- United States

- /

- Building

- /

- NYSE:ALLE

Allegion (ALLE): Evaluating Valuation After Recent Pullback and Strong Long-Term Returns

Reviewed by Simply Wall St

Allegion (ALLE) shares have caught the eye of investors recently, with the stock posting a nearly 2% decline over the past day and a 6% drop in the past week. Despite these short-term moves, long-term performance remains impressive. This raises questions about current valuation and the events driving price action.

See our latest analysis for Allegion.

Allegion’s share price momentum has eased in recent weeks, cooling after a strong rally earlier this year. Despite the recent pullback, the company’s year-to-date share price return of 30.1% and one-year total shareholder return of 19% show that broader sentiment has stayed positive. This suggests investors see longer-term growth potential, even as the pace slows near recent highs.

If Allegion’s run has you rethinking your next move, this is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Allegion’s impressive gains have left the stock undervalued based on its fundamentals, or if the market has already priced in all expected future growth. This could leave little room for upside for new buyers.

Most Popular Narrative: 6.7% Undervalued

Allegion's narrative fair value stands at $179.36, compared to the last close of $167.30. This creates a clear gap that could intrigue value-focused investors. What categories of innovation or market dynamic underpin this positive gap?

Robust expansion in smart and connected security solutions, particularly through strong electronics growth (double-digit in Q2) and new launches like SimonsVoss's batteryless FORTLOX electronic cylinder, positions Allegion to benefit from increased adoption of IoT and digital building management, supporting higher future revenues and improved margin mix.

Wondering what’s powering this bullish call? There is one big expectation at the heart of these projections that could change how you see Allegion’s fair value. If you want to uncover what analysts are forecasting for revenue and profit expansion, and why future market positioning is so crucial, the full narrative spells out all the details. Don’t miss the forward-looking assumptions that could challenge the market’s view.

Result: Fair Value of $179.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing international weakness or a downturn in nonresidential construction could threaten Allegion’s growth narrative and challenge future earnings expansion.

Find out about the key risks to this Allegion narrative.

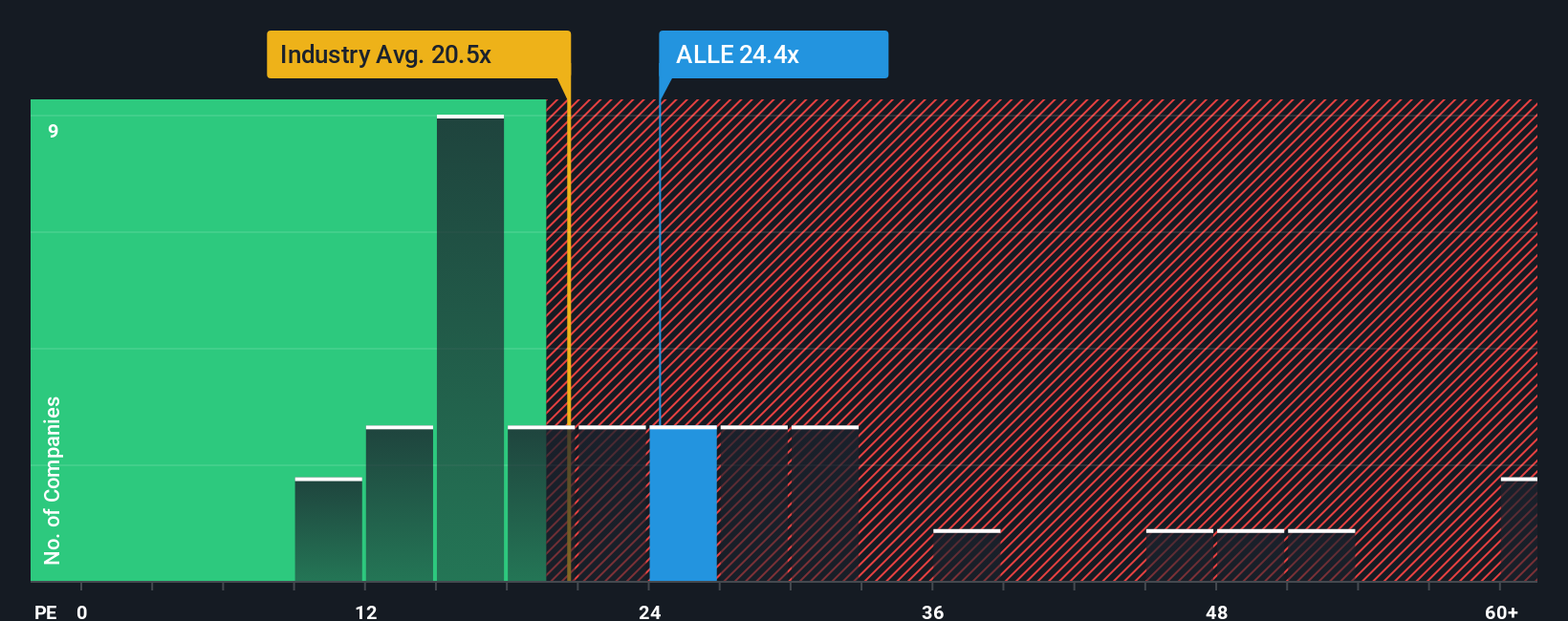

Another View: Market Multiples Raise a Red Flag

While the narrative approach suggests Allegion is undervalued, comparing its price-to-earnings ratio of 22.5x to the US Building industry average of 19.8x and a peer average of 17.9x paints a different picture. Allegion's fair ratio stands at 21.9x, which suggests the shares could be noticeably expensive relative to where the market might gravitate. Could current optimism be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allegion Narrative

If you see the story differently or want to dig into the numbers for yourself, you can build your own perspective in just a few minutes with Do it your way.

A great starting point for your Allegion research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their opportunities. Stay ahead by tapping into sectors set to power tomorrow’s growth with a screener tailored to your next move.

- Maximize your passive income and uncover fresh yield possibilities by checking out these 17 dividend stocks with yields > 3%, which offers over 3% returns and sustainable payout profiles.

- Ride the momentum of digital transformation and target companies harnessing breakthrough tech through these 27 AI penny stocks, changing the investment landscape.

- Unlock untapped value by pinpointing these 877 undervalued stocks based on cash flows with robust financials and compelling growth stories that most investors are overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLE

Allegion

Engages in the provision of security products and solutions worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives