- United States

- /

- Machinery

- /

- NYSE:ALG

Assessing Alamo Group After 18% Drop and Rising Infrastructure Spending News

Reviewed by Bailey Pemberton

- Curious if Alamo Group is an overlooked bargain or just fairly priced? Let’s dive into what might make this stock a compelling or cautionary pick for value hunters.

- The share price has bounced a modest 0.9% over the past week, but is still down 13.0% for the past month and 18.1% over the last year. This has shifted attention to its longer-term growth story versus near-term risk.

- Recent industry headlines have highlighted rising infrastructure spending and renewed focus on equipment upgrades across municipalities. Both of these factors influence Alamo Group’s market position, and investors are now watching closely to see how these broader trends could translate into stability or opportunity for the company’s stockholders.

- If you look at pure numbers, the company’s current valuation score is 6 out of 6, which means it is ticking every undervalued box. Next, we’ll explore the valuation checks themselves and discuss a smarter way to assess what Alamo Group is really worth, so stay tuned.

Find out why Alamo Group's -18.1% return over the last year is lagging behind its peers.

Approach 1: Alamo Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s expected future cash flows and discounting them back to their present value. This approach provides a grounded way to estimate what a business is intrinsically worth today. For Alamo Group, this analysis uses the 2 Stage Free Cash Flow to Equity method, which factors in both analysts’ estimates and steadily extrapolated growth over time.

According to the latest data, Alamo Group’s last twelve months of Free Cash Flow stand at $150 million. Analysts project that Free Cash Flow will modestly increase, reaching approximately $153.5 million by the end of 2027. Beyond the analyst forecast horizon, Simply Wall St extrapolates further growth, with projections estimating Free Cash Flow could grow to about $188 million by 2035.

With all these forecasted cash flows discounted to their present value, the DCF valuation model places Alamo Group’s intrinsic value at $219.85 per share. Compared to the current trading price, this implies the stock is trading at a 26.8% discount to its intrinsic value. This may suggest an opportunity for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alamo Group is undervalued by 26.8%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Alamo Group Price vs Earnings

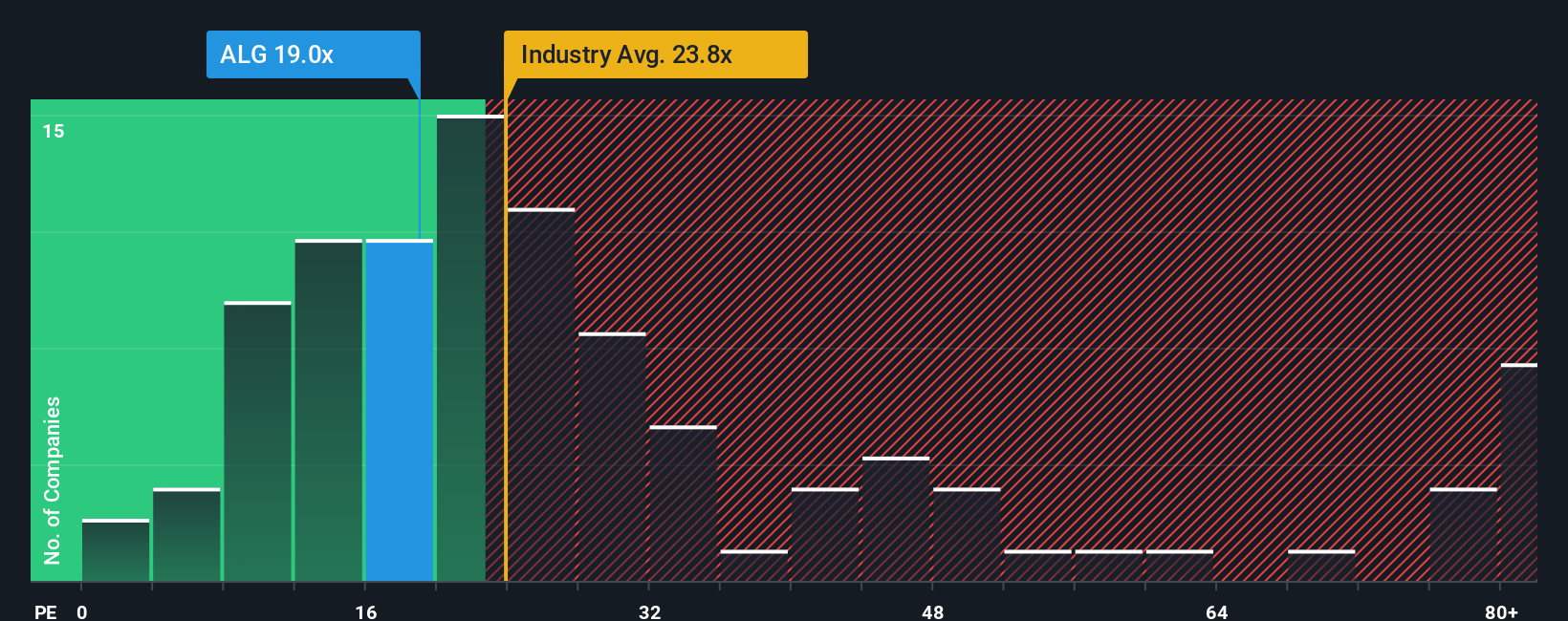

For profitable companies like Alamo Group, the Price-to-Earnings (PE) ratio is a widely recognized valuation tool. It provides a direct measure of what investors are willing to pay today for each dollar of a company’s earnings. This makes it especially valuable for companies with a consistent history of profits, as it gives a quick snapshot of market sentiment relative to profitability.

Importantly, a "normal" or "fair" PE ratio varies depending on a company’s growth prospects and perceived risks. Typically, firms with higher growth expectations or lower risk profiles command higher PE multiples, while more mature or riskier businesses are assigned lower ones.

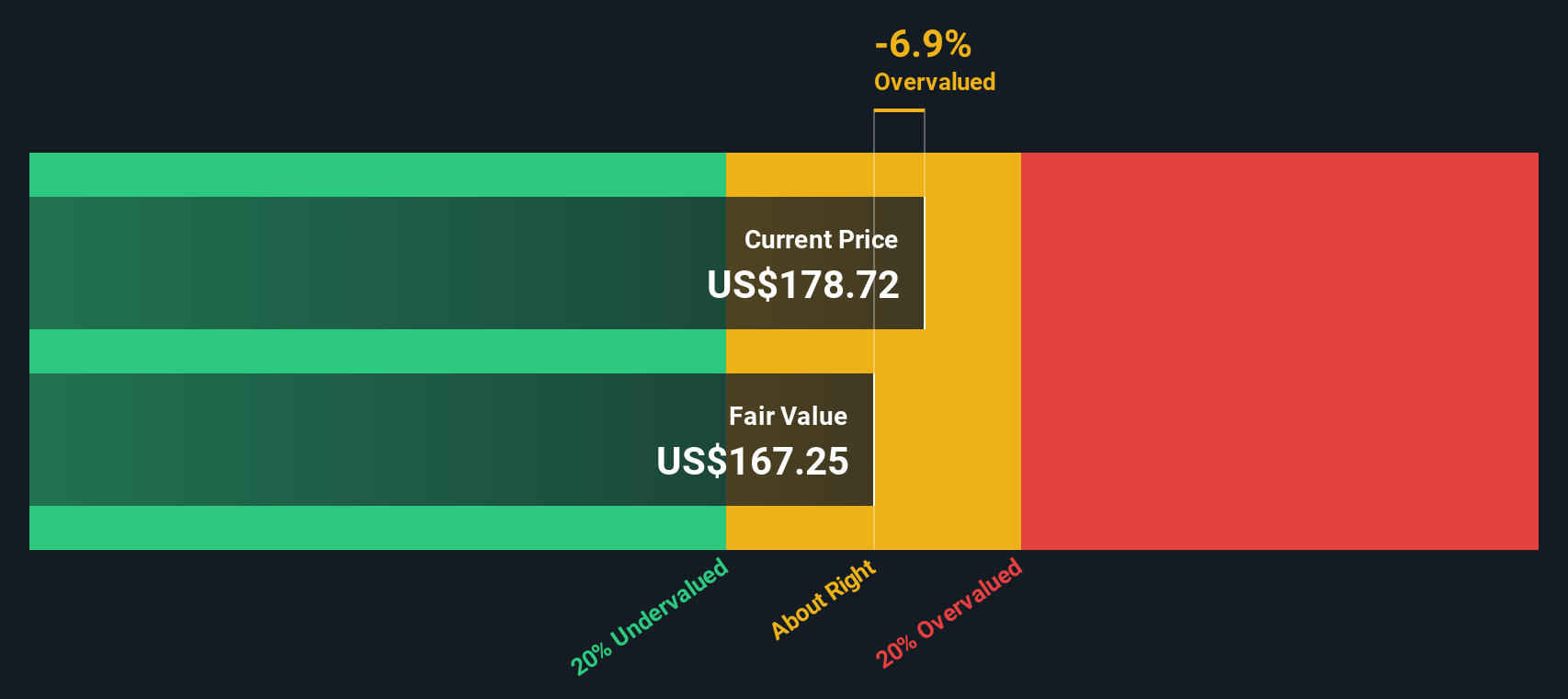

Currently, Alamo Group trades on a PE ratio of 16.8x. This compares favorably with the industry average of 24.8x and the peer average of 19.6x. Simply Wall St’s proprietary Fair Ratio for Alamo Group is 19.1x. This reflects a data-driven expectation based on factors such as Alamo’s earnings growth, margins, market capitalization, and industry risk profile.

The advantage of using the Fair Ratio is that it looks beyond simple peer or industry comparisons. Its calculation incorporates unique attributes like profit margins, expected growth, and the company’s risk and size. This offers a more nuanced picture of what a “fair” PE ratio should be.

Since Alamo Group’s current PE of 16.8x is slightly below the Fair Ratio of 19.1x, it suggests the shares are trading at a modest discount to what is justified by its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alamo Group Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story or perspective about a company. You bring together your outlook on its future, your assumptions for revenue, earnings, and profit margins, and shape these into an estimated fair value. Narratives bridge the gap between what you see happening in Alamo Group's business, how that shapes its financial outlook, and what you believe its shares are worth.

Simply Wall St makes Narratives accessible and easy to use, right inside the Community page, with millions of investors leveraging this tool to back up their decisions. Narratives help you decide when to buy or sell by highlighting the difference between your Fair Value and the current Price, giving you clarity no matter what the market is doing.

Because Narratives are updated dynamically as new information appears, such as earnings releases or major news, you can quickly adjust your view and stay current. For example, some investors may have a bullish Narrative for Alamo Group, forecasting ongoing infrastructure-driven growth and a fair value as high as $244, while others see headwinds ahead and estimate a fair value closer to $213. By building or comparing different Narratives, you can find the story and the number that makes the most sense for your investment style.

Do you think there's more to the story for Alamo Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALG

Alamo Group

Designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural uses worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success