- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

ATI (ATI): A Fresh Look at Valuation Following CEO Leadership Changes and Strong Aerospace Momentum

Reviewed by Simply Wall St

ATI Inc. (ATI) caught investor attention following the recent announcement that CEO Kimberly A. Fields will become Board Chair next year. This move is designed to maintain momentum in its aerospace and defense focus.

See our latest analysis for ATI.

ATI's recent executive shuffle comes on the heels of an exceptional run for shareholders, with a 75% year-to-date share price return and a three-year total shareholder return above 240%. Leadership continuity appears to be reinforcing market confidence, as momentum is building in both ATI’s stock and its aerospace ambitions.

If the sector’s energy has sparked your curiosity, now is an ideal time to explore standout aerospace and defense companies. The full list is just a click away at See the full list for free.

With analyst sentiment on the rise and ATI’s stock trading well ahead of the industry, investors now face a crucial question: is there upside left, or is the market already pricing in years of growth?

Most Popular Narrative: 18% Undervalued

ATI's latest close at $96.47 is outpaced by the narrative consensus fair value of $118.25. That gap ignites debate about the next move. Let's spotlight one of the key assumptions driving this viewpoint.

Recent long-term contract expansions with both Boeing and Airbus, including new titanium alloy sheet supply and broader product offerings, lock in higher volumes and minimums, expand ATI's share, and feature inflation pass-through and attractive pricing, directly supporting reliable, higher-margin revenue growth and a structurally improved earnings base through the decade.

What’s the secret math behind this bullish price target? Analysts are banking on margin expansion and volume growth, but there is a twist in the projections that will surprise even seasoned investors. Don’t miss the details driving this forecast. See what could really move the needle next.

Result: Fair Value of $118.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain if key aerospace customers cut orders or if global supply chain pressures intensify. Either scenario could quickly dampen ATI’s bullish outlook.

Find out about the key risks to this ATI narrative.

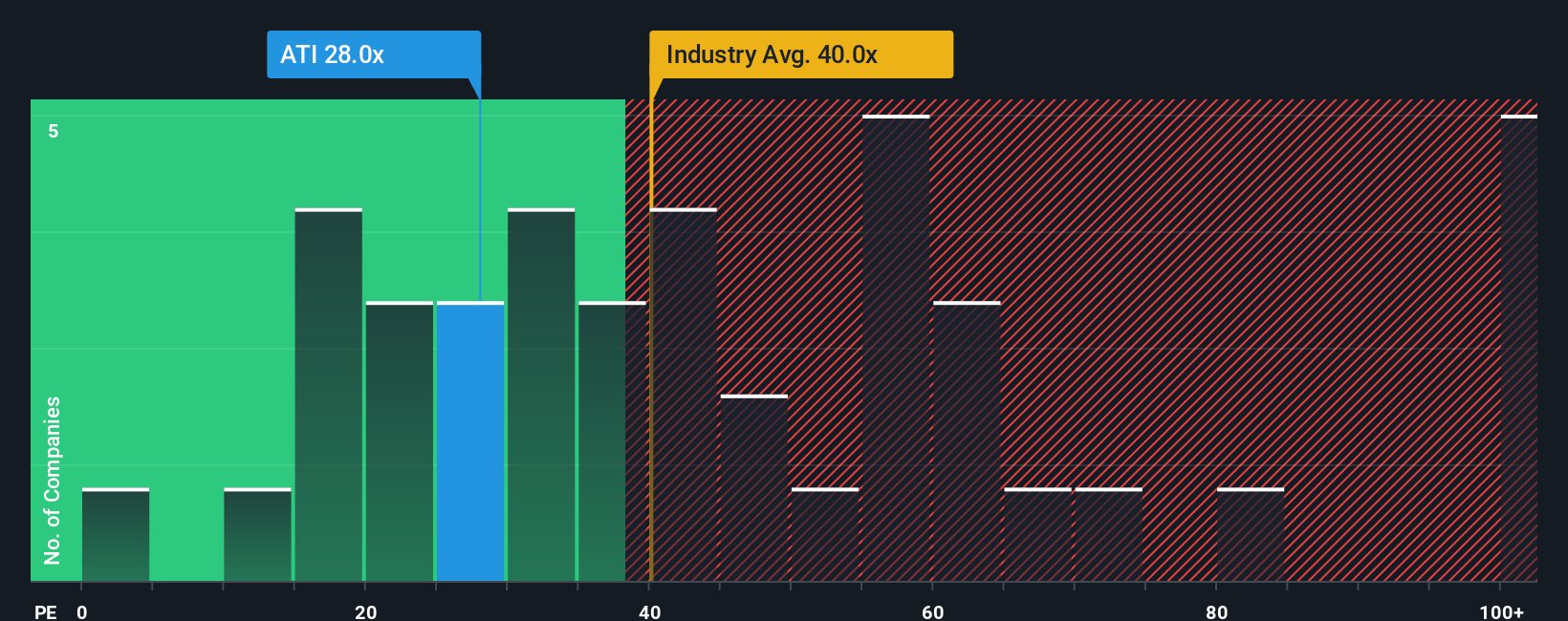

Another View: Multiple-Based Valuation

While the consensus fair value points to ATI being undervalued, a look at price-to-earnings ratios offers a subtler story. ATI trades at 29.5x earnings, lower than the industry average of 36.1x and its peer average of 31.6x, but still above its estimated fair ratio of 32.4x. This suggests ATI is priced reasonably, with some cushion but not a deep discount. Does this difference make ATI less risky, or is it a sign that the market is catching up to the story?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ATI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 922 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ATI Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft your own ATI view in just a few minutes. Do it your way

A great starting point for your ATI research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now and open the door to new opportunities by exploring original stock ideas curated for forward-thinking investors like you. Don’t let these possibilities slip by.

- Capture growth with these 26 AI penny stocks reshaping industries powered by artificial intelligence and automation. Find out who’s positioned to lead tomorrow.

- Maximize your income strategy as you scan these 15 dividend stocks with yields > 3% boasting strong yields and reliable payout records that help your wealth work smarter.

- Take charge and spot bargains in these 922 undervalued stocks based on cash flows that the market hasn’t fully appreciated yet. See which companies present big upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives