- United States

- /

- Building

- /

- NYSE:AOS

Will A. O. Smith’s (AOS) 6 Percent Dividend Hike Signal a Shift in Growth Expectations?

Reviewed by Sasha Jovanovic

- On October 13, 2025, A. O. Smith’s board approved a 6% increase in the quarterly cash dividend to $0.36 per share, payable November 17 to shareholders of record as of October 31.

- This dividend boost, alongside optimism about upcoming earnings and increased demand in the water purification market, highlights the company’s commitment to shareholder returns and positions it within a swiftly evolving industry.

- We’ll explore how the dividend increase signals confidence in A. O. Smith’s cash flow and future growth prospects.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

A. O. Smith Investment Narrative Recap

To be an A. O. Smith shareholder right now, you need to believe in the company’s ability to leverage rising demand in water treatment and purification, while effectively navigating weakness in key overseas markets and a largely mature North American water heater sector. While the recently raised dividend reflects management’s confidence and commitment to rewarding shareholders, its effect on near-term earnings will be modest compared to more direct business catalysts or risks, such as ongoing market challenges in China or cost pressures in North America.

Among the latest announcements, the appointment of Chris Howe as Chief Digital Information Officer on October 3 stands out in relation to A. O. Smith’s shift toward higher-margin, tech-driven water filtration and heating solutions. This focus on digital transformation could become increasingly important as the company prioritizes innovation to boost growth and set itself apart from competitors, especially with increasing demand for smart water purifiers and connected appliances.

However, it is important to keep in mind that, despite the positive outlook and growing dividend, investors should not overlook the ongoing risk of prolonged weakness and uncertainty in China, where...

Read the full narrative on A. O. Smith (it's free!)

A. O. Smith's outlook anticipates $4.3 billion in revenue and $634.5 million in earnings by 2028. This is based on a projected annual revenue growth rate of 4.6% and an earnings increase of $115.9 million from the current level of $518.6 million.

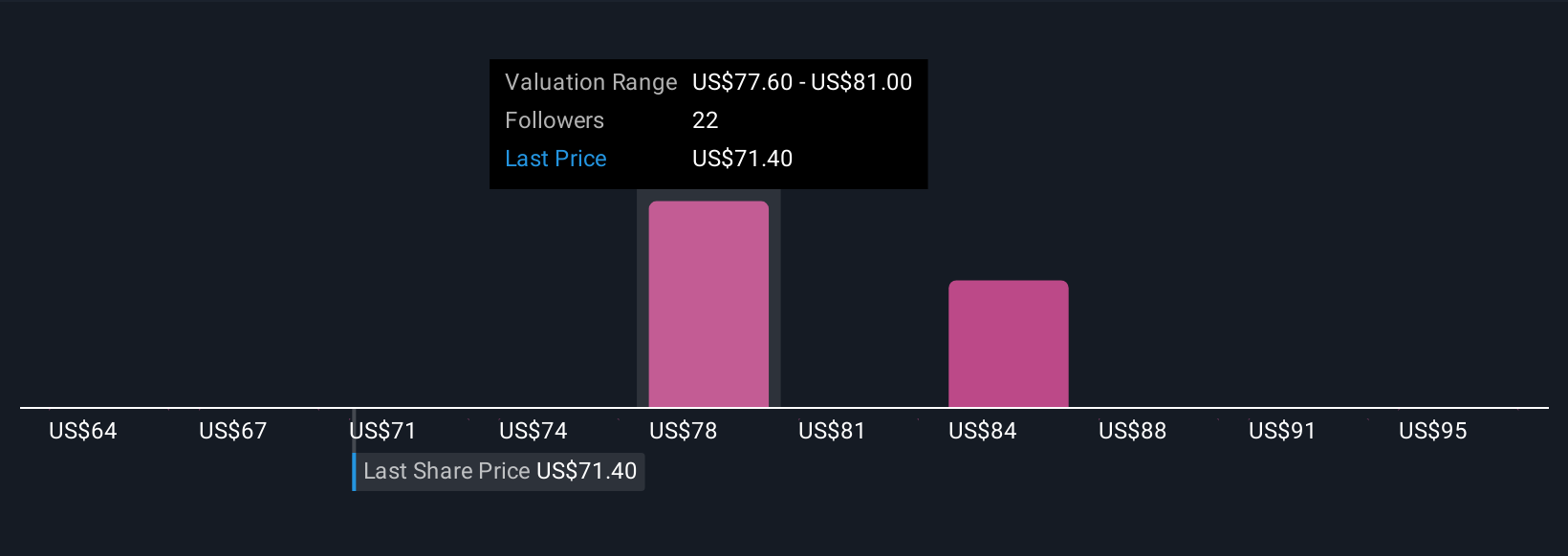

Uncover how A. O. Smith's forecasts yield a $79.83 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span from US$70 to an outlier near US$41,380, highlighting significant divergence in member forecasts. As you explore these alternative viewpoints, remember that many see slower North American growth and China headwinds as crucial issues for A. O. Smith’s future performance.

Explore 6 other fair value estimates on A. O. Smith - why the stock might be a potential multi-bagger!

Build Your Own A. O. Smith Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your A. O. Smith research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free A. O. Smith research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate A. O. Smith's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AOS

A. O. Smith

Manufactures and markets residential and commercial gas and electric water heaters, boilers, heat pumps, tanks, and water treatment products in North America, China, Europe, and India.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives