- United States

- /

- Machinery

- /

- NYSE:AGCO

AGCO’s Precision Farming Push via PTx Trimble Deal Might Change the Case for Investing in AGCO (AGCO)

Reviewed by Sasha Jovanovic

- AGCO recently completed the PTx Trimble joint venture, aiming to strengthen its precision farming capabilities and enhance digital solutions for its agricultural equipment business.

- This partnership underscores AGCO's ongoing response to replacement demand for older machinery and highlights its commitment to adopting advanced smart farming technologies.

- We’ll explore how AGCO’s digital investments, especially the PTx Trimble venture, could influence its broader investment narrative going forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

AGCO Investment Narrative Recap

To be a shareholder in AGCO today, you would need to believe that the company's focus on digital transformation and increasing demand for advanced agricultural solutions can drive sustainable long-term growth, even as short-term risks remain pronounced. The recent completion of the PTx Trimble joint venture is a key move to reinforce AGCO’s presence in precision agriculture, but it does not materially offset the most significant near-term challenge, ongoing demand softness in North American and Western European equipment markets. The appointment of Brian Sorbe as President of PTx directly relates to AGCO’s increased investment in smart farming and digital technology. His experience in precision agriculture could help AGCO optimize the benefits of the new PTx Trimble partnership, supporting the company’s effort to capture higher-margin software-driven revenues, which remains a major catalyst despite prevailing market risks. Yet in contrast, it’s vital for investors to recognize that persistent dealer inventory overhang in North America could still weigh on AGCO’s overall earnings if...

Read the full narrative on AGCO (it's free!)

AGCO's narrative projects $12.1 billion in revenue and $800.1 million in earnings by 2028. This requires 5.9% yearly revenue growth and a $700.5 million earnings increase from the current $99.6 million.

Uncover how AGCO's forecasts yield a $119.86 fair value, a 13% upside to its current price.

Exploring Other Perspectives

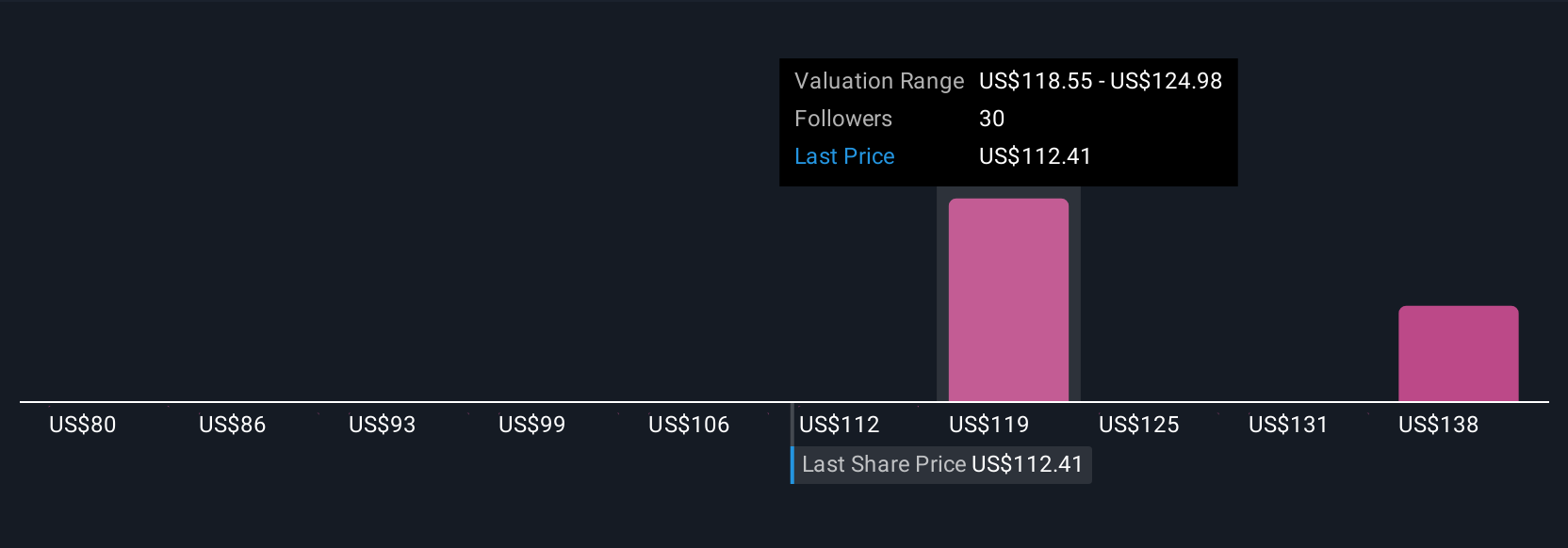

Four fair value estimates from the Simply Wall St Community range from US$80 to US$178.39, highlighting sharply differing opinions. With ongoing exposure to soft demand in core markets, you may want to explore several voices before forming an outlook on AGCO.

Explore 4 other fair value estimates on AGCO - why the stock might be worth as much as 68% more than the current price!

Build Your Own AGCO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AGCO research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AGCO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AGCO's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGCO

AGCO

Manufactures and distributes agricultural equipment and replacement parts worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026