- United States

- /

- Machinery

- /

- NYSE:AGCO

AGCO (AGCO): Assessing Valuation After Fendt and Valtra Win Top Industry Awards for Precision Farming Innovation

Reviewed by Simply Wall St

AGCO (AGCO) is turning heads this week as its Fendt and Valtra brands collected major honors at the AGRITECHNICA 2025 trade show, including Tractor of the Year and Farm Machine awards. These recognitions highlight AGCO’s momentum in precision farming technology and smart machinery for the global agricultural sector.

See our latest analysis for AGCO.

AGCO’s award sweep arrives amid a year of solid momentum for shareholders. The company’s one-year total return stands at 12.7%, while the share price sits at $104.43 after steady gains year-to-date. Innovation headlines and a hefty buyback announcement have helped offset recent North American demand challenges and kept sentiment constructive, even as insider selling ticks up. Short-term trends show a slight pullback. The longer-term picture suggests the company’s industry credibility and push into precision technology may be building underlying support.

If AGCO’s smart machinery surge has you watching for the next breakout, now’s a great time to discover fast growing stocks with high insider ownership.

With industry accolades piling up and the stock trading below analyst targets, investors are left to wonder whether AGCO is trading at a bargain or if the market already reflects its growth potential in the share price.

Most Popular Narrative: 12.8% Undervalued

AGCO last closed at $104.43, with the most popular narrative estimating fair value at $119.77 per share. That is a substantial gap, reflecting analysts’ belief in underlying strengths despite this year’s sector turbulence.

Investments in premium brands, precision agriculture, and digital solutions position AGCO for stronger growth, higher margins, and enhanced earnings quality.

Structural improvements and aftermarket expansion support operational efficiency, stable earnings, and robust capital returns to shareholders.

Want to know what is fueling this sizable valuation gap? The engine lies in how analysts see AGCO’s ability to ramp up margins and earnings growth through significant technology upgrades. Curious how aggressive the earnings forecast is, and whether the margin leap required is typical for the sector? Unpack the narrative’s keystone assumptions to grasp what makes this fair value tick.

Result: Fair Value of $119.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand in core markets and elevated tariffs could challenge AGCO’s margin expansion and raise questions about its longer-term growth outlook.

Find out about the key risks to this AGCO narrative.

Another View: Multiples Tell a Cautious Story

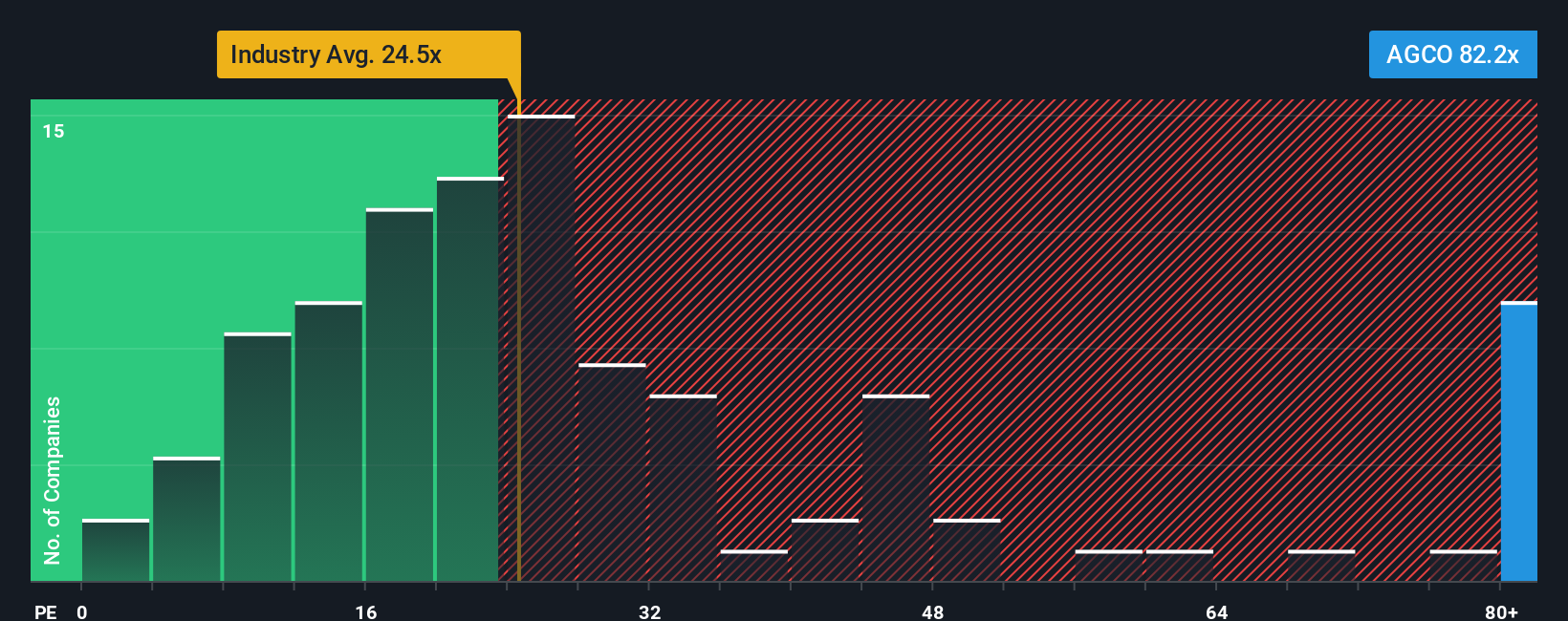

Stepping back from the fair value estimate, let’s consider where AGCO trades on its price-to-earnings metric. At 20.8x earnings, AGCO is priced a touch above its peer group average of 18.7x but remains slightly cheaper than the broader US Machinery industry average of 23.9x. Compared to a fair ratio of 25.8x, there could be headroom. However, paying over peer norms brings its own risks if company improvement doesn’t accelerate. So, does the market’s pricing reflect built-in caution, or hidden upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AGCO Narrative

If this doesn’t match your perspective or you’d rather chart your own path through the numbers, crafting your own story for AGCO takes just a few minutes. Do it your way.

A great starting point for your AGCO research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take action now and get ahead of the curve by tapping into unique stock opportunities before the crowd catches on. These three powerful themes could help you spot the next winner sooner:

- Unlock income growth by checking out these 16 dividend stocks with yields > 3%, which highlights attractive yields and proven dividend track records you won't want to miss.

- Capture cutting-edge potential with these 25 AI penny stocks, focusing on advances in artificial intelligence that could reshape entire industries.

- Position yourself for market upswings by reviewing these 886 undervalued stocks based on cash flows, which features companies trading below their true worth according to cash flow signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGCO

AGCO

Manufactures and distributes agricultural equipment and replacement parts worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives