- United States

- /

- Machinery

- /

- NYSE:AGCO

Should AGCO’s (AGCO) Dividend and Upbeat Outlook Shift Investors’ Focus After Recent Sales Decline?

Reviewed by Sasha Jovanovic

- On October 23, 2025, AGCO's Board of Directors declared a regular quarterly dividend of $0.29 per common share, payable on December 15, 2025, to all stockholders of record as of November 14, 2025.

- Alongside this dividend announcement, AGCO raised its full-year net sales forecast and increased its earnings guidance, showing greater management confidence despite a recent 19% decline in quarterly sales.

- We’ll explore how AGCO’s decision to boost its full-year outlook, despite recent sales weakness, shapes the company’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AGCO Investment Narrative Recap

The investment case for AGCO centers on the belief that rising global demand for agricultural productivity and precision ag technologies outweighs current end-market volatility. The recent dividend announcement and management’s decision to raise full-year net sales and earnings guidance, despite a sharp sales decline, has not meaningfully changed the primary short-term catalyst, an anticipated recovery in North American and European demand, or reduced the most important risk, which remains prolonged regional weakness and elevated dealer inventories. Among AGCO’s latest updates, the raised 2025 net sales and earnings guidance is most relevant to this dividend news. By aiming for US$9.8 billion in full-year sales and higher earnings per share, AGCO underscores its focus on margin stability and operational resilience, key factors as investors weigh the potential for improved demand and ongoing inventory risks. However, investors should not overlook the possibility that, despite management’s improved outlook, the risk of prolonged demand weakness in core regions could pressure margins well into next year...

Read the full narrative on AGCO (it's free!)

AGCO's narrative projects $12.1 billion in revenue and $800.1 million in earnings by 2028. This requires 5.9% yearly revenue growth and a $700.5 million earnings increase from $99.6 million today.

Uncover how AGCO's forecasts yield a $121.85 fair value, a 12% upside to its current price.

Exploring Other Perspectives

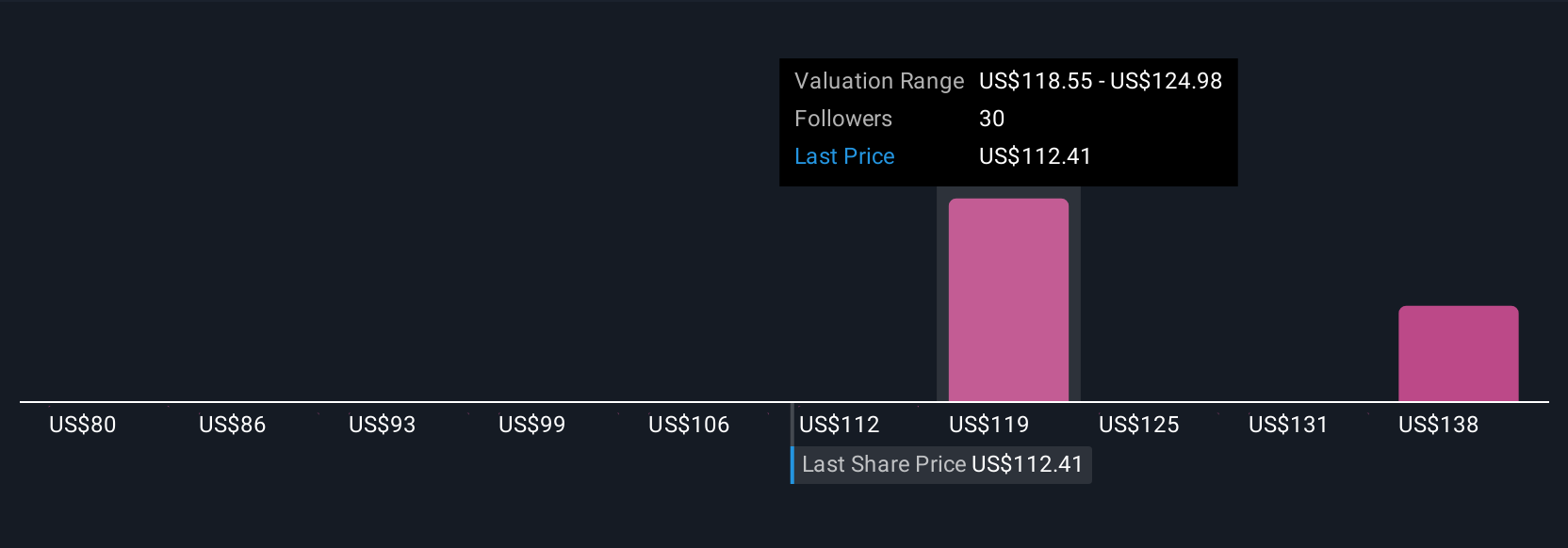

Simply Wall St Community members estimate AGCO’s fair value between US$80 and US$137.25 using their own forecasts, with three distinct perspectives. With management’s higher guidance challenging weak industry trends, these diverse opinions show how performance outlooks can vary, be sure to compare multiple viewpoints before making up your own mind.

Explore 3 other fair value estimates on AGCO - why the stock might be worth 26% less than the current price!

Build Your Own AGCO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AGCO research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free AGCO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AGCO's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGCO

AGCO

Manufactures and distributes agricultural equipment and replacement parts worldwide.

Moderate risk with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives