- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

A Look at AAR Corp’s (AIR) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for AAR.

With a recent 2.9% one-month share price return and an impressive 22.4% total shareholder return over the past year, AAR looks to be maintaining positive momentum. This reflects renewed optimism about its long-term growth potential despite a slight dip in the latest session.

If you’re exploring fresh opportunities alongside AAR’s run, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With AAR’s robust one-year rally and solid earnings growth, investors may wonder if its shares are still undervalued or if the current price already reflects optimistic future expectations. Could there be more upside, or has the market caught up?

Most Popular Narrative: 8% Undervalued

With the prevailing fair value set at $91 per share compared to the latest close of $83.65, the narrative signals meaningful room for upside. This view emerges from a consensus that AAR’s expansion and efficiency moves underpin solid future growth.

The commercialization of additional MRO capacity in Oklahoma City and Miami, both already sold out before opening, positions AAR to capitalize on the expected long-term rise in global air travel and the need for ongoing maintenance of aging aircraft fleets. This supports robust revenue growth and improved earnings visibility.

Want to see what’s fueling this bullish forecast? The fair value calculation is driven by ambitious growth assumptions and a profit leap that competitors would envy. Discover which razor-sharp financial projections are behind this target to see what separates this scenario from the market’s view.

Result: Fair Value of $91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition from original equipment manufacturers and challenges in digital execution could limit AAR’s margin expansion or stall its current growth trajectory.

Find out about the key risks to this AAR narrative.

Another View: Market Multiples Tell a Different Story

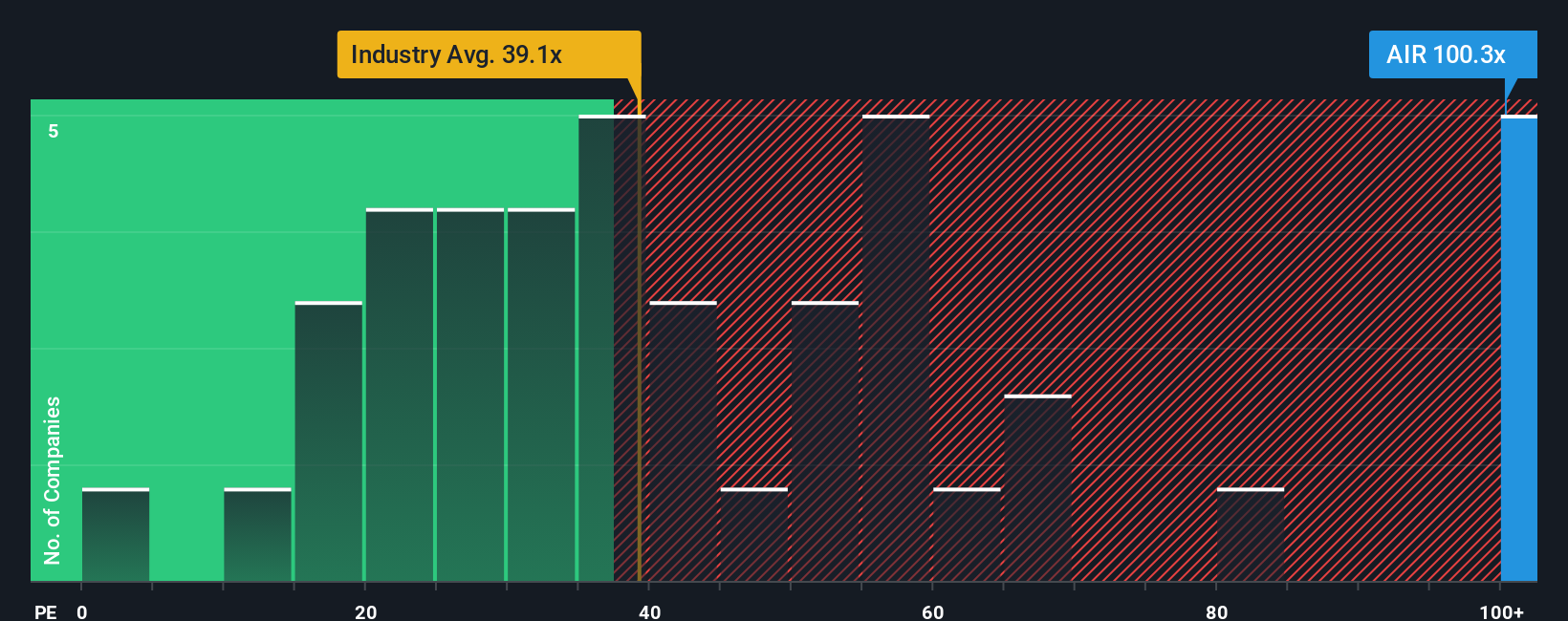

While growth-driven models point towards value, a closer look at price-to-earnings suggests AAR may be running hot. At 114.5x, its ratio is nearly triple the US industry average of 38.9x and well above the fair ratio of 50x. Could AAR’s momentum outpace these high expectations, or is caution needed here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAR Narrative

If you prefer digging into the numbers yourself or want your own spin on AAR’s story, you can shape your perspective in just a few minutes. Do it your way

A great starting point for your AAR research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your opportunities to just one stock? The smartest investors keep searching for undervalued gems, powerful trends, and overlooked markets. This approach helps ensure that no breakout slips by.

- Spot income potential as you review these 14 dividend stocks with yields > 3% and capture yields above 3% from companies rewarding shareholders.

- Fuel your portfolio with growth by targeting these 25 AI penny stocks positioned at the forefront of the artificial intelligence revolution.

- Uncover tomorrow’s bargains, acting early on these 865 undervalued stocks based on cash flows to get ahead before the rest of the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives