- United States

- /

- Machinery

- /

- NYSE:AGCO

AGCO (AGCO) Valuation: Assessing New Guidance and Dividend Confidence

Reviewed by Simply Wall St

AGCO (NYSE:AGCO) has just declared a regular quarterly dividend of $0.29 per share, scheduled for payment on December 15, 2025. In addition, the company raised its full-year net sales forecast and earnings guidance.

See our latest analysis for AGCO.

AGCO’s latest dividend and improved outlook arrive as the stock continues to build on its momentum, with a year-to-date share price return of 19.01%. Over the past year, shareholders have enjoyed a total return of 9.48%, a steady performance reflecting both recent innovations and a renewed sense of confidence around the company’s direction.

If this positive trajectory in ag technology piques your interest, it might be the perfect moment to discover other fast-growing companies with high insider ownership. Check out fast growing stocks with high insider ownership.

But with AGCO's improved guidance and strong long-term returns already reflected in recent gains, the question remains: is there still hidden value for new investors, or are markets fully pricing in its future growth potential?

Most Popular Narrative: 10.8% Undervalued

AGCO’s current share price of $108.67 sits below the consensus fair value estimate of $121.85, offering a notable gap. The following narrative sets the scene for why analysts believe the market may be missing something big.

The global push for higher agricultural productivity due to population growth and rising food demand continues to drive AGCO's investments in premium brands (like Fendt) and expansion into underserved regions, positioning the company to outgrow industry demand and materially lift long-term revenue growth.

Want to know what revolutionary trends are behind this valuation? Find out which financial leaps, margin shifts, and future targets power this bold analyst consensus. This narrative is not just another market opinion. Discover the strategic pivots and projected transformation fueling AGCO’s growth thesis.

Result: Fair Value of $121.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand in core markets and escalating tariff costs could undermine AGCO’s margin targets. This may put the optimistic growth outlook at risk.

Find out about the key risks to this AGCO narrative.

Another View: Market Ratios Paint a Different Picture

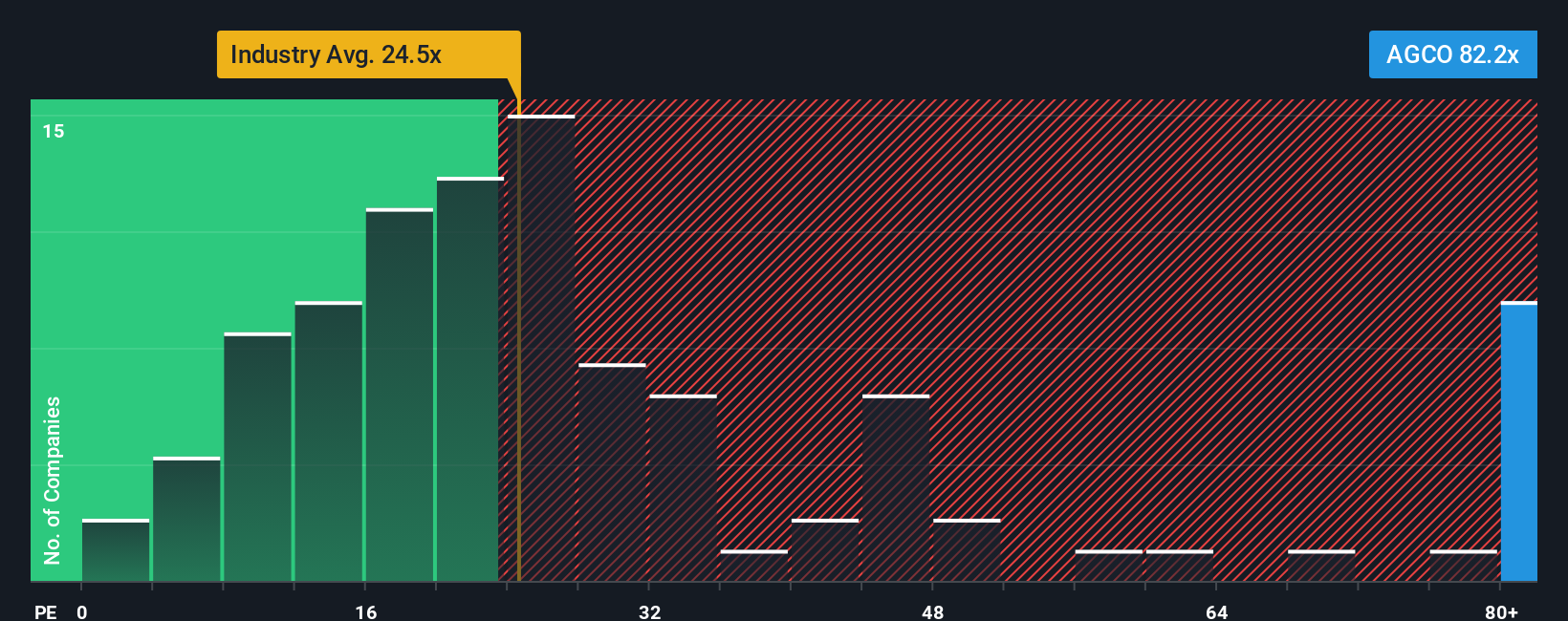

Looking beyond discounted cash flow, AGCO’s share price trades at 81.4 times its earnings. This is much higher than both the industry average of 24.7x and the peer average of 18.7x, and it is also above a fair ratio of 40.1x. Such a premium suggests investors are already paying up for growth expectations, so does this signal potential overvaluation or simply reflect unique prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AGCO Narrative

If you prefer to come to your own conclusions or think there’s another story in the numbers, you can shape your own narrative in just a few minutes. Do it your way.

A great starting point for your AGCO research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Unlock More High-Potential Opportunities

Smart investors never limit themselves to one great pick. Use the Simply Wall Street Screener to target tomorrow’s winners before the crowd catches up.

- Accelerate your growth game by picking from these 877 undervalued stocks based on cash flows that are primed for strong cash flow and market-beating prices.

- Capture unstoppable passive income streams by looking into these 17 dividend stocks with yields > 3% with attractive yields above 3%.

- Step into a frontier market by considering these 27 quantum computing stocks at the forefront of next-generation computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGCO

AGCO

Manufactures and distributes agricultural equipment and replacement parts worldwide.

Moderate risk with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives