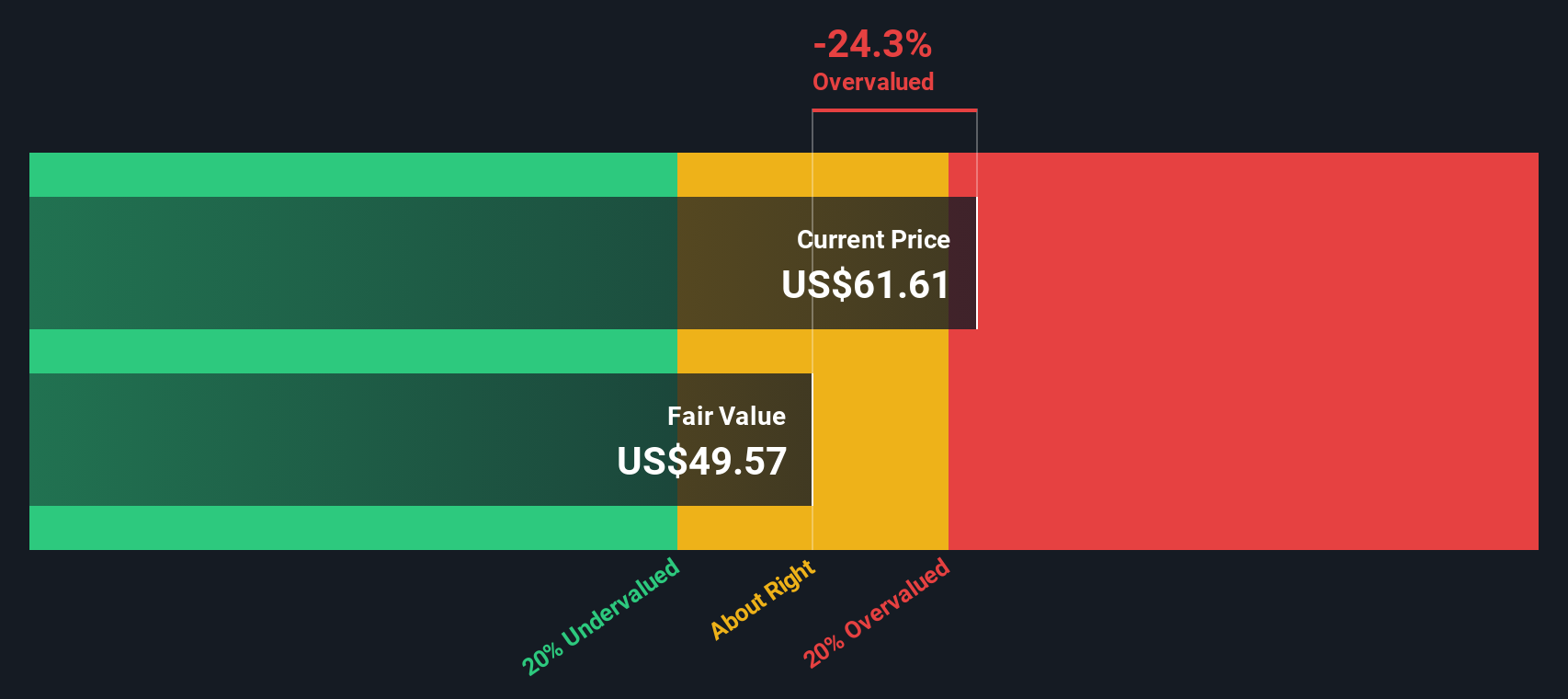

Another View: SWS DCF Model Tells a Different Story

While multiples suggest Atkore is attractively valued versus its peers and industry, our SWS DCF model paints a less optimistic picture. Based on projected future cash flows, Atkore’s share price currently exceeds the estimated fair value by a notable margin, signaling overvaluation from this perspective. Does this gap hint at downside risk, or does it reflect market optimism about longer-term growth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Atkore Narrative

If you like to examine the facts or want to build your own view, it only takes a few minutes to craft a narrative based on the latest data. Do it your way.

A great starting point for your Atkore research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just stop at Atkore. Uncover powerful opportunities by using the Simply Wall Street Screener and make sure you’re always ahead of the crowd.

- Spot hidden gems in high-growth markets by evaluating these 27 AI penny stocks, which are pushing the boundaries of artificial intelligence and automation.

- Start building your portfolio’s income potential by reviewing these 19 dividend stocks with yields > 3%, which features strong yields above 3% to help boost your returns.

- Get ahead of tomorrow’s megatrends with these 28 quantum computing stocks, which is driving breakthrough innovations in computing and advanced hardware.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATKR

Atkore

Engages in the manufacture and sale of electrical, mechanical, safety, and infrastructure products and solutions in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives