- United States

- /

- Construction

- /

- NYSE:AMRC

A Look at Ameresco (AMRC) Valuation Following Arizona’s Largest Battery Storage Project Launch

Reviewed by Simply Wall St

Ameresco (AMRC) just brought a 50MW, 200 MWh battery energy storage system online in Arizona, marking the state's largest behind-the-meter project so far. The rollout is connected to Nucor’s expansion and broader energy transition plans.

See our latest analysis for Ameresco.

Ameresco shares have soared lately, with a 19.4% 1-month price return and a notable 132% jump over the past 90 days. This momentum picked up after their Arizona battery project announcement, which helped offset a lackluster three-year total shareholder return and highlighted renewed growth enthusiasm.

If Ameresco’s recent surge has you interested in what’s next, now is a great moment to discover fast growing stocks with high insider ownership.

With such a dramatic share price turnaround and impressive project milestones, investors are left wondering whether Ameresco’s growth is already reflected in the stock price, or if the recent momentum signals a genuine buying opportunity.

Most Popular Narrative: 12% Overvalued

With Ameresco closing at $41.55 and the narrative setting fair value at $37.11, the stock price sits notably above the consensus valuation. This gap is fueling debate over whether optimism has run ahead of the underlying fundamentals.

Expanded government incentives for clean energy and storage (including ITCs and the Inflation Reduction Act) have allowed Ameresco to monetize new projects more quickly and enhance project economics. This has improved both revenue predictability and net margins through increased operating leverage.

Want to unravel how new projects, smart contract wins, and ambitious margin improvement shape this valuation? The narrative is built on aggressive growth projections, and a crucial financial leap that only a deeper dive will reveal.

Result: Fair Value of $37.11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions and shifting regulatory policies could easily derail Ameresco’s growth projections. This casts uncertainty over its future performance.

Find out about the key risks to this Ameresco narrative.

Another View: How Does Market Pricing Stack Up?

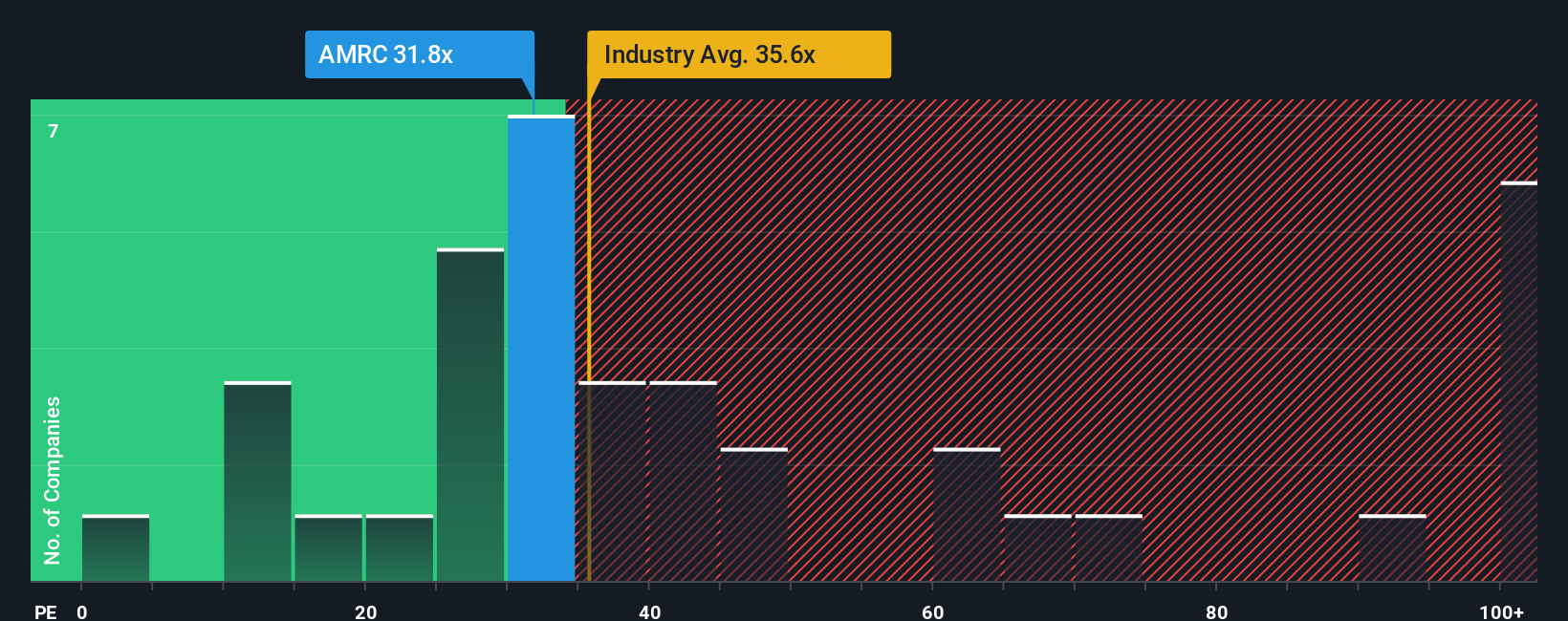

Looking at Ameresco through the lens of price-to-earnings, the market is valuing shares at 35.3 times earnings, which is essentially in line with peers and the US Construction industry average of 35.8. However, this is well below our calculated fair ratio of 52.3. This narrower gap suggests a more balanced risk profile, but also means upside could be limited unless the market re-rates. Does this close pricing leave the stock exposed to swings in sentiment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameresco Narrative

If you’re keen to dig into the numbers and shape the story to fit your perspective, you can easily craft your own take in just a few minutes. Do it your way.

A great starting point for your Ameresco research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Staying ahead means seizing opportunities others might miss. Uncover game-changing stock ideas with the tools experts use, and spot tomorrow’s winners before the crowd.

- Tap into untapped potential by tracking these 875 undervalued stocks based on cash flows, which stand out for impressive cash flow valuation and offer attractive entry points.

- Spot the next wave of health transformation by following these 34 healthcare AI stocks, making breakthrough advances in AI-driven medical and life sciences.

- Accelerate your search for future-defining innovations by zeroing in on these 28 quantum computing stocks, positioned at the center of quantum computing’s growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives