- United States

- /

- Construction

- /

- NYSE:AMRC

Ameresco (AMRC): Assessing Valuation After Quarterly Sales and Income Growth Plus 2025 Guidance Reaffirmation

Reviewed by Simply Wall St

Ameresco (AMRC) just reported higher sales and net income for both its third quarter and year-to-date results, compared to last year. The company also maintained its full-year revenue outlook, highlighting its ongoing growth story.

See our latest analysis for Ameresco.

Ameresco has stayed in the news lately, breaking ground on new clean energy projects, presenting at key industry conferences, and reiterating its earnings guidance for 2025. Despite a sharp 19% dip in its 30-day share price return, recent momentum remains positive with a 65% gain over 90 days and a 28% total shareholder return over the past year. This suggests that investors are warming up to Ameresco’s growth story after a challenging few years.

If watching Ameresco’s rebound has sparked your interest, now could be a fitting time to broaden your perspective and discover fast growing stocks with high insider ownership

With Ameresco delivering robust growth and reaffirming its guidance, investors now face a key question: is the current share price undervaluing future potential, or has the market already priced in next year’s expected gains?

Most Popular Narrative: 18.2% Undervalued

At $33.72, Ameresco's last close still trails the narrative fair value of $41.22, setting the stage for a closer look at the fundamentals driving this optimism.

Expanded government incentives for clean energy and storage (including ITCs and the Inflation Reduction Act) have allowed Ameresco to monetize new projects more quickly and enhance project economics. This has improved both revenue predictability and net margins through increased operating leverage.

Want to know what’s fueling this bullish valuation? The heart of the narrative is a major leap in recurring profits, together with a future profit multiple that defies industry trends. Curious which surprising assumptions are powering the jump from today’s value to the narrative’s price target? Dive in to see what’s behind these bold projections.

Result: Fair Value of $41.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain challenges or regulatory shifts could disrupt project execution. This poses real risks to Ameresco’s growth and profit outlook.

Find out about the key risks to this Ameresco narrative.

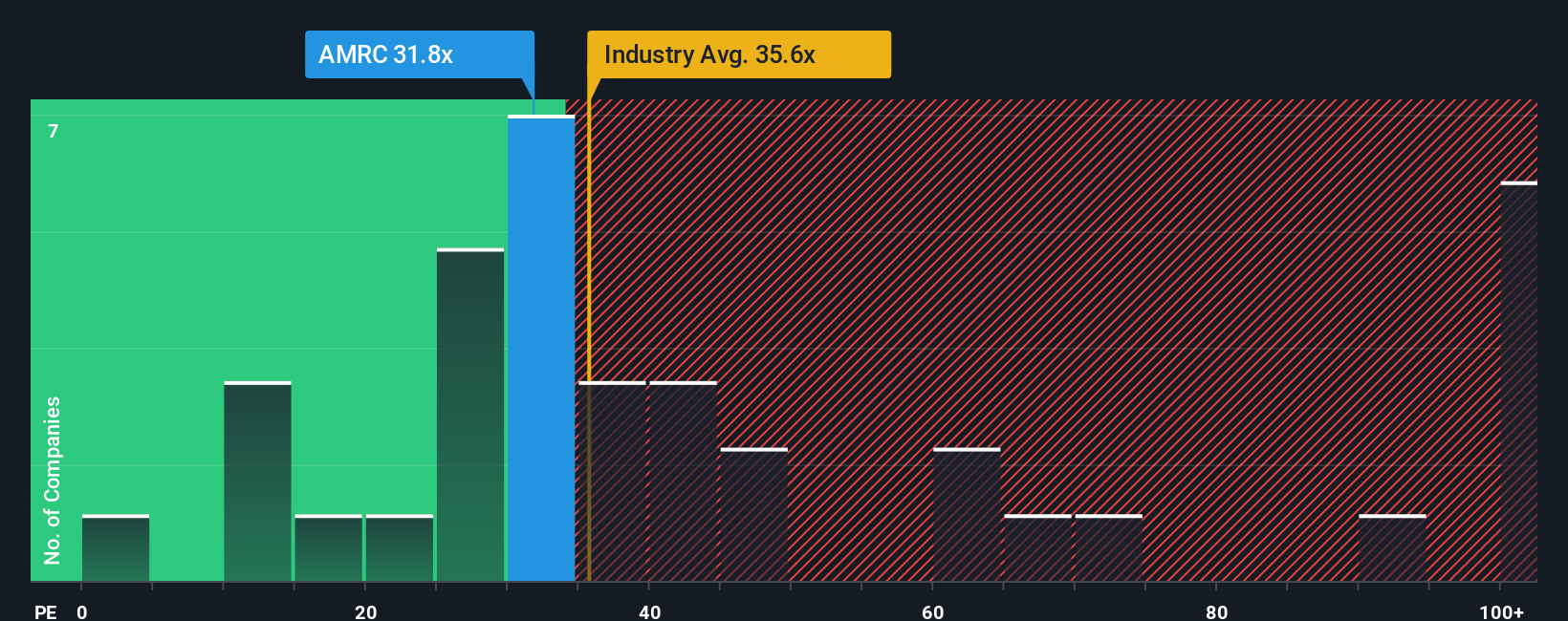

Another View: Price-to-Earnings Signals a Premium

While the narrative fair value puts Ameresco in the “undervalued” bracket, the company’s current price-to-earnings ratio stands at 28.3 times earnings. This is higher than the peer average of 25.2 but still below the US Construction industry’s average of 33.6. Compared to the fair ratio of 49.5, there seems to be room for upward movement, but paying a premium versus direct peers adds some valuation risk. Is the market being overly optimistic about sustained growth, or is there still opportunity on the table?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameresco Narrative

If you see things differently or prefer to do a bit of hands-on research, you’re welcome to put together your own narrative in just a few minutes. Do it your way

A great starting point for your Ameresco research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next opportunity to pass you by. Use the Simply Wall Street Screener to uncover companies off the radar and transform your watchlist with fresh potential.

- Supercharge your search for overlooked bargains by checking out these 865 undervalued stocks based on cash flows with strong cash flow and attractive valuations.

- Target long-term wealth with these 14 dividend stocks with yields > 3%, which delivers reliable yields above 3% for income-focused investors seeking portfolio stability.

- Get ahead of the curve as artificial intelligence reshapes markets by evaluating these 25 AI penny stocks with breakthrough potential in digital innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives