- United States

- /

- Electrical

- /

- NYSE:AMPX

A Fresh Look at Amprius Technologies (AMPX) Valuation Following UAV Battery Deal With ESAero

Reviewed by Simply Wall St

Amprius Technologies (AMPX) revealed that Empirical Systems Aerospace has selected its SiCore SA08 cell for use in unmanned aerial vehicle battery packs. This move highlights the growing adoption of Amprius’s batteries across defense, logistics, and public safety sectors.

See our latest analysis for Amprius Technologies.

Shares of Amprius Technologies have surged recently, with a 30-day share price return of 15.55% and an impressive 341.61% year-to-date share price return, fueled by rapid adoption of its battery technology. Momentum is clearly building, as the one-year total shareholder return stands at a striking 808.63%. This reflects growing confidence in the company's growth prospects. While there was a slight dip in the last week, the longer-term trajectory has been powerfully positive.

If Amprius’s gains have you searching for the next breakout story, now is the perfect time to explore See the full list for free.

With such remarkable share price gains and rapid revenue growth, the key question now is whether Amprius remains undervalued or if recent momentum means the market has already priced in these expectations. Could there still be a buying opportunity?

Most Popular Narrative: 13.9% Undervalued

With a narrative fair value of $14.67 versus the last closing price of $12.63, the latest narrative points to notable upside, driven by powerful business shifts and investor optimism.

Diversification of the customer and geographic revenue base through global contract manufacturing partnerships (notably new capacity in South Korea) is expected to reduce revenue volatility and support scale-up. This should improve operating leverage and expand net earnings over time. Ongoing investment in automation and manufacturing capacity, supported by government contracts like the $10.5M Defense Innovation Unit award, positions Amprius to capture a larger share of future high-margin opportunities in defense and critical infrastructure, enhancing both revenue visibility and earnings stability.

Curious why analysts believe Amprius could deliver at a level only elite tech names achieve? The math behind this valuation is audacious, with big assumptions around future revenue, profits, and scale. Discover which ambitious projections define this optimism and see just how bold the scenario really is.

Result: Fair Value of $14.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, scaling up production and maintaining a lead over fast-evolving competitors could present challenges to the bullish outlook and put Amprius’s growth narrative to the test.

Find out about the key risks to this Amprius Technologies narrative.

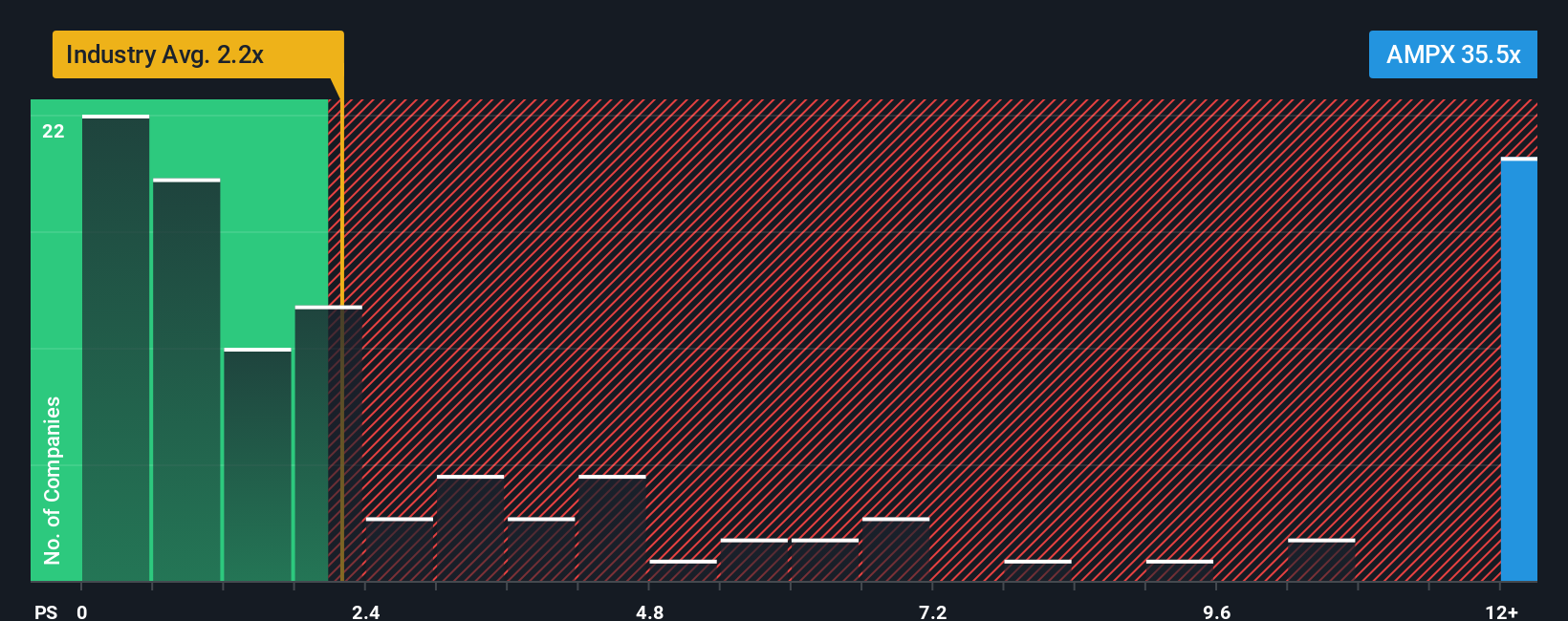

Another View: High Price-to-Sales Ratio Raises Questions

While one approach values Amprius Technologies as having significant upside, the market’s current valuation looks far less conservative. Its price-to-sales ratio stands at 35.2x, compared to an industry average of just 2.6x and a fair ratio of 1.5x. This wide gap suggests the stock is priced for perfection. What happens if growth stalls or expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amprius Technologies Narrative

If you want to dig into the numbers, challenge these assumptions, or simply build your own forecast, you can shape your own story of Amprius in just minutes. Do it your way

A great starting point for your Amprius Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the market and seize this moment to expand your search. There are exciting stocks with massive growth potential waiting for thoughtful investors like you.

- Spot tomorrow’s tech giants early by targeting these 27 AI penny stocks that are poised to shake up major industries with artificial intelligence innovation.

- Capture income and stability by securing yields above 3% with these 19 dividend stocks with yields > 3% that are primed to reward long-term shareholders.

- Capitalize on the rapidly evolving digital finance landscape by evaluating these 80 cryptocurrency and blockchain stocks that are breaking new ground in blockchain and crypto assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives