- United States

- /

- Construction

- /

- NYSE:ACM

Does AECOM’s Strong 25% Rally Make Sense After Major Infrastructure Wins?

Reviewed by Bailey Pemberton

Thinking about what to do with AECOM stock? You are not alone. With the share price closing recently at $132.88 and putting up a standout year-to-date return of 25.0%, it is clear that investors are paying close attention. Over the past year, AECOM’s stock has climbed 28.4%, while the longer five-year return sits at a staggering 207.2%. Those are numbers that tend to spark serious curiosity, and sometimes, a touch of FOMO.

Of course, underneath these strong returns are shifting expectations and a company that keeps finding ways to grab industry headlines. Recent announcements have highlighted AECOM's big infrastructure project wins and expanded partnerships in sustainable urban development. These moves seem to have reassured investors about the company's momentum, which likely explains the resilience and steady climb in share price over the past three years, up a noteworthy 80.7%.

The big question, though, is whether the stock is still a good deal after such a powerful run. Valuation is often where confident investors and cautious ones part ways. Based on six valuation checks, AECOM scores a 2—meaning it is undervalued in 2 out of 6 categories. That is not a slam dunk, but it is not a red light, either. To really get a sense of where AECOM stands, it is worth looking at how the main valuation methods line up, and I will show you an even smarter way to judge a stock’s value before we are done.

AECOM scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AECOM Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic tool for valuing companies. It takes all expected future cash flows, or how much cash AECOM is likely to generate year by year, and then discounts them back to today. This allows investors to estimate what those future earnings are worth right now.

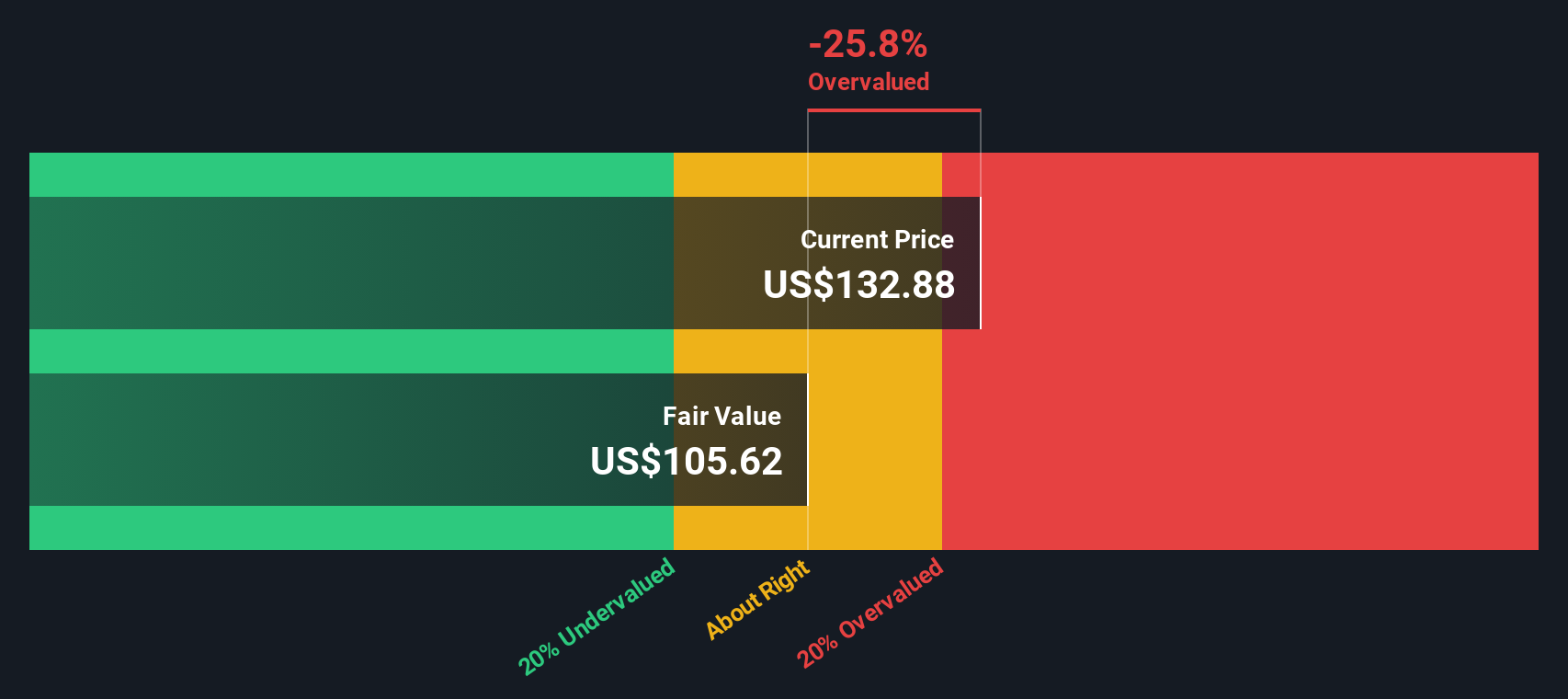

According to the latest numbers, AECOM generated Free Cash Flow (FCF) of $795.87 million over the last twelve months. Analyst estimates continue for the next several years, with projected FCF reaching $823.1 million in 2027. Looking even further ahead, the model extrapolates annual FCF growth, forecasting values approaching $1.01 billion by 2035. For each of these years, Simply Wall St discounts those cash flows back to present value and builds a comprehensive intrinsic valuation using the 2 Stage Free Cash Flow to Equity method.

The resulting intrinsic value from this DCF model is $105.62 per share. With AECOM's recent market price at $132.88, the DCF analysis implies the stock is trading about 25.8% higher than its fair value estimation. This suggests it is overvalued based on future cash flow forecasts alone.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AECOM may be overvalued by 25.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: AECOM Price vs Earnings

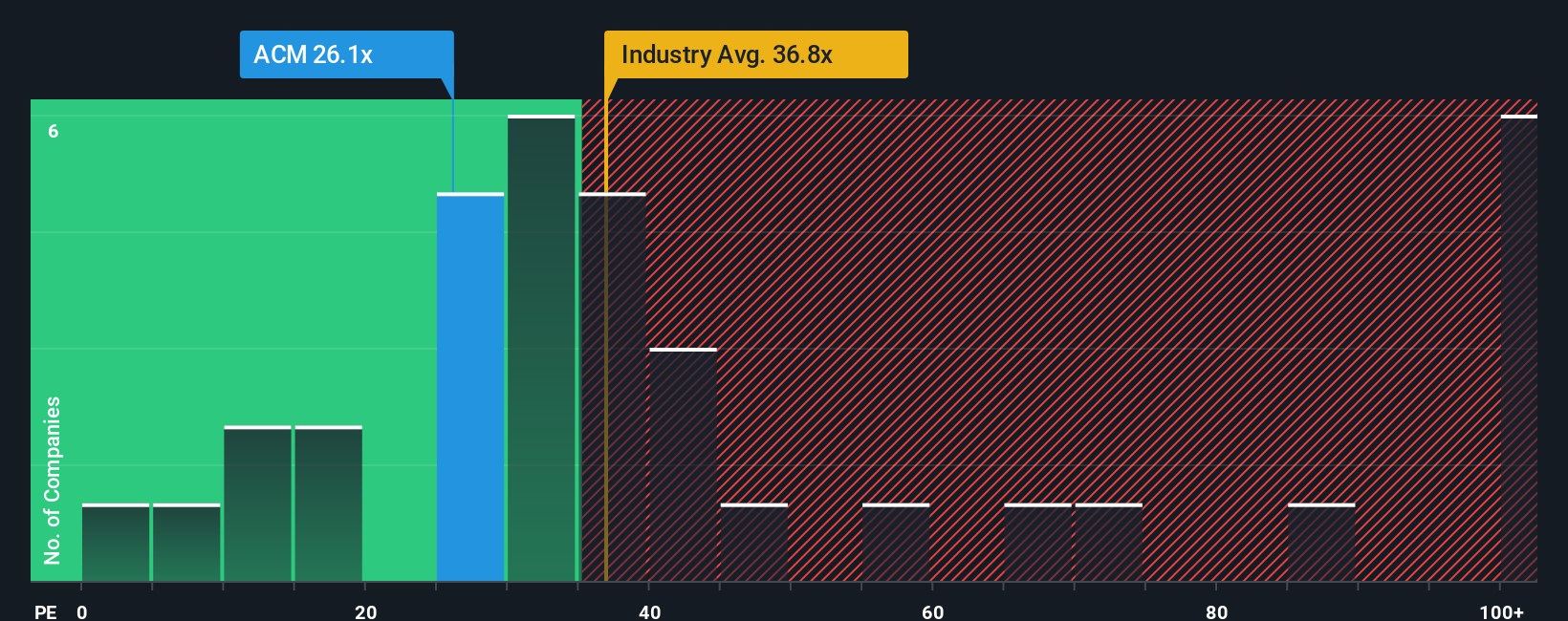

The Price-to-Earnings (PE) ratio is the go-to valuation metric for profitable companies like AECOM because it directly connects the stock’s price to its actual bottom-line earnings. It provides a clear snapshot of how much investors are paying for each dollar of profit, making it an intuitive gauge for whether a company is richly or reasonably valued.

But not all PE ratios are created equal. A “normal” or “fair” PE depends on how quickly the company is expected to grow, how stable its industry is, and how risky the business model might be. Fast-growing or lower-risk companies often deserve a higher PE, while slower or riskier firms typically trade at a discount.

Right now, AECOM trades at a PE of 26x. For context, the Construction industry average is about 35.3x, and peers sport an average PE closer to 58.8x. However, Simply Wall St’s Fair Ratio for AECOM is calculated at 23.4x, which adjusts for specific factors like the company’s growth prospects, profit margins, market cap, and sector risks. While peer and industry averages offer quick comparisons, the Fair Ratio gives a more holistic measure due to its detailed, proprietary adjustment for what’s actually going on at AECOM.

With AECOM’s actual PE only slightly above the Fair Ratio, the shares appear to be priced about right on this metric. They are neither particularly cheap nor expensive, once all the unique factors are weighed.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AECOM Narrative

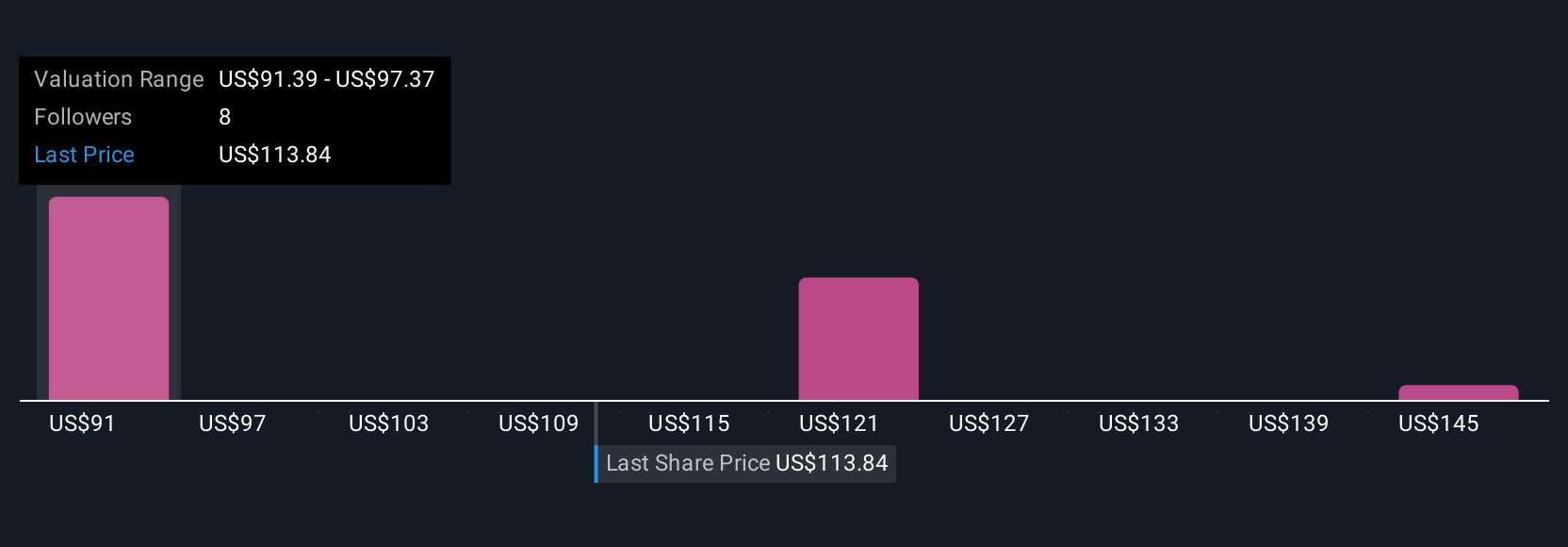

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story you believe about a company, brought to life with numbers. It reflects your conviction about AECOM's future revenue, margins, and fair value in a way that is both visible and testable. Unlike static ratios, a Narrative allows you to connect recent news or strategy shifts directly to a living financial forecast that updates in real time. On Simply Wall St's Community page, Narratives make it easy to see what investors like you assume about AECOM’s prospects, and how those convictions translate into a fair share price.

Narratives help you decide when it makes sense to buy or sell by comparing your calculated fair value to the current price. These valuations adjust automatically as new information or results emerge. For example, one AECOM investor may build a Narrative expecting an aggressive price target of $145.0 if government infrastructure spending accelerates, while another sets a more cautious fair value of just $109.0 based on concerns over cost pressures or macro headwinds. Narratives bring clarity and adaptability to your decisions, letting you invest with a strategy as dynamic as the company itself.

Do you think there's more to the story for AECOM? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACM

AECOM

Provides professional infrastructure consulting services for governments, businesses, and organizations worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives