- United States

- /

- Building

- /

- NYSE:ALLE

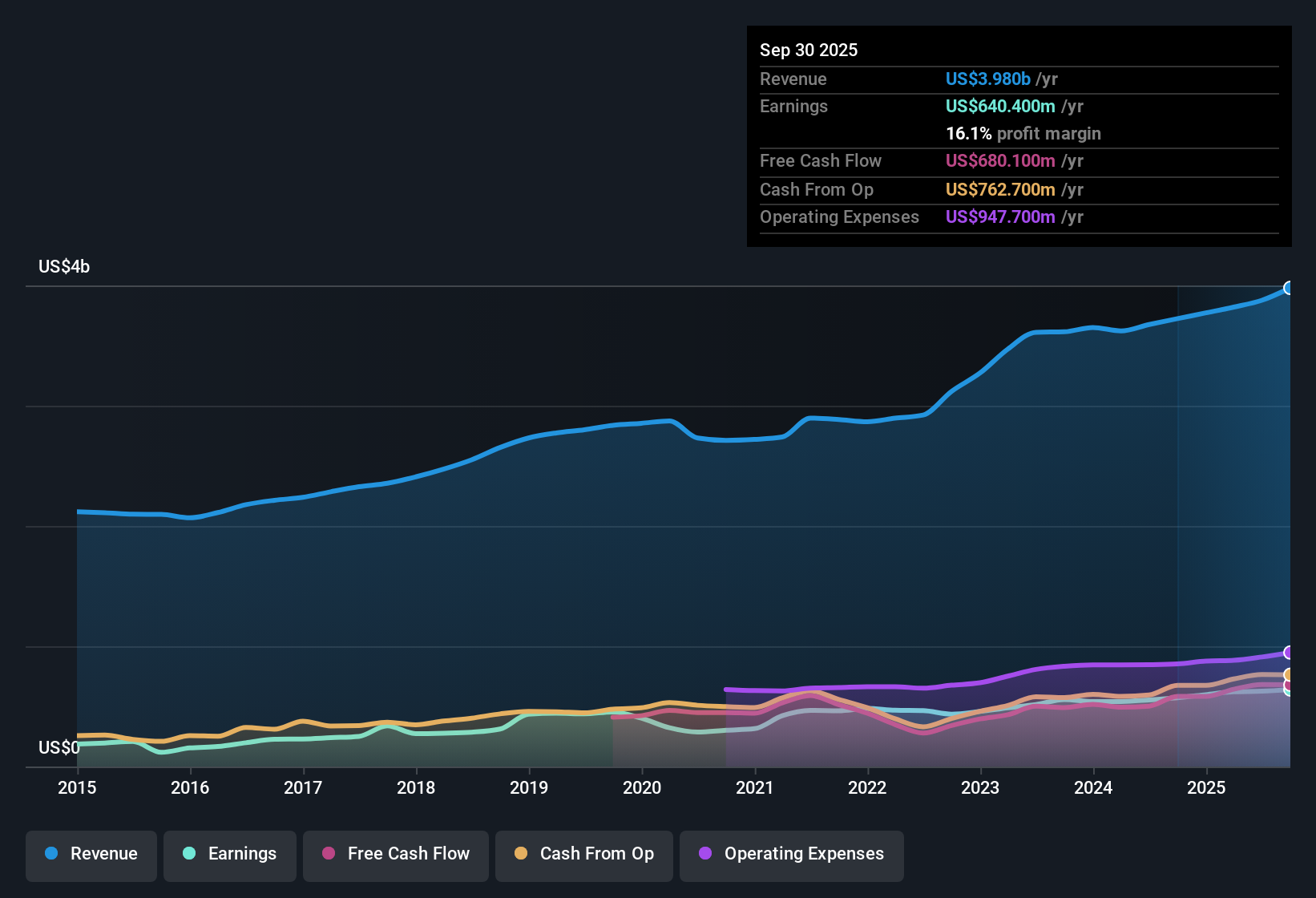

Allegion (ALLE) Earnings Growth Outpaces 5-Year Average, Puts Valuation in Focus

Reviewed by Simply Wall St

Allegion (ALLE) posted earnings growth of 13% over the past year, outpacing its 5-year average of 11% annually. Net profit margins climbed to 16.2% from last year's 15.1%, reflecting improved profitability. Looking ahead, analysts expect earnings to grow 8.9% per year and revenue to increase by 6.8% per year, both slightly lagging the broader US market averages. While operational results have been impressive, Allegion’s shares currently trade above estimated fair value. The price-to-earnings ratio is 23.5x, noticeably higher than both its peers and the US building industry average.

See our full analysis for Allegion.The real question is how these figures hold up against the broader narratives in the market. The next section dives into how Allegion's results compare to widely tracked community and analyst viewpoints.

See what the community is saying about Allegion

Recurring Revenue Expands with Digital Focus

- Analysts expect Allegion’s revenue to grow at 7.1% per year for the next three years, with profit margins projected to rise from 16.2% to 17.3% by 2026. This highlights a push toward higher-margin digital products and enhanced operational efficiency.

- According to the analysts' consensus view, new investments in electronic and software acquisitions (like ELATEC, Gatewise, Waitwhile) are anticipated to generate fresh recurring revenues and boost profit margins as SaaS and high-margin hardware become a bigger part of the portfolio.

- Expansion in smart and connected security solutions, along with new digital launches, position Allegion to benefit from strong adoption of IoT and digital building management.

- High demand in institutional and nonresidential markets is bolstering both revenue growth and margin stability in a way that smooths out cyclical fluctuations.

- Recent earnings and guidance solidify this more predictable growth pathway, reinforcing the consensus that Allegion is transforming its margin profile with innovation and recurring revenues. Curious to see if Wall Street’s consensus view matches your own? 📊 Read the full Allegion Consensus Narrative.

Acquisition Strategy Lifts Earnings but Brings Risks

- Analysts expect earnings to climb from $626.2 million currently to $825.7 million by 2028, assuming continued success from strategic M&A and new product launches across electronic and non-mechanical business lines.

- The consensus narrative notes that while targeted acquisitions are growing earnings and extending Allegion's reach, aggressive buyouts and integration efforts bring risks:

- Execution missteps or overpaying for deals could weaken margins if anticipated synergies do not materialize.

- International revenue challenges and a heavy reliance on nonresidential construction cycles create additional volatility that could threaten steady earnings growth if macro conditions deteriorate.

Valuation Premium Highlights Market Confidence and Caution

- Allegion shares currently trade at $171.22, which is above the DCF fair value of $139.66 and priced at a 23.5x price-to-earnings ratio. This puts them at a premium to both their peer average of 18x and the US building industry average of 19.7x.

- The analysts' consensus view contends that the small gap between the current price and the $180.91 analyst price target shows Allegion is largely viewed as fairly valued, even after adjusting forecasts for annual revenue and earnings growth.

- This small premium suggests investors are willing to pay up for perceived earnings quality and future recurring revenues, but any disappointment or slowdown could make the current price look stretched.

- Consensus still urges investors to “sense check” these projections, given the modest upside and multiple expansion already baked into current valuations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Allegion on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on these figures? Shape your unique take and create a personal narrative in just a few minutes. Do it your way

A great starting point for your Allegion research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Allegion’s premium valuation and modest expected upside highlight concerns that future growth may already be priced in. This leaves limited room for disappointment.

If you’re looking for greater value and upside, check out these 876 undervalued stocks based on cash flows to help discover stocks that may offer stronger returns without the steep price tag.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLE

Allegion

Engages in the provision of security products and solutions worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives