- United States

- /

- Electrical

- /

- NYSE:AME

A Look at AMETEK’s Valuation After Record Q3 Results and Upgraded Earnings Guidance

Reviewed by Simply Wall St

AMETEK (AME) recently posted record third quarter results, delivering double-digit growth in both sales and earnings that surpassed expectations. The company also raised its full-year earnings guidance and shared an upbeat sales outlook.

See our latest analysis for AMETEK.

AMETEK’s upbeat quarterly results fueled a noticeable rally, with the share price climbing nearly 10% over the past month and delivering a 13% total shareholder return for the year. The stock has maintained strong momentum, supported by a healthy long-term track record and renewed confidence following the company’s latest sales and earnings outlook.

If you’re searching for what else is powering ahead lately, now is a good time to explore fast growing stocks with high insider ownership.

The key question for investors now, as AMETEK’s strong results fuel a sharp rally, is whether the current share price still offers value or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 6.7% Undervalued

Compared to its last close price of $202.11, the most widely followed narrative projects a fair value of $216.53. This sets a modestly optimistic tone and highlights the catalysts that could justify this premium.

Ongoing successful execution of a disciplined M&A strategy, leveraging a robust acquisition pipeline and significant balance sheet capacity, provides a catalyst for compounding top-line and EPS growth. Integration synergies and operational excellence also drive expansion of operating and EBITDA margins.

Want to know what’s fueling this valuation boost? The analysts’ narrative hinges on aggressive market share moves, anticipated profit margins, and a future earnings figure that rivals some market leaders. Ready to discover which surprising performance targets and bold projections underlie this upbeat fair value? Dive in to get the inside story on the numbers behind this valuation.

Result: Fair Value of $216.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key end markets or overreliance on acquisitions could quickly challenge these optimistic assumptions and affect AMETEK’s growth outlook.

Find out about the key risks to this AMETEK narrative.

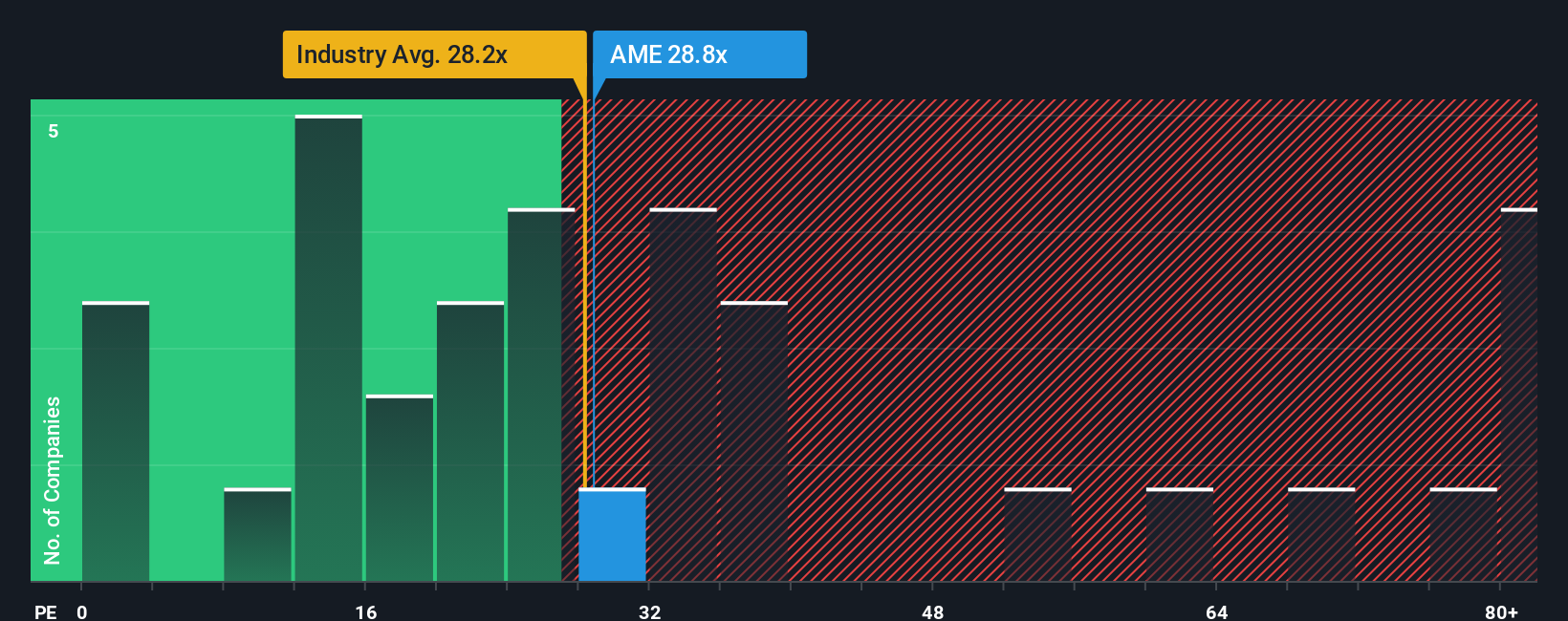

Another View: Multiples Tell a Mixed Story

Looking at value through the lens of price-to-earnings, AMETEK trades at 31.7x, matching the US Electrical industry average and well below the 44.7x peer average. This suggests some relative value. However, this ratio sits above its fair ratio of 25.4x, highlighting potential valuation risk that the market could eventually correct. Does this premium mean investors are too optimistic, or is there more under the hood?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AMETEK for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AMETEK Narrative

If you see the story differently or want to dig into the numbers yourself, crafting a personal narrative takes just a few minutes. Do it your way

A great starting point for your AMETEK research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Serious opportunities go beyond just one standout stock. Give yourself the best shot at investing success by checking out these unique stock ideas today.

- Unlock big potential with these 836 undervalued stocks based on cash flows that are trading well below their estimated fair value. This could give you a head start on the market.

- Capture income and stability through these 20 dividend stocks with yields > 3% boasting yields above 3 percent, which may help bolster your portfolio over time.

- Seize the innovation wave by targeting these 27 AI penny stocks leading advances in artificial intelligence and reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AME

AMETEK

Manufactures and sells electronic instruments (EIG) and electromechanical (EMG) devices in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives