- United States

- /

- Construction

- /

- NYSE:AGX

Argan (AGX) Is Up 12.9% After Securing Major Contract for 860 MW Texas Power Plant

Reviewed by Sasha Jovanovic

- Gemma Power Systems, a subsidiary of Argan, recently announced it has secured an engineering, procurement, and construction contract for an approximately 860 MW natural gas-fired power plant in the ERCOT market, with the full value included in Argan's project backlog for the October 2025 quarter.

- This significant win highlights Argan's ability to execute and add large multi-year projects that strengthen revenue visibility and reinforce its sector presence.

- We'll explore how this major power plant contract meaningfully increases Argan's backlog and shapes its investment outlook going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Argan Investment Narrative Recap

For Argan shareholders, the core belief centers on the company's ability to win and deliver large-scale infrastructure projects, backed by robust demand for power generation and grid modernization. The new 860 MW natural gas plant contract further enhances short-term visibility for revenue growth and sets a positive tone for backlog strength, but it does not fundamentally reduce the largest risk, earnings sensitivity to project timing and flawless execution for these few, large buildouts.

Of the recent announcements, the October 30 green light for Gemma’s 1,350 MW Texas project stands out, closely mirroring the current news as both significantly expand Argan's multi-year backlog and underpin its revenue catalysts. Together, these projects reinforce backlog quality, supporting near-term momentum while highlighting how customer concentration remains a key consideration.

By contrast, investors should not overlook that even with a record backlog, Argan’s earnings can quickly fluctuate if...

Read the full narrative on Argan (it's free!)

Argan's narrative projects $1.5 billion revenue and $142.0 million earnings by 2028. This requires 18.1% yearly revenue growth and a $24.8 million increase in earnings from $117.2 million.

Uncover how Argan's forecasts yield a $262.00 fair value, a 25% downside to its current price.

Exploring Other Perspectives

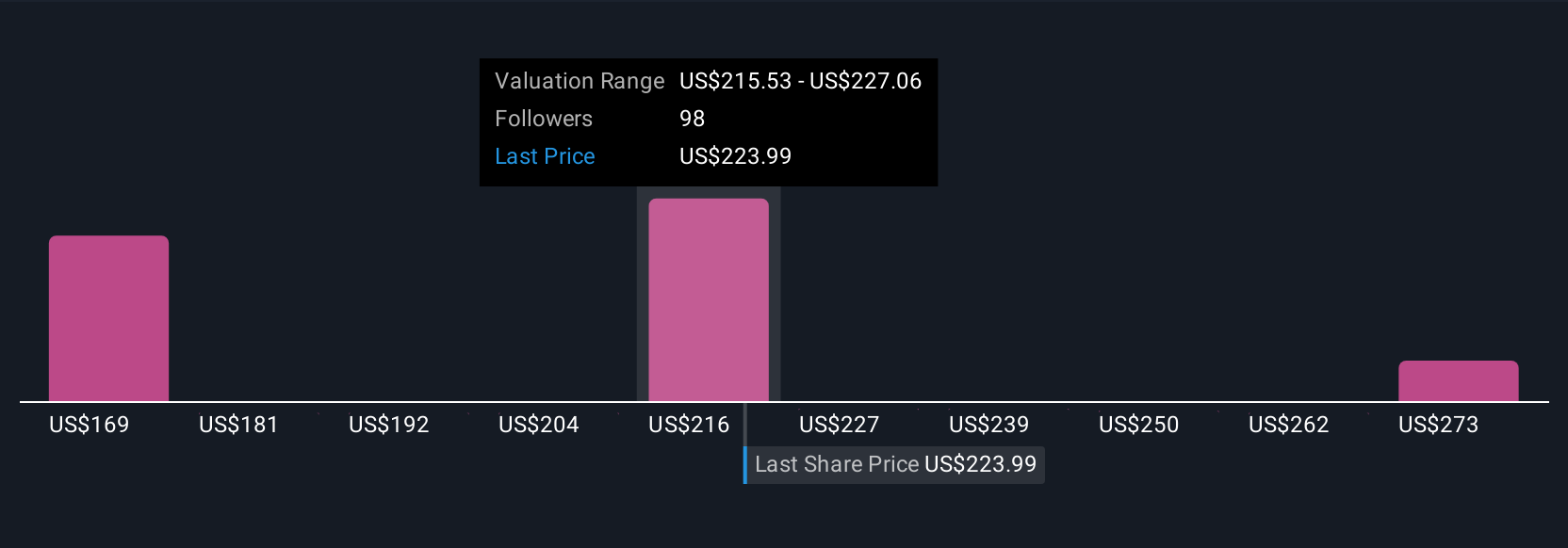

Eight members of the Simply Wall St Community estimate Argan's fair value between US$229.49 and US$284.68 per share. While many see opportunity in expanding backlogs, customer and project concentration could impact future returns, make sure to review diverse opinions before deciding what this means for you.

Explore 8 other fair value estimates on Argan - why the stock might be worth 35% less than the current price!

Build Your Own Argan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Argan research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Argan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Argan's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives