- United States

- /

- Trade Distributors

- /

- NYSE:AIT

Applied Industrial Technologies (AIT): Evaluating Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Applied Industrial Technologies (AIT) has drawn investor attention as recent performance metrics continue to show both resilience and shifts in the company’s growth story. The past year delivered a mixed picture for shareholders, which makes it a topic of interest for those tracking industrial sector trends.

See our latest analysis for Applied Industrial Technologies.

Applied Industrial Technologies has seen its share price ease back in recent weeks, despite long-term results that still outshine many industrial peers. While the 1-year total shareholder return slipped by 6.6%, those who invested three or five years ago have enjoyed impressive gains of nearly 100% and over 240%, respectively. This momentum signals genuine value creation even as the latest move hints at a pause in the rally.

If you’re curious about what other companies are building lasting growth, now’s a good time to discover fast growing stocks with high insider ownership

Given recent price movement and solid long-term gains, the central question emerges: is Applied Industrial Technologies trading at an attractive value now, or is the market already reflecting its future growth prospects?

Most Popular Narrative: 17% Undervalued

Applied Industrial Technologies’ widely accepted fair value estimate is $303, significantly higher than its last close of $250. This valuation difference is based on ambitious future growth drivers and financial targets.

Continued strategic investments in automation, robotics integration, and digital platforms are shifting the company's sales mix toward higher-margin, value-added services and reducing reliance on lower-growth MRO distribution. This provides a path for consolidated margin expansion and enhanced long-term earnings power.

Want to know which future assumptions supercharge this premium share price? The narrative depends on bold upgrades in automation, margins, and a valuation multiple that would surprise most industrial investors. Ready to see what’s included in that figure? The details might challenge your expectations of what drives value in this sector.

Result: Fair Value of $303 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing muted demand across key industrial sectors and a sustained reliance on acquisitions could present challenges to Applied's long-term growth and margin expansion.

Find out about the key risks to this Applied Industrial Technologies narrative.

Another View: Multiples Tell a Different Story

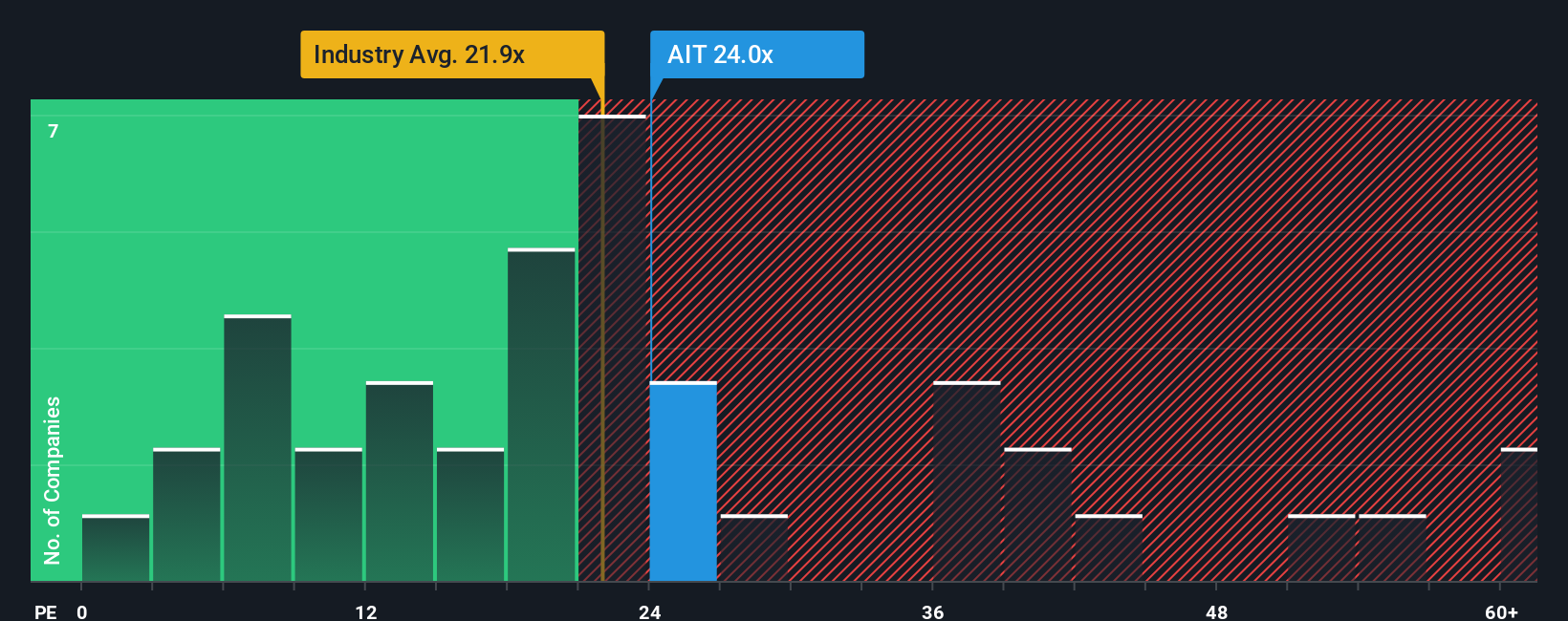

Looking at Applied Industrial Technologies through its price-to-earnings ratio paints a more cautious picture. The company trades at 23.6x earnings, which is higher than both industry (20.6x) and peer (18.9x) averages, and above its own fair ratio of 21.7x. Does this premium signal hidden risk, or has value simply run ahead of results?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Industrial Technologies Narrative

If you have a different perspective or want to dig into the numbers firsthand, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Applied Industrial Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay one step ahead and tap into promising opportunities before the crowd catches on. The right screener can guide your next smart move and help you grow your portfolio with confidence.

- Catch market momentum by uncovering these 875 undervalued stocks based on cash flows with solid cash flow that are flying under most investors’ radar.

- Target tomorrow’s healthcare breakthroughs and secure your edge by checking out these 31 healthcare AI stocks changing lives with advanced medical technology.

- Position yourself for the next tech wave when you scan these 27 quantum computing stocks, accelerating innovation in quantum computing and shaping the future of data.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIT

Applied Industrial Technologies

Distributes industrial motion, power, control, and automation technology solutions in the United States, Canada, Mexico, Australia, New Zealand, Singapore, and Costa Rica.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives