- United States

- /

- Construction

- /

- NYSE:APG

APi Group (APG) Valuation Check as 2025 Revenue Guidance Targets at Least Midpoint of Range

Reviewed by Simply Wall St

Guidance-driven outlook for APi Group stock

APi Group (APG) just updated its 2025 outlook, telling investors it expects net revenue to land at or above the midpoint of its guidance range, roughly $7.9 billion for the year.

See our latest analysis for APi Group.

The guidance update comes after strong recent momentum, with a roughly 62 percent year to date share price return and a three year total shareholder return above 200 percent, suggesting investors are increasingly pricing in sustained growth.

If APi Group’s trajectory has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for more potential standouts.

With shares up sharply and management guiding to higher revenues, investors now face a key question: is APi Group still trading below its intrinsic value, or has the market already priced in years of future growth?

Most Popular Narrative Narrative: 9.4% Undervalued

With APi Group last closing at $38.88 against a narrative fair value near $42.90, the spread suggests expectations for stronger profitability ahead.

Consistent expansion in recurring contracts now targeted to reach 60%+ of revenue by 2028 supports higher adjusted EBITDA margins and predictable cash generation, further improving earnings quality and financial resilience. Continued progress on digital transformation, AI driven productivity tools, and process standardization is expected to deliver ongoing operating leverage and SG&A efficiency, enhancing incremental margins and overall profitability.

Curious how rising recurring revenue, ambitious margin targets, and a richer future earnings multiple all stack up into that valuation call? The narrative explains the growth math behind this seemingly modest discount, step by step.

Result: Fair Value of $42.9 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view could be challenged if integration of bolt on deals stumbles or if tight, skilled labor markets continue to squeeze margins.

Find out about the key risks to this APi Group narrative.

Another View: Multiples Flag Rich Pricing

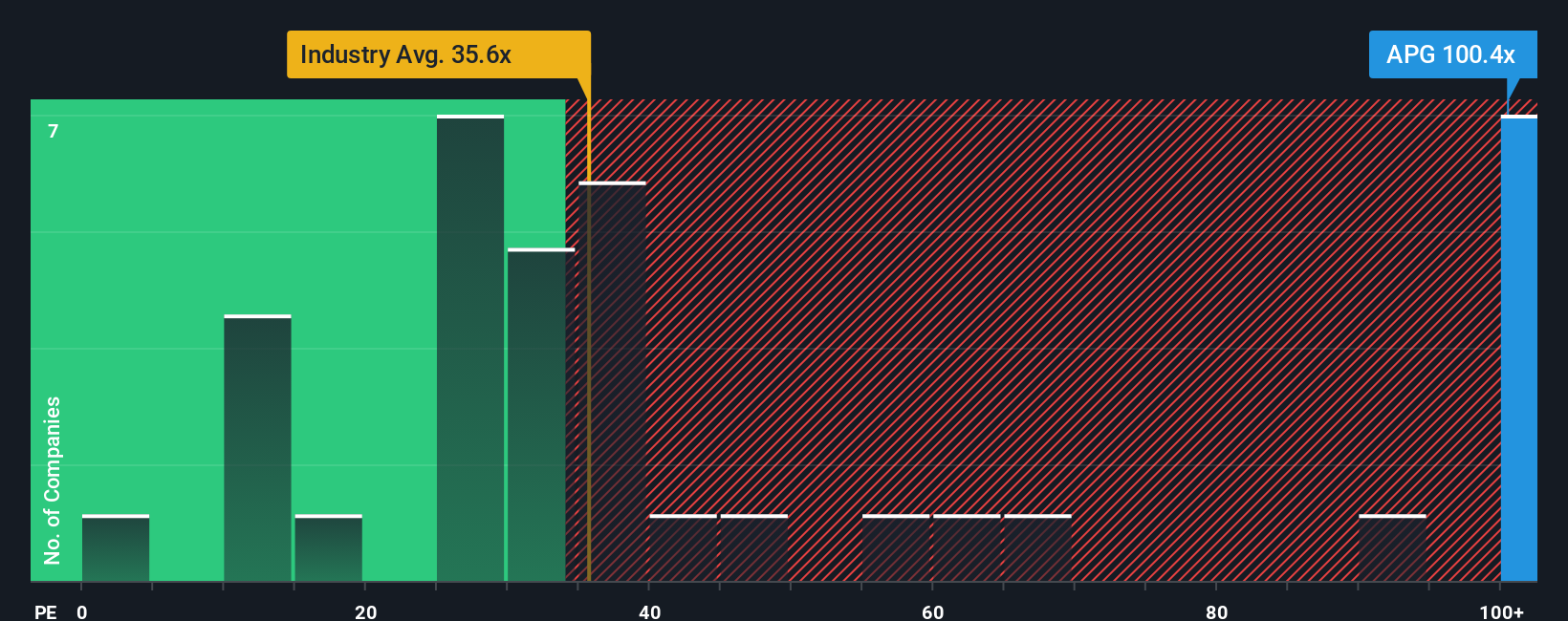

While narratives and guidance point to upside, the current earnings multiple tells a different story. APi Group trades at about 103.7 times earnings, versus roughly 32 times for the US Construction industry and an estimated fair ratio of 59.1 times. This suggests meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own APi Group Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a complete narrative in just minutes, Do it your way.

A great starting point for your APi Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put your capital to work by scanning focused stock ideas on Simply Wall St’s screener so you do not miss the next standout opportunity.

- Capture potential mispricings early by targeting these 910 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Tap into powerful secular trends by zeroing in on these 24 AI penny stocks poised to benefit from accelerating adoption of artificial intelligence.

- Secure more reliable income streams by reviewing these 12 dividend stocks with yields > 3% that may complement or balance growth focused positions like APi Group.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APG

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion