- United States

- /

- Machinery

- /

- NYSE:ALG

A Fresh Look at Alamo Group (ALG) Valuation as Shares Rebound from Recent Dip

Reviewed by Simply Wall St

Alamo Group (ALG) has caught investors' attention following a modest daily gain and a near 2% rise over the past week. Considering its 12% return over the past year, many are taking a closer look at current valuations and recent momentum.

See our latest analysis for Alamo Group.

Alamo Group’s share price has bounced modestly this week, even as it cools off from a recent 30-day dip. With a 1-year total shareholder return just under 12% and plenty of momentum earlier this year, investors are watching to see if last year’s steady growth sparks renewed optimism or signals a pause before the next move.

If this kind of performance has you considering what else might be on the rise, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading nearly 30% below their average analyst target and recent profit growth outpacing revenue, the question now is whether Alamo Group is undervalued or if the market has already taken its future growth into account.

Most Popular Narrative: 23% Undervalued

The latest widely followed narrative points to a fair value of $244.25, well above Alamo Group's last close of $187.57. This gap is fueling interest in what is behind such a bullish outlook.

Robust organic growth in the Industrial Equipment division, evidenced by record sales (+17.6% YoY), soaring backlog (approximately $510 million), and strong order bookings (+21% YoY in Q2), is directly tied to rising infrastructure investments and government spending. These conditions are expected to persist globally, which supports continued revenue expansion and earnings growth.

What’s driving this intense optimism? The narrative hints at long-term growth engines, massive project pipelines, and an ambitious earnings target that few would expect from an industrial company. Curious about the bold assumptions guiding this high valuation? See what’s sparking such bullish targets in the full narrative.

Result: Fair Value of $244.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent underperformance in key divisions or a major slowdown in government spending could quickly challenge this upbeat outlook for Alamo Group.

Find out about the key risks to this Alamo Group narrative.

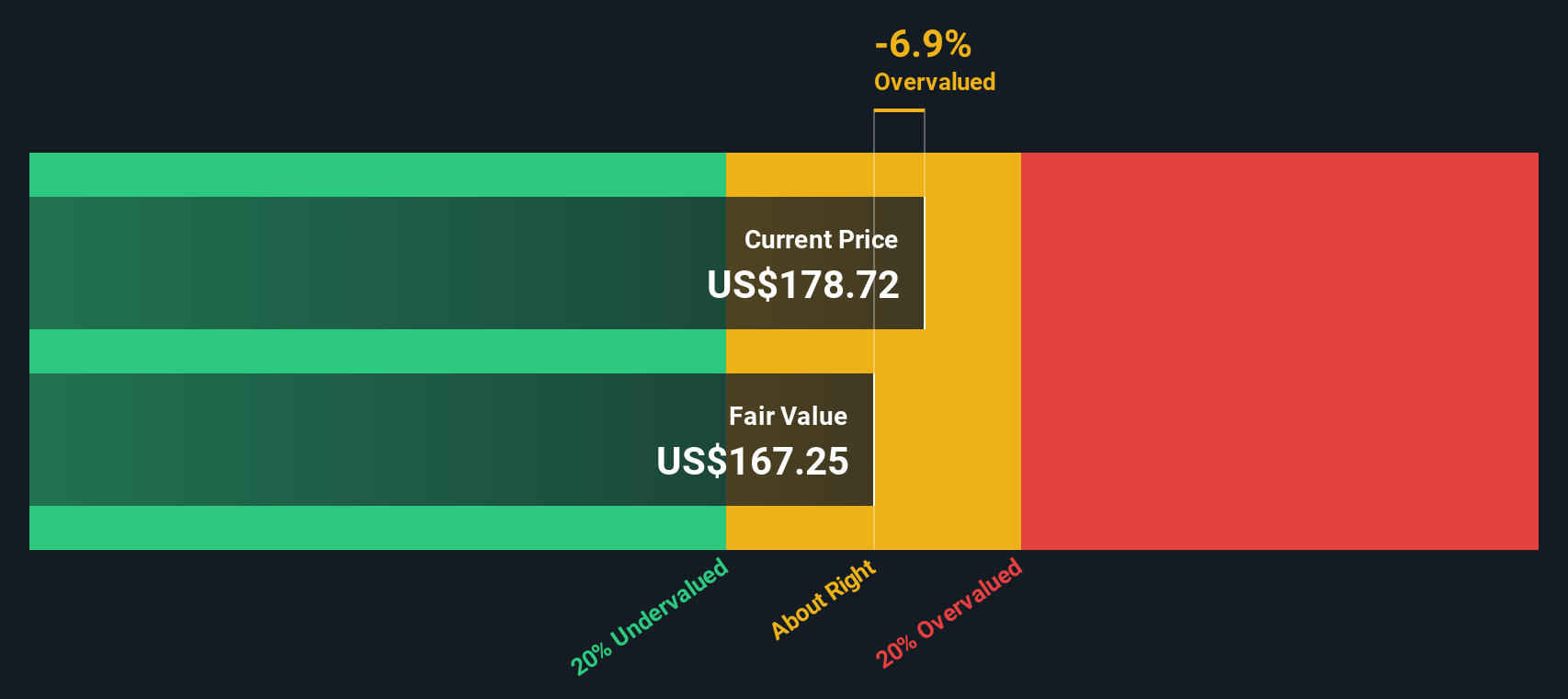

Another View: DCF Model Tells a Different Story

While analyst targets suggest Alamo Group is notably undervalued, the SWS DCF model paints a more cautious picture. According to this approach, shares are actually trading just above their fair value of $182.25. This raises a key question: Which outlook will prove more reliable amid shifting market expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alamo Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alamo Group Narrative

If you have a different perspective or want to run your own checks, you can put together a narrative from scratch in under 3 minutes. Do it your way

A great starting point for your Alamo Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss the chance to uncover hidden gems or tap into powerful growth themes. The right screener could put your next top-performing stock at your fingertips.

- Spot opportunities in high-yield companies by browsing these 17 dividend stocks with yields > 3% and see which stocks are paying out the most robust returns.

- Capitalize on innovation sweeping healthcare by checking out these 33 healthcare AI stocks and track businesses transforming medicine with artificial intelligence.

- Get ahead of the curve and evaluate these 868 undervalued stocks based on cash flows, a list packed with stocks trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALG

Alamo Group

Designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural uses worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives