- United States

- /

- Machinery

- /

- NYSE:AGCO

How AGCO's (AGCO) Push Into AI-Driven Precision Planting Could Shape Its Investment Outlook

Reviewed by Sasha Jovanovic

- In recent days, the precision planting market has seen growing momentum, with AGCO advancing its investments in precision hardware and software to meet rising global food demands and boost planting accuracy.

- An important development is the industry-wide focus on integrating digital and AI-driven solutions, which has accelerated adoption in North America and positioned AGCO as a key player in this technological shift.

- We'll look at how AGCO's expansion in precision agriculture technology may influence its longer-term investment prospects and analyst expectations.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

AGCO Investment Narrative Recap

At its core, an investment in AGCO hinges on belief in the rising impact of precision agriculture and technology-driven farming solutions amid growing global food demand. The latest news highlights rapid advancements in digital and AI-enabled planting, which may reinforce AGCO’s exposure to precision markets but does not appear to alter the most important short-term catalyst: whether demand recovers in North America and Europe. The central risk remains that subdued farm spending and inventory overhang could still weigh on margins.

Among AGCO’s recent announcements, the appointment of Brian Sorbe as President of PTx stands out. Sorbe’s background in precision farming suggests a focus on expanding AGCO’s digital ag offerings, which directly aligns with the accelerating adoption of precision technologies identified as a major growth catalyst for the business.

By contrast, investors should also be watching for signs of continued dealer inventory excess and demand weakness in core markets...

Read the full narrative on AGCO (it's free!)

AGCO's outlook anticipates $12.1 billion in revenue and $800.1 million in earnings by 2028. This is based on a 5.9% annual revenue growth rate and a $700.5 million increase in earnings from the current $99.6 million.

Uncover how AGCO's forecasts yield a $121.85 fair value, a 14% upside to its current price.

Exploring Other Perspectives

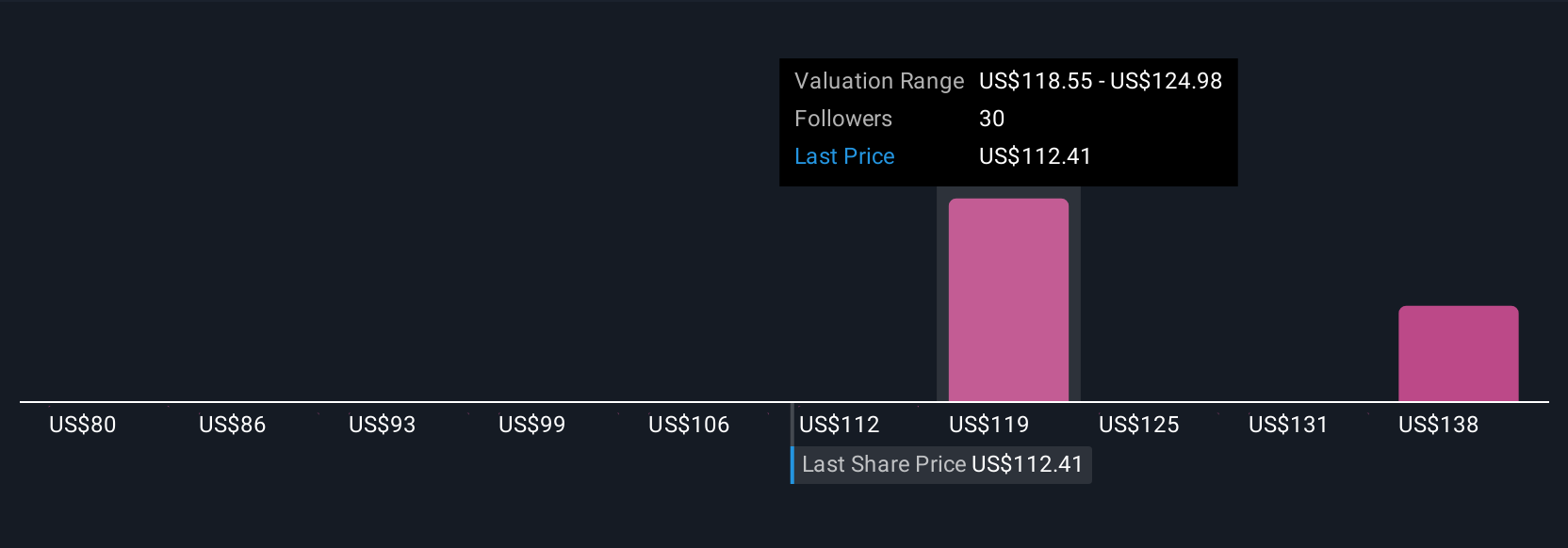

Four community fair value estimates for AGCO range widely between US$80 and US$136. Analysts point to North American demand and industry inventories as major short-term variables for financial results, so it’s worth checking multiple viewpoints before acting.

Explore 4 other fair value estimates on AGCO - why the stock might be worth 25% less than the current price!

Build Your Own AGCO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AGCO research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free AGCO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AGCO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGCO

AGCO

Manufactures and distributes agricultural equipment and replacement parts worldwide.

Moderate risk with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives