- United States

- /

- Machinery

- /

- NYSE:AIN

Albany International (AIN): Assessing Valuation After CEO Share Purchase Fuels Investor Interest

Reviewed by Simply Wall St

Albany International (AIN) recently posted third-quarter results that fell short of expectations. However, shares saw a slight uptick after President and CEO Gunnar Kleveland purchased 2,300 shares of Class A stock.

See our latest analysis for Albany International.

Albany International’s share price has struggled recently, with a steep 1-month loss of 20.8% and a year-to-date decline of 42.7%. While the CEO's share purchase offered a brief boost and raised some eyebrows about growth potential, momentum remains weak as the 1-year total shareholder return sits at -45.6%. This is a sign investors remain cautious about the company’s turnaround story.

If you’re looking for ideas beyond Albany International, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock now trading at a sizeable discount to analyst price targets, investors are left wondering if Albany International is an undervalued opportunity or if the market has already factored in all future prospects.

Most Popular Narrative: 23% Undervalued

According to the most widely followed narrative, Albany International’s fair value estimate stands meaningfully above its last close price, making its discount hard to ignore. This sets the stage for a closer look at what's driving such optimism.

Accelerating adoption of lightweight composites in aerospace and defense, demonstrated by expanding content on next generation aircraft, ramping on key programs like CH-53K, LEAP, and Bell 525, and new applications such as 3D woven parts replacing titanium, positions Albany's Engineered Composites segment for significant high-margin revenue and earnings expansion.

Want to find out what fuels those bullish forecasts? The most popular model banks on aggressive improvements, soaring profits, richer margins, and shifts toward higher-value products. Discover the boldest estimates analysts are using to justify such a high fair value.

Result: Fair Value of $59.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including structural declines in traditional paper demand and operational setbacks. These challenges could undermine Albany International's rebound story.

Find out about the key risks to this Albany International narrative.

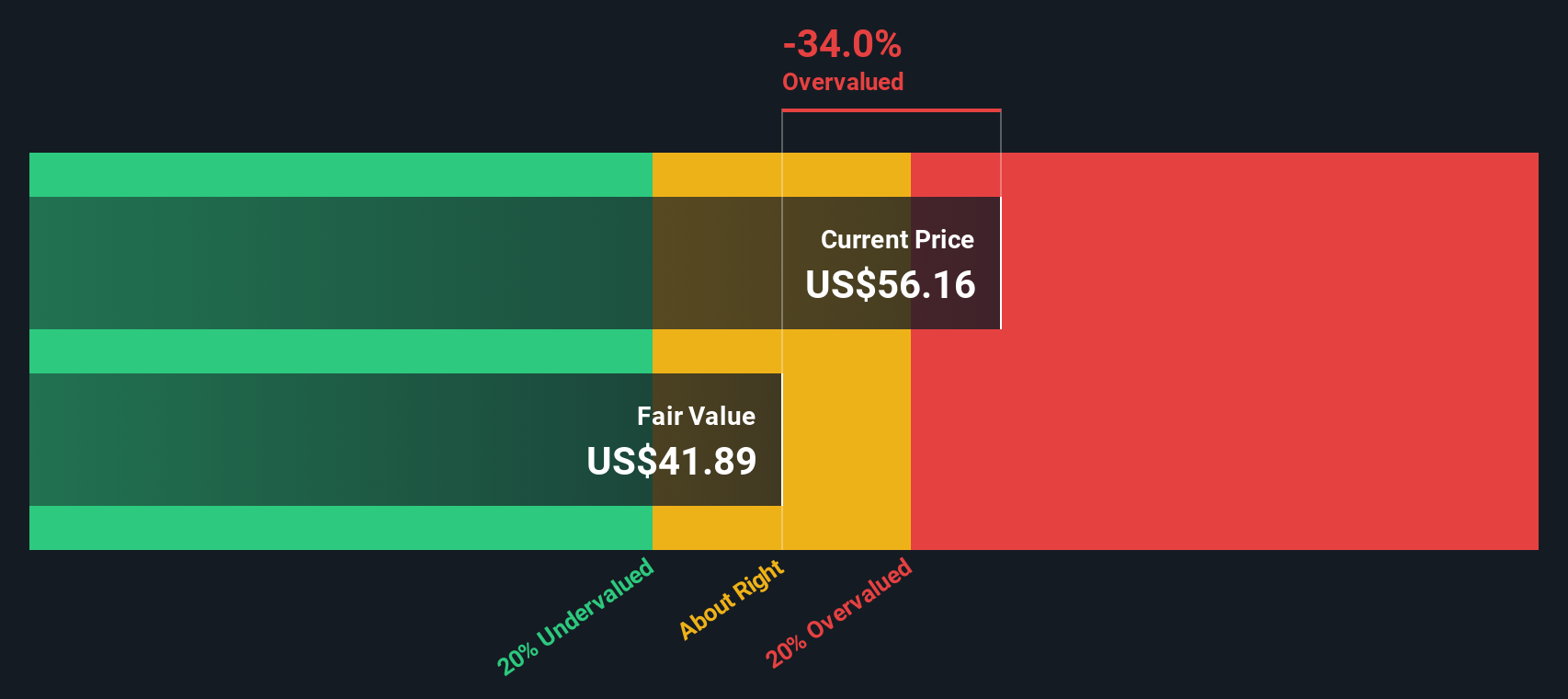

Another View: SWS DCF Model Says Shares Are Overvalued

While analyst models suggest Albany International is undervalued, our SWS DCF model arrives at a different conclusion. According to this approach, the shares are trading well above their estimated fair value of $28.87. This suggests the market may be factoring in more optimistic assumptions than are justified. Which outlook will ultimately play out?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Albany International Narrative

If you’re not convinced by the models above or want to take a hands-on approach, dive deeper into the numbers and shape your own view in just a few minutes: Do it your way

A great starting point for your Albany International research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your portfolio by targeting companies with outstanding growth, robust trends, or untapped potential. Don’t settle for yesterday’s winners when new opportunities await.

- Uncover tomorrow's market movers and tap into exciting potential with these 3605 penny stocks with strong financials.

- Boost your strategy by following standout performers with strong fundamentals using these 924 undervalued stocks based on cash flows.

- Stay ahead of innovation by following pioneers in medical technology through these 30 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIN

Albany International

Engages in the machine clothing and engineered composites businesses.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives