- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

Can Recognition for Veteran Support Influence Analyst Sentiment Toward AAR (AIR) Shares?

Reviewed by Sasha Jovanovic

- In recent news, AAR Corp. received the 2026 Military Friendly® Gold Employer and Military Friendly Spouse® Employer designations, with about 20% of its U.S. workforce being veterans, while also seeing a rise in analyst sentiment, including a Zacks Rank #1 (Strong Buy) and upward earnings estimate revisions.

- An interesting highlight is that despite a rise in short interest, AAR Corp.'s short interest as a percent of float remains well below the industry average, suggesting less bearish sentiment compared to its aerospace peers.

- We'll explore how improved analyst sentiment and recognition for supporting veterans might reshape AAR Corp.'s investment outlook going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AAR Investment Narrative Recap

To be a shareholder in AAR Corp., you need to believe in the company’s ability to leverage steady growth in global air travel, capitalize on its MRO expansion, and maintain a competitive edge amid shifting demand between commercial and defense customers. The recent Military Friendly® Gold Employer award and stronger analyst sentiment do not materially shift the core short-term catalyst, additional MRO capacity driving revenue growth, or the primary risk, which remains the company’s exposure to cyclical downturns in commercial aviation.

Among the recent announcements, AAR’s Zacks Rank #1 (Strong Buy) and the upward revisions in full-year earnings estimates stand out as the most relevant to the investment story. This recognition from analysts aligns closely with the main catalyst: the company’s ability to secure higher-margin contracts and scale new capacity, which could support robust performance if demand holds steady.

However, this optimism exists alongside the ongoing risk that, if airlines cut costs or reduce flying hours, AAR’s Parts Supply segment could...

Read the full narrative on AAR (it's free!)

AAR's narrative projects $3.2 billion revenue and $293.3 million earnings by 2028. This requires 4.8% yearly revenue growth and a $280.8 million earnings increase from $12.5 million currently.

Uncover how AAR's forecasts yield a $91.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

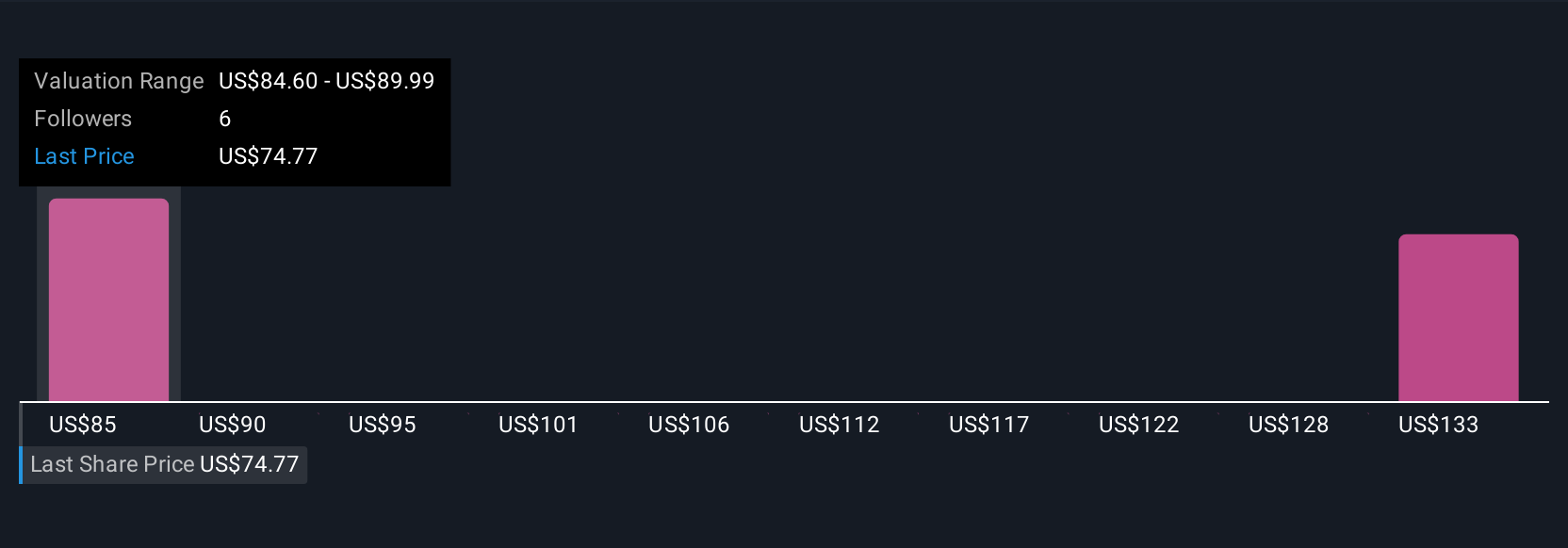

The Simply Wall St Community provided three fair value estimates for AAR Corp., ranging from US$76.69 up to US$192.03 per share. While earnings expansion is a central theme this year, the wide spread in valuations highlights the importance of considering multiple viewpoints before making decisions.

Explore 3 other fair value estimates on AAR - why the stock might be worth 6% less than the current price!

Build Your Own AAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AAR research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AAR's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives