- United States

- /

- Trade Distributors

- /

- NYSE:AL

Air Lease (AL) Margin Surge Reinforces Debates on One-Off Gains and Long-Term Profit Trajectory

Reviewed by Simply Wall St

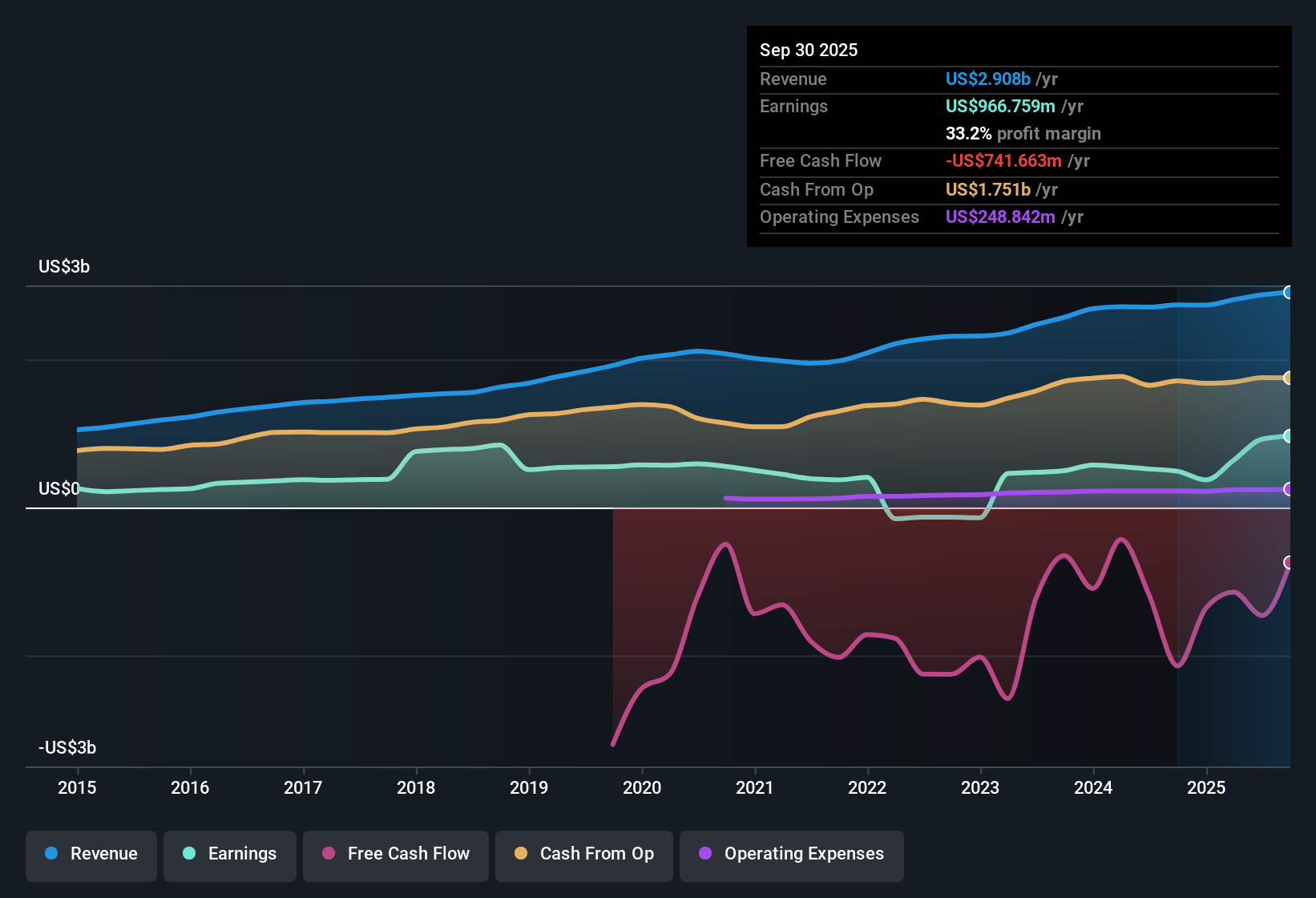

Air Lease (AL) reported a major jump in profitability, posting net profit margins of 33.2% compared to 17.9% last year, and nearly doubling earnings growth to 97.2% year over year, powered by a one-off $727.2 million gain. Despite the boost, consensus now points to a 20.6% annual decline in earnings for the next three years, with revenue expected to grow at 7.3% yearly, which trails the broader US market’s 10.5% pace. Margins are considerably improved, but investors face a complex picture driven by exceptional gains and cautious outlooks ahead.

See our full analysis for Air Lease.The next section explores how these headline results compare against long-standing narratives on Air Lease, highlighting both the consensus views and points of debate.

See what the community is saying about Air Lease

Non-Recurring Gains Boost Net Margins

- Net profit margin surged to 33.2%, more than double last year's 17.9%. However, this was heavily influenced by a one-off $727.2 million insurance gain tied to the Russia fleet write-off.

- According to the analysts' consensus view, while strong lease rates persist and Air Lease’s young, fuel-efficient fleet helps maintain premium pricing, a reliance on such exceptional insurance recoveries raises concerns about the sustainability of today's elevated net margins and future comparability of earnings.

- Consensus narrative notes future profit margins are expected to shrink from 32.1% to 15.5% by 2027, highlighting how one-off settlements are unlikely to provide continued support.

- Analysts also point out that as these insurance settlements phase out, reported net income gains will be harder to replicate and could pressure the underlying business’s profitability.

Valuation Remains Below Peers Despite Analyst Optimism

- Air Lease trades at a 7.4x price-to-earnings ratio, much lower than industry (21.7x) and peer (26.1x) averages. The stock sits well above its discounted cash flow (DCF) fair value of $15.91 per share, while the current share price is $63.64.

- The analysts' consensus view highlights that, even as analysts see earnings declining by 20.6% annually over three years, the consensus price target stands at $66.00, about 3.7% above today’s market price, signaling lingering optimism for long-term value.

- Consensus also notes that to justify this target, the company must trade at a much higher PE of 17.3x in 2027, up from the 7.0x seen today.

- Despite the growth slowdown, analysts argue Air Lease’s unique fleet position and market shifts may support rerating in the future, but only if structural tailwinds persist.

Rising Financing Costs and Supply Risks Weigh on Outlook

- Interest expense for Air Lease is climbing as the company relies on leveraged financing, and persistent aircraft delivery delays from OEMs create uncertainty around future fleet expansion and earnings growth.

- The analysts' consensus view flags that higher borrowing costs and unpredictable aircraft sale volumes could materially pressure net income and limit Air Lease’s ability to capitalize on fleet renewal trends.

- Consensus points out that any prolonged high interest rate environment or supply chain disruptions could weaken revenue growth and capital flexibility.

- Bears would argue that unresolved risks like Russia litigation and macroeconomic shocks add further downside not reflected in today’s stock price.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Air Lease on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures above? Build and share your perspective in just a few minutes. Your story could make a difference. Do it your way

A great starting point for your Air Lease research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Air Lease faces declining earnings forecasts, reliance on one-off gains, and rising borrowing costs. These factors cast doubt on the sustainability of its recent profitability.

Want businesses with proven resilience and healthy finances? Discover solid balance sheet and fundamentals stocks screener (1981 results) built to withstand uncertainty and deliver greater stability for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AL

Air Lease

An aircraft leasing company, engages in the purchase and leasing of commercial jet aircraft to airlines in the Asia Pacific, Europe, the Middle East, Africa, Mexico, Central America, South America, the United States, and Canada.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives