- United States

- /

- Electrical

- /

- NYSE:AME

Assessing AMETEK (AME) Valuation After Record Sales and Analyst-Beating Revenue Results

Reviewed by Simply Wall St

AMETEK (AME) recently reported record sales and EBITDA, with revenues coming in above analyst expectations despite a tough economic backdrop. This operational strength has set the company apart from its industrial peers.

See our latest analysis for AMETEK.

AMETEK’s standout quarterly results and resilient fundamentals have caught the market’s eye, helping fuel positive sentiment. The company’s total shareholder return over the last year stands at an impressive 12.8%, with nearly 97% gains over the past five years. This suggests steady long-term momentum as operational strength remains the key narrative.

If you’re keeping an eye out for industrial leaders showing signs of momentum, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

Despite its remarkable run and robust fundamentals, does AMETEK still have room to outperform? Or has the market already factored in future growth, leaving limited upside for prospective buyers?

Most Popular Narrative: 9.1% Undervalued

Analysts’ consensus targets suggest AMETEK’s momentum is not fully priced in. They estimate a fair value that is notably higher than the current close, indicating expectations for more room to run if growth plays out.

Adoption of digital reality, automation, and advanced metrology solutions is accelerating across key end markets such as aerospace, defense, and architecture. This trend was recently reinforced by the FARO Technologies acquisition, which expands AMETEK's addressable market and supports both revenue and margin growth through higher value, software-enabled recurring revenue streams. Growing global focus on sustainability and energy efficiency, along with regulatory requirements across sectors (such as energy, grid modernization, and environmental labs), is driving long-term demand for high-precision analytical and monitoring instrumentation. This favors AMETEK's portfolio and supports steady revenue and market share gains.

Want to know if rapid software growth and innovation could drive a new valuation era? This narrative hinges on bold forecasts for future profit margins, earnings per share, and a premium valuation multiple rarely seen outside tech. What key financial leaps are behind such optimism? Click in and find out what’s fueling the bulls.

Result: Fair Value of $205.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key analytical segments or delays in global project funding could quickly threaten the positive outlook for AMETEK’s continued momentum.

Find out about the key risks to this AMETEK narrative.

Another View: Are Multiples Telling a Different Story?

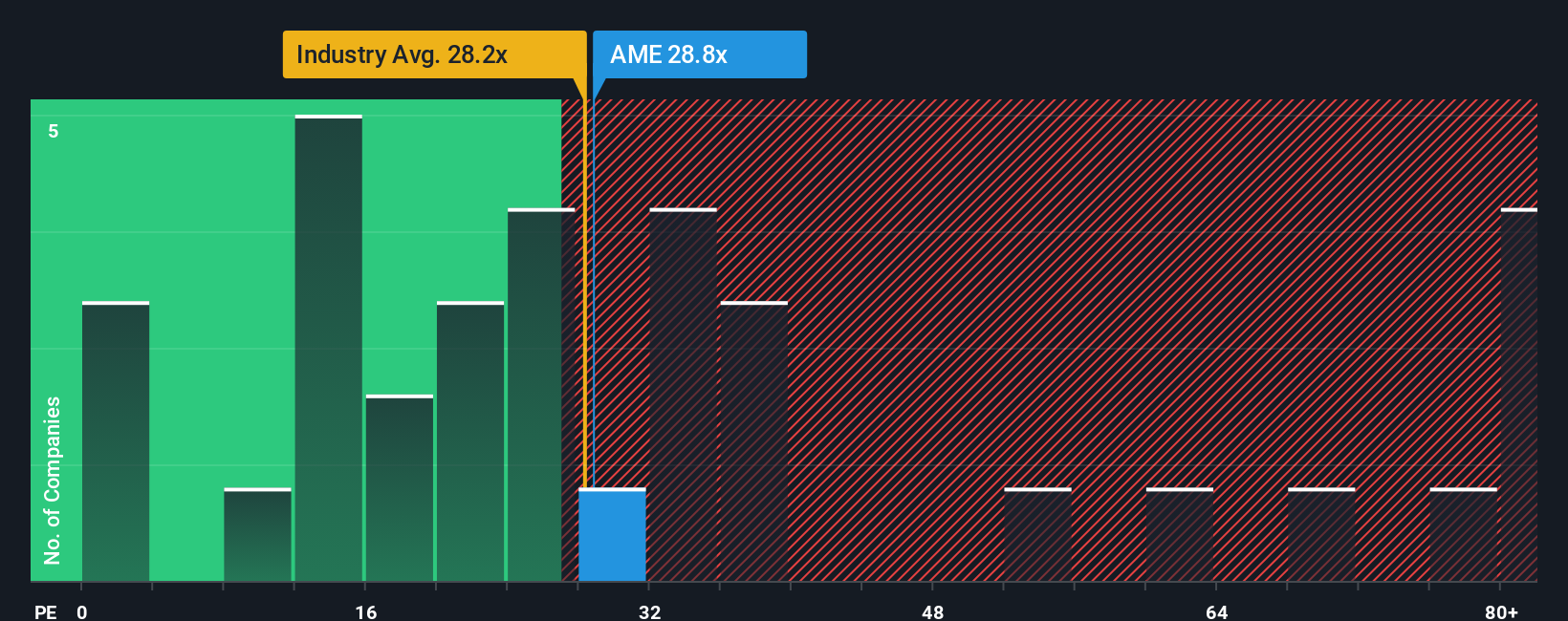

While analyst forecasts and fundamentals point to more upside, AMETEK is currently valued at 30.1x earnings, which is cheaper than the peer average of 43x and just below the US Electrical industry average of 30.7x. However, this ratio is well above the fair ratio of 24.4x, hinting at valuation risk if market optimism fades. Could this be a warning sign, or does it reflect long-term confidence in AMETEK’s prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AMETEK for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AMETEK Narrative

If you see the story unfolding differently or want to investigate your own angles in the data, you can shape a fresh perspective for yourself in just minutes: Do it your way

A great starting point for your AMETEK research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let bigger opportunities pass you by. Powerful trends are reshaping the markets right now, and there is more to gain if you broaden your search.

- Tap into high yields and stable income potential by taking a look at these 17 dividend stocks with yields > 3%, where top picks reward shareholders with dependable returns.

- Spot tomorrow’s breakthrough medical leaders before the crowd by checking out these 33 healthcare AI stocks, fueled by cutting-edge advances in health and artificial intelligence.

- Unlock hidden value and growth potential among the market’s most overlooked gems by searching through these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AME

AMETEK

Manufactures and sells electronic instruments (EIG) and electromechanical (EMG) devices in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives