Stock Analysis

- United States

- /

- Construction

- /

- NYSE:AGX

Exploring Undiscovered Stocks With Potential In July 2024

Reviewed by Simply Wall St

Over the past year, the United States stock market has shown robust growth, climbing 23% and continuing its upward trajectory with a 2.2% rise in just the last week. In this vibrant market environment, identifying stocks with untapped potential can offer intriguing opportunities for investors looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| River Financial | 131.04% | 17.59% | 20.70% | ★★★★★★ |

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Safety Insurance Group (NasdaqGS:SAFT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Safety Insurance Group, Inc. operates in the United States, offering private passenger and commercial automobile insurance, along with homeowner policies, with a market capitalization of approximately $1.20 billion.

Operations: The company specializes in property and casualty insurance, generating a revenue of $985.43 million from this segment. It operates with a gross profit margin of 7.43% as of the latest reporting period in 2024.

Safety Insurance Group has shown notable performance, with earnings growth of 95% over the past year, significantly outpacing the insurance industry's 42.9%. This growth is supported by a strong debt to equity ratio improvement from 0% to 3.7% in five years and robust interest coverage at 90.4 times EBIT. Despite a decline in earnings by an average of 18.9% annually over the past five years, recent financials reveal a rebound, with Q1 revenue rising to $268 million from $214 million year-over-year and net income reaching $20 million compared to a loss previously. The company also affirmed its quarterly dividend at $0.90 per share, underscoring its financial health and commitment to shareholder returns.

- Click here to discover the nuances of Safety Insurance Group with our detailed analytical health report.

Assess Safety Insurance Group's past performance with our detailed historical performance reports.

Safety Insurance Group (NasdaqGS:SAFT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Safety Insurance Group, Inc. operates in the United States, offering private passenger and commercial automobile insurance, along with homeowner policies, with a market capitalization of approximately $1.20 billion.

Operations: The company specializes in property and casualty insurance, generating a revenue of $985.43 million from this segment. It operates with a gross profit margin of 7.43% as of the latest reporting period in 2024.

Safety Insurance Group has shown notable performance, with earnings growth of 95% over the past year, significantly outpacing the insurance industry's 42.9%. This growth is supported by a strong debt to equity ratio improvement from 0% to 3.7% in five years and robust interest coverage at 90.4 times EBIT. Despite a decline in earnings by an average of 18.9% annually over the past five years, recent financials reveal a rebound, with Q1 revenue rising to $268 million from $214 million year-over-year and net income reaching $20 million compared to a loss previously. The company also affirmed its quarterly dividend at $0.90 per share, underscoring its financial health and commitment to shareholder returns.

- Click here to discover the nuances of Safety Insurance Group with our detailed analytical health report.

Assess Safety Insurance Group's past performance with our detailed historical performance reports.

World Acceptance (NasdaqGS:WRLD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: World Acceptance Corporation operates in the consumer finance sector within the United States, with a market capitalization of approximately $745.17 million.

Operations: The company operates in the consumer finance sector, primarily generating revenue through lending services. It has demonstrated a gross profit margin of 72.61% as of the most recent quarter, reflecting its ability to manage costs relative to revenue effectively.

World Acceptance Corporation, a lesser-known player in the consumer finance sector, recently announced robust earnings growth of 264.3% over the past year, significantly outpacing its industry's decline of 11.5%. Despite a challenging five-year period with earnings decreasing annually by 4.1%, the company's recent performance and strategic share repurchases—totaling $20 million—signal potential resilience and investor confidence. Additionally, its Price-To-Earnings ratio stands attractively at 10.3x, below the US market average of 17.6x, complemented by high-quality earnings and effective interest coverage (EBIT is 3.1 times interest payments). However, investors should note WRLD's elevated debt levels with a net debt to equity ratio of 114.1%.

- Unlock comprehensive insights into our analysis of World Acceptance stock in this health report.

Examine World Acceptance's past performance report to understand how it has performed in the past.

World Acceptance (NasdaqGS:WRLD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: World Acceptance Corporation operates in the consumer finance sector within the United States, with a market capitalization of approximately $745.17 million.

Operations: The company operates in the consumer finance sector, primarily generating revenue through lending services. It has demonstrated a gross profit margin of 72.61% as of the most recent quarter, reflecting its ability to manage costs relative to revenue effectively.

World Acceptance Corporation, a lesser-known player in the consumer finance sector, recently announced robust earnings growth of 264.3% over the past year, significantly outpacing its industry's decline of 11.5%. Despite a challenging five-year period with earnings decreasing annually by 4.1%, the company's recent performance and strategic share repurchases—totaling $20 million—signal potential resilience and investor confidence. Additionally, its Price-To-Earnings ratio stands attractively at 10.3x, below the US market average of 17.6x, complemented by high-quality earnings and effective interest coverage (EBIT is 3.1 times interest payments). However, investors should note WRLD's elevated debt levels with a net debt to equity ratio of 114.1%.

- Unlock comprehensive insights into our analysis of World Acceptance stock in this health report.

Examine World Acceptance's past performance report to understand how it has performed in the past.

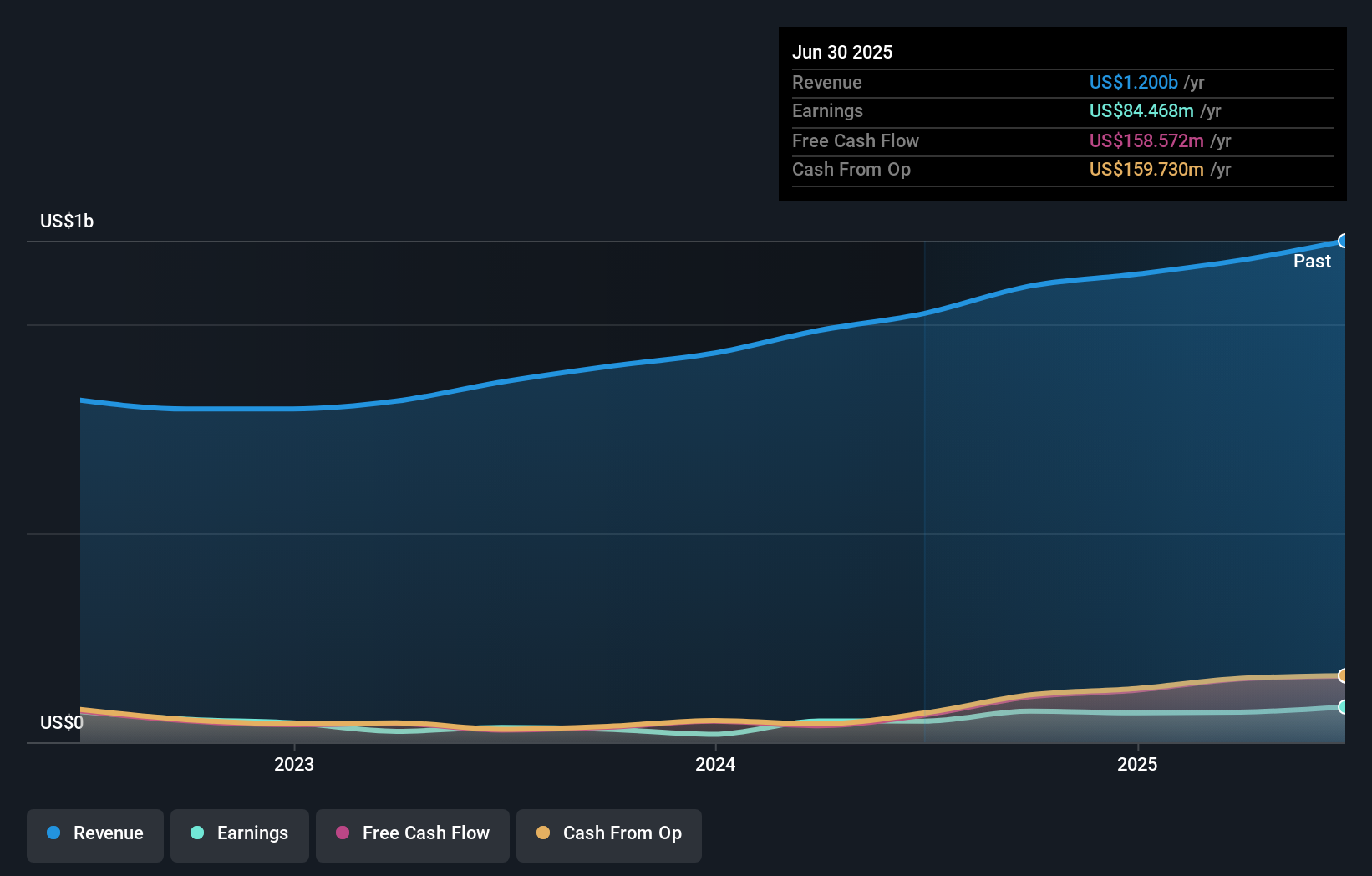

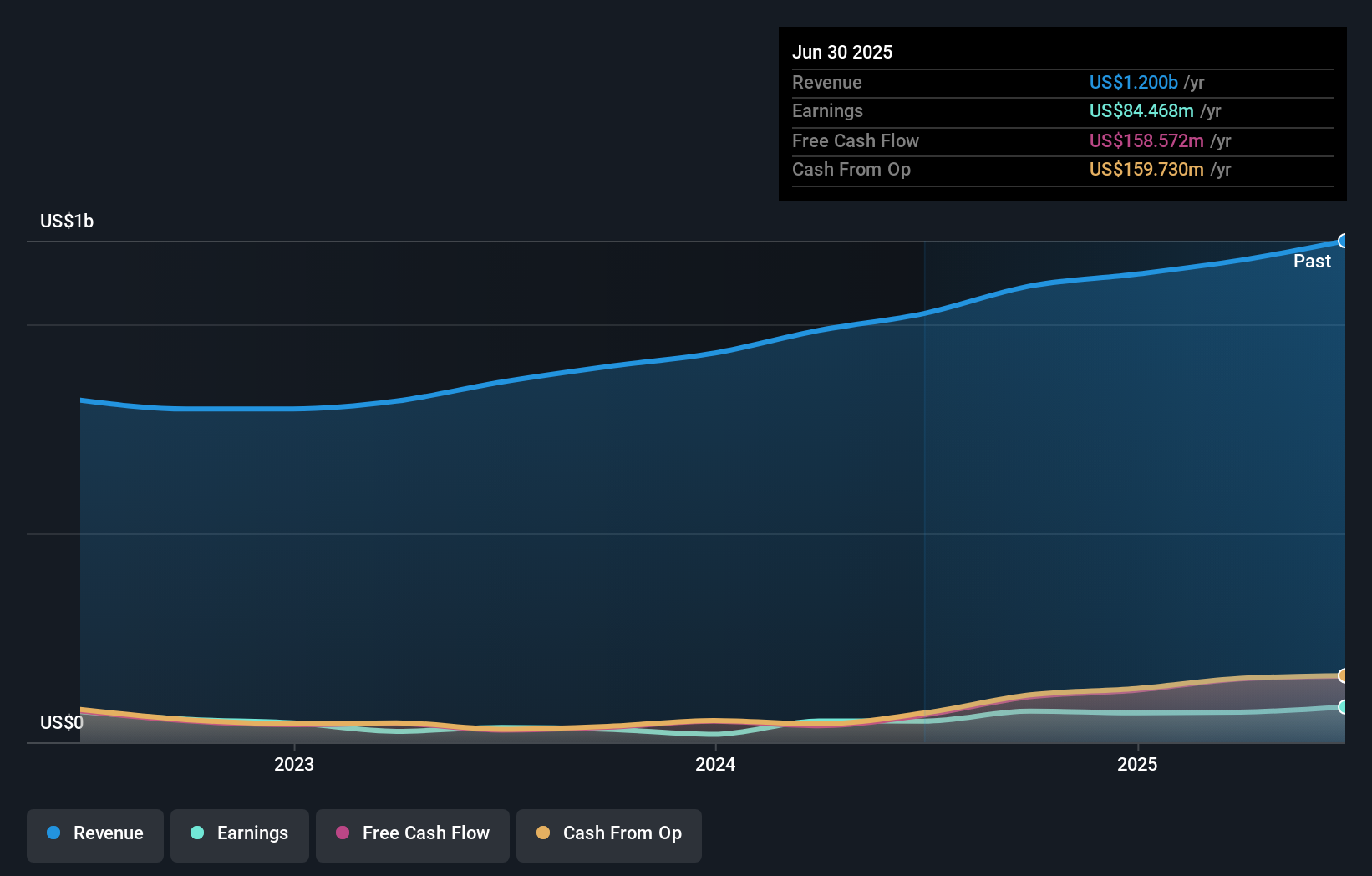

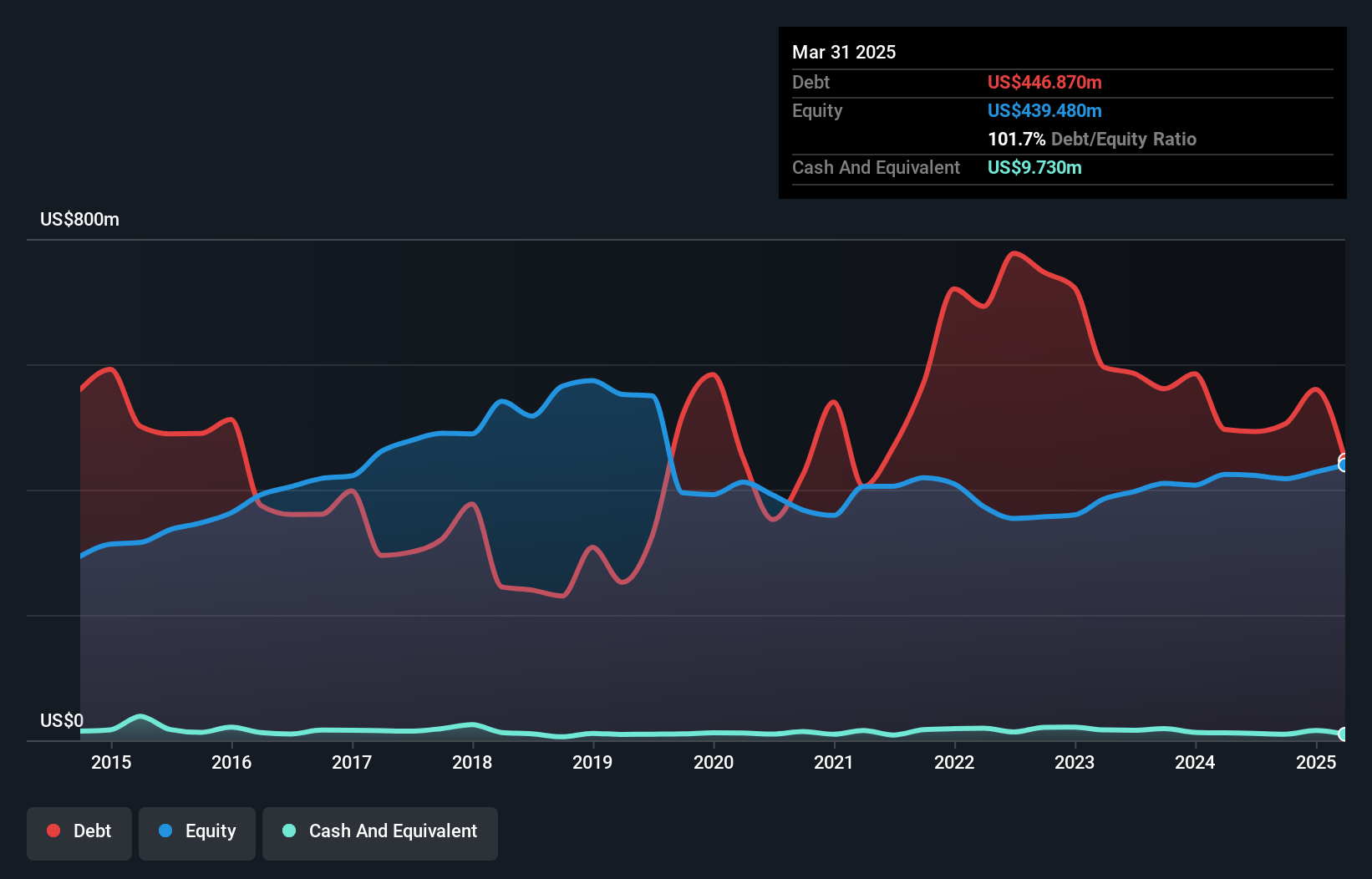

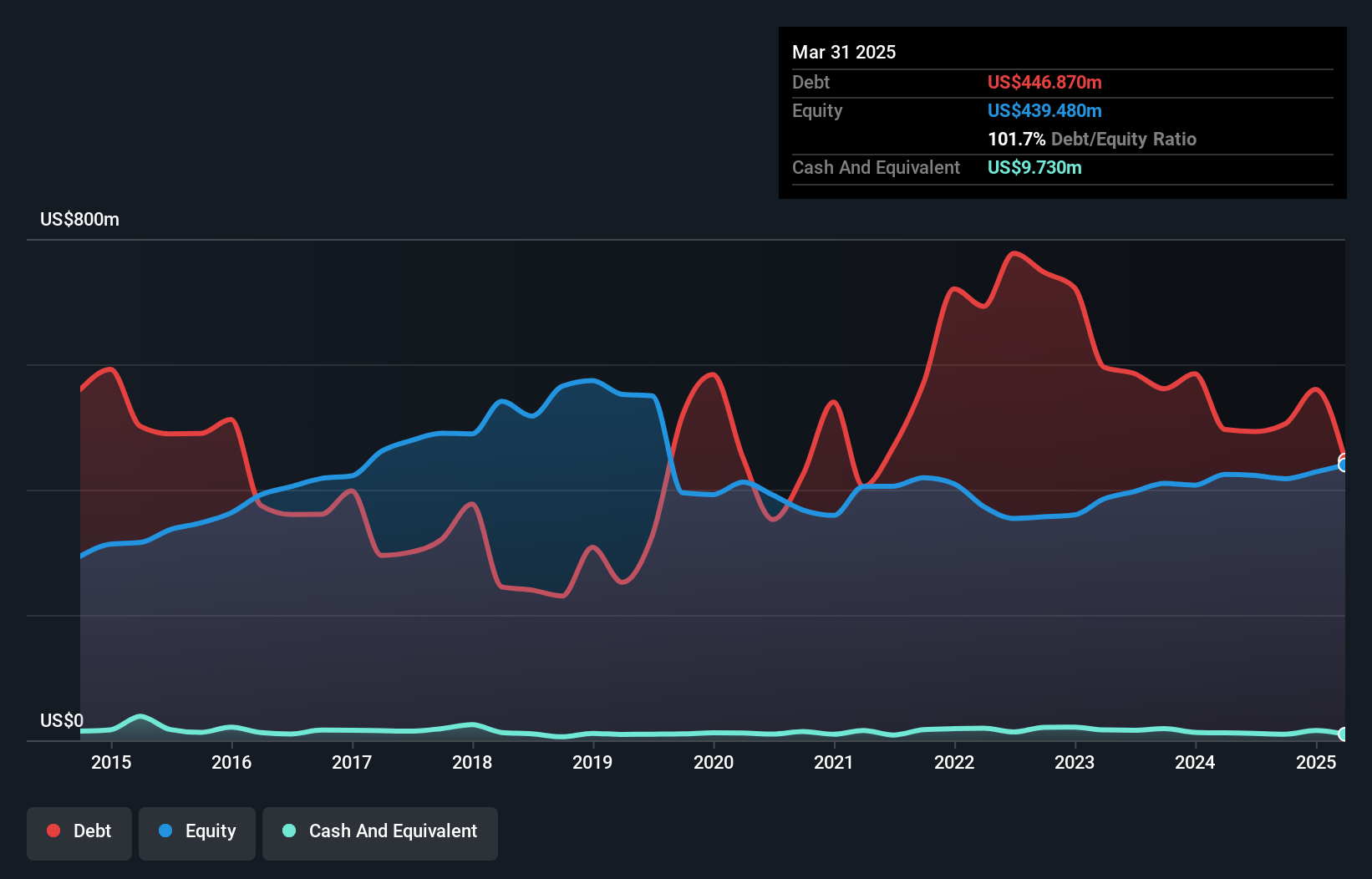

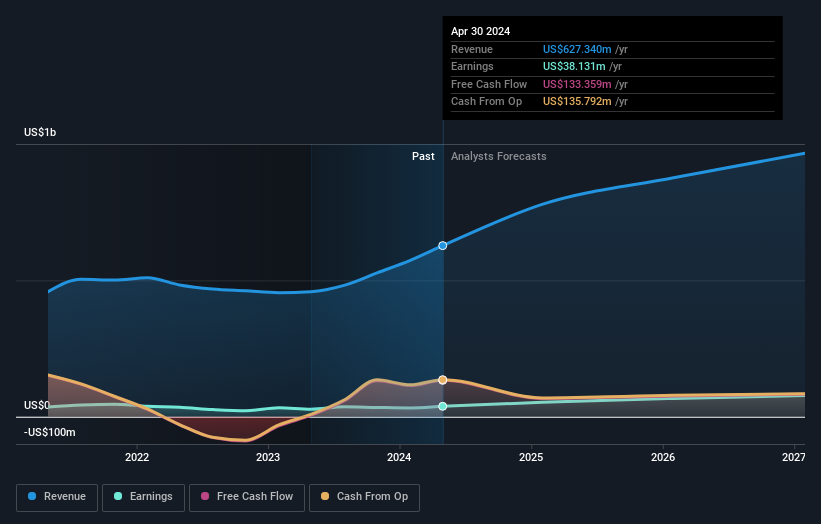

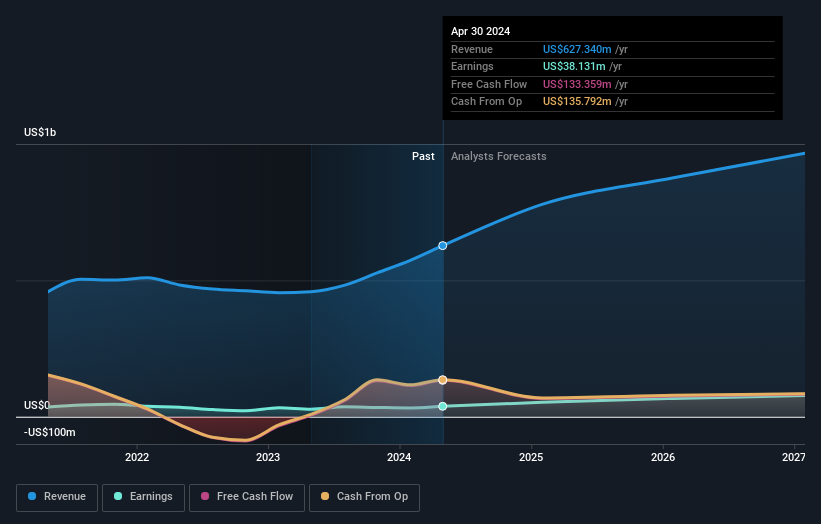

Argan (NYSE:AGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Argan, Inc., through its subsidiaries, offers a range of services including engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting primarily for the power generation sector; it has a market capitalization of approximately $1.03 billion.

Operations: Power Services, Telecom Services, and Industrial Services form the core revenue streams for the company, with Power Services being the predominant segment. Gross profit margins have shown variability over recent periods, reflecting changes in cost of goods sold and operational efficiency.

Amidst shifts in the investment landscape, Argan stands out with its remarkable 37.5% earnings growth surpassing the construction industry's 13.5%. This performance is bolstered by a debt-free status and projections of a 24.87% annual earnings increase. Recently, Argan has been actively repurchasing shares, with significant buybacks enhancing shareholder value. Moreover, its inclusion in various Russell indexes underscores its growing appeal to growth-focused investors, aligning with strategic moves like seeking acquisitions to bolster its market position further.

- Navigate through the intricacies of Argan with our comprehensive health report here.

Gain insights into Argan's past trends and performance with our Past report.

Argan (NYSE:AGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Argan, Inc., through its subsidiaries, offers a range of services including engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting primarily for the power generation sector; it has a market capitalization of approximately $1.03 billion.

Operations: Power Services, Telecom Services, and Industrial Services form the core revenue streams for the company, with Power Services being the predominant segment. Gross profit margins have shown variability over recent periods, reflecting changes in cost of goods sold and operational efficiency.

Amidst shifts in the investment landscape, Argan stands out with its remarkable 37.5% earnings growth surpassing the construction industry's 13.5%. This performance is bolstered by a debt-free status and projections of a 24.87% annual earnings increase. Recently, Argan has been actively repurchasing shares, with significant buybacks enhancing shareholder value. Moreover, its inclusion in various Russell indexes underscores its growing appeal to growth-focused investors, aligning with strategic moves like seeking acquisitions to bolster its market position further.

- Navigate through the intricacies of Argan with our comprehensive health report here.

Gain insights into Argan's past trends and performance with our Past report.

Taking Advantage

- Get an in-depth perspective on all 227 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Argan is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market.

Flawless balance sheet established dividend payer.