- United States

- /

- Electrical

- /

- NYSE:AMPX

Is It Too Late to Consider Amprius Technologies After Shares Surge Over 1100% in 2025?

Reviewed by Simply Wall St

Thinking about what to do with Amprius Technologies stock? You’re not alone. After a jaw-dropping 1129.6% gain over the past year and an incredible 308.7% surge year-to-date, plenty of investors are wondering if the recent rally is just the beginning or if it’s time to take profits. In just the past month, shares leapt 63.0%, while the last week alone saw a spirited 27.9% jump. These dramatic moves have caught the market’s attention and signal that perceptions of the company’s growth prospects, and perhaps its risk profile, have shifted in a big way.

Some of this enthusiasm has been tied to industry chatter about breakthroughs in advanced battery technologies, which could boost companies like Amprius Technologies. But with all this excitement, it’s natural to ask: is the stock still trading at a fair price or have expectations outpaced reality?

Running a quick check on valuation tells us Amprius scores a 0 out of 6 on commonly used undervaluation criteria, meaning the standard metrics just aren’t flashing bargain here. So, how should investors think about what these numbers are really saying? Next, I’ll walk you through the traditional approaches analysts use to value companies like Amprius, and stick around because we’ll finish with a fresh perspective that could help make sense of this unique story.

Amprius Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Amprius Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors gauge what a stock might truly be worth based on the business’s ability to generate cash in the years ahead.

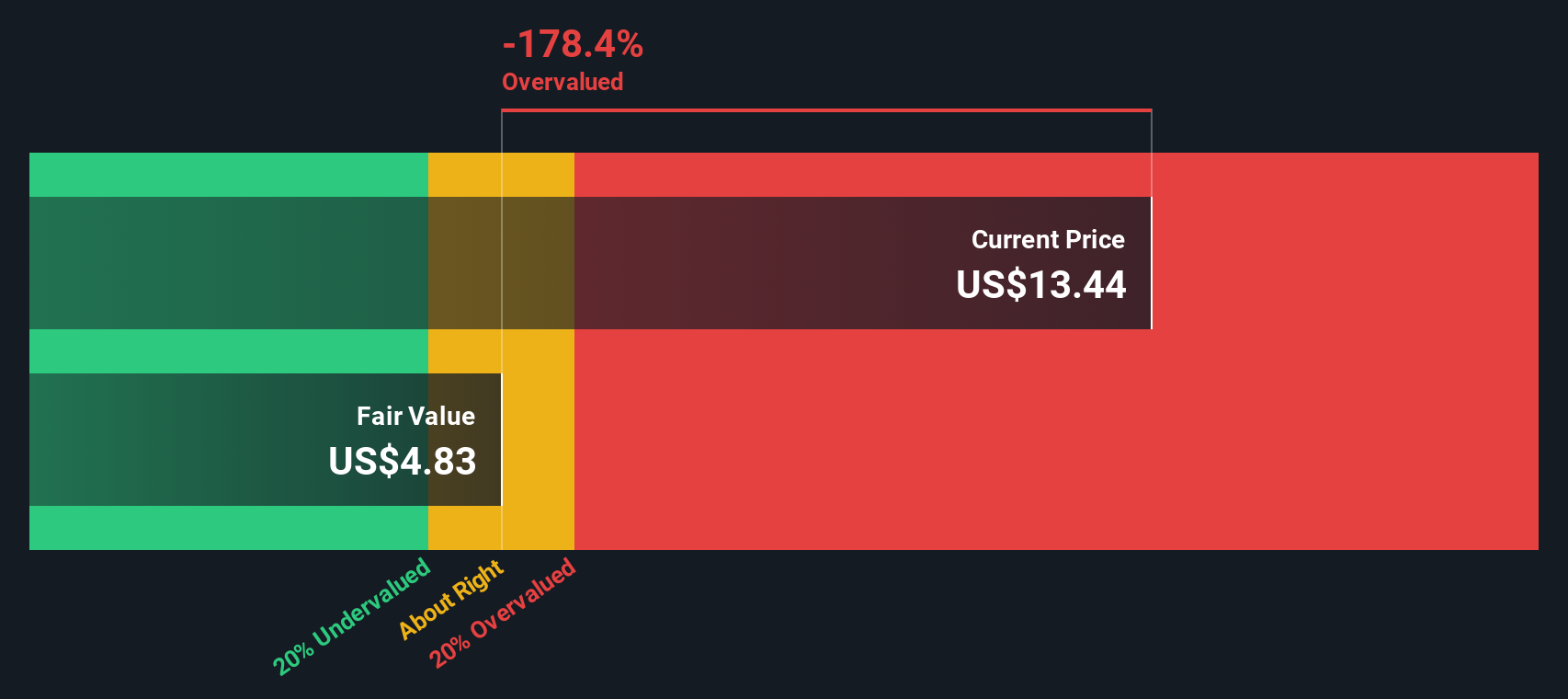

For Amprius Technologies, the DCF uses a 2 Stage Free Cash Flow to Equity model. The company’s last twelve months of Free Cash Flow stands at -$51.35 million, deep in negative territory as the firm invests heavily for future growth. Analysts forecast substantial improvement, with Free Cash Flow projected to recover to $16.35 million by 2027. Beyond that, Simply Wall St extrapolates these estimates, showing continued annual growth in cash flows and reaching $53.51 million by 2035.

Based on these projections, the DCF model calculates an estimated fair value of $4.92 per share. However, Amprius’s current share price is 137.8% higher than this intrinsic value, indicating the stock is dramatically overvalued according to these cash flow-based assumptions.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Amprius Technologies.

Approach 2: Amprius Technologies Price vs Sales

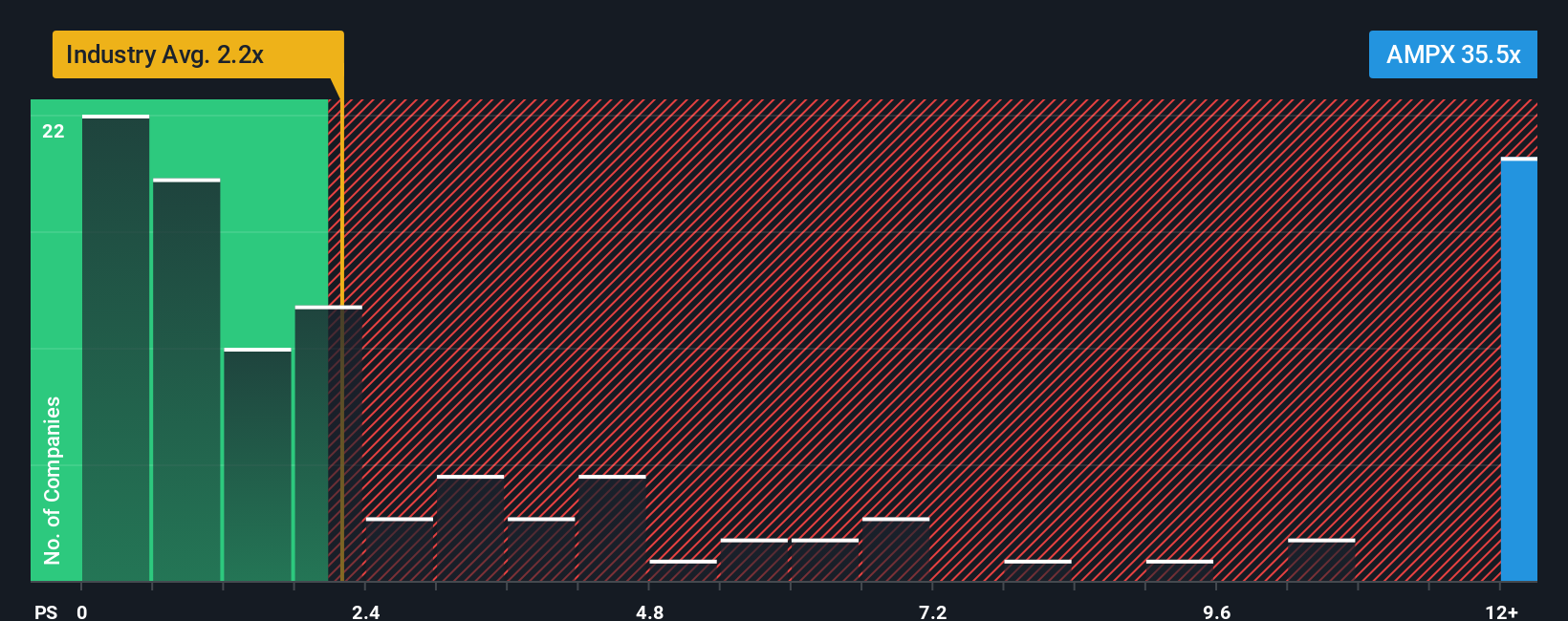

Valuing a company using the Price-to-Sales (P/S) multiple is common when the business is not yet profitable, as is the case with Amprius Technologies. For companies still in growth mode or investing heavily in future opportunities, sales offer a clearer and more consistent benchmark than earnings, which can be volatile or negative during expansion phases.

What counts as a “normal” or “fair” P/S ratio depends on the company’s growth prospects and risk profile. High-growth innovators often deserve a premium, but higher risk or inconsistent performance can lower that multiple. For context, Amprius currently trades at a P/S ratio of 32.6x, which is significantly above the electrical industry average of 2.2x and its peer set average of 6.3x. While such a sizable premium could suggest the potential for strong future growth or indicate elevated risks, it is important to view this in a broader context.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. Unlike basic comparisons to industry or peer averages, the Fair Ratio analyzes Amprius’s growth trajectory, profit margins, risks, industry category, and market capitalization to estimate what would actually be reasonable for this stock. For Amprius, the Fair Ratio lands at 1.41x. With the actual P/S at 32.6x, this represents a significant gap, signaling a stock that is priced far above what today’s fundamentals and risk factors would warrant.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Amprius Technologies Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a story or perspective you create about a company that links your view of its business prospects to a set of financial forecasts and, ultimately, a fair value for the stock.

Instead of relying only on historical numbers or rigid analyst models, Narratives allow you to express your own outlook. For example, your expectations for Amprius Technologies’ revenue growth, margins, and earnings can be reflected in a Narrative to see what those mean for the company's fair value.

Narratives make valuation accessible and dynamic. Anyone can build and update them on the Simply Wall St platform’s Community page, which is used by millions of investors. When new information comes in, Narrative fair values update in real time, allowing you to quickly compare your Narrative price to the actual market price and make more informed decisions about buying or selling.

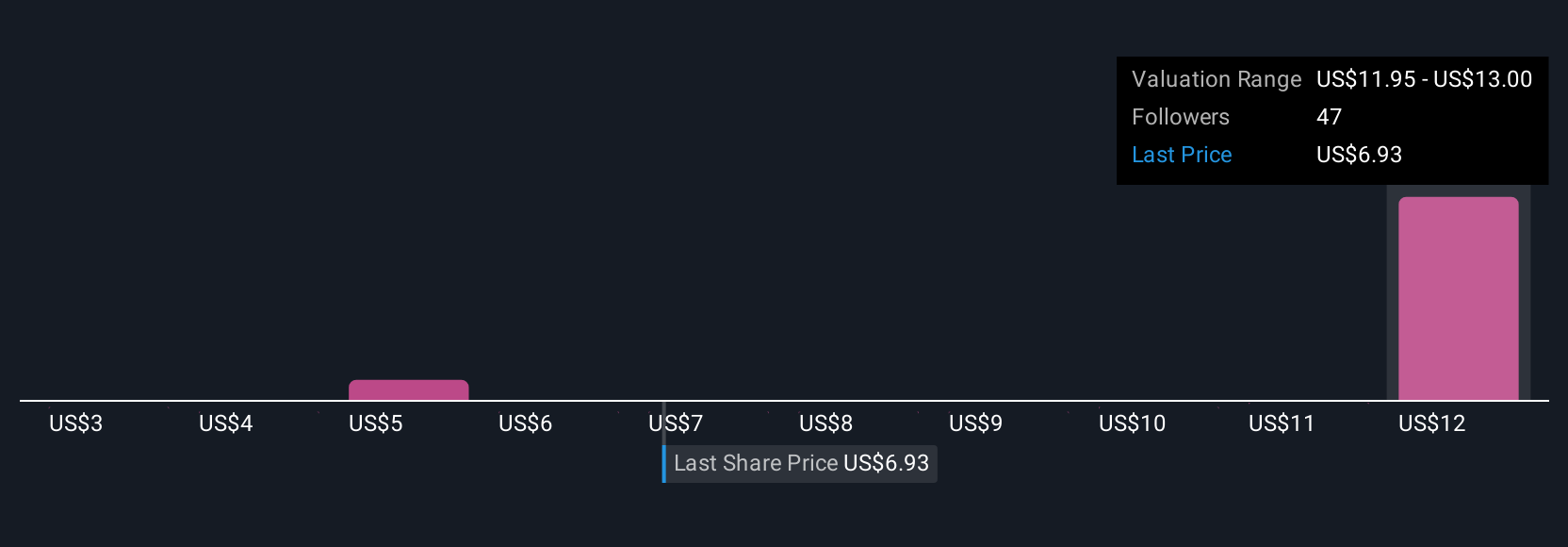

For Amprius Technologies, one investor’s Narrative could reflect total confidence in long-term demand and rapid revenue growth, resulting in a bullish fair value of $18.00 per share. In contrast, a more cautious Narrative might highlight risks like market concentration and dilution, estimating a fair value closer to $10.00.

Do you think there's more to the story for Amprius Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives