- United States

- /

- Construction

- /

- NYSE:ACM

AECOM (NYSE:ACM): Evaluating Valuation Following Landmark Mukaab Project Win in Saudi Arabia

Reviewed by Simply Wall St

AECOM (NYSE:ACM), together with Jacobs, has been selected to provide design services for The Mukaab, the ambitious centerpiece of Riyadh's New Murabba development. This milestone initiative supports Saudi Arabia’s Vision 2030 for innovative urban transformation.

See our latest analysis for AECOM.

In the weeks leading up to this high-profile win, AECOM's share price has shown solid momentum, up nearly 12% in the past 90 days and delivering a strong 26% total shareholder return over the last twelve months. Events such as securing The Mukaab project have added to the sense of ongoing opportunity. The company’s steady growth has also contributed to impressive long-term returns.

If you’re interested in uncovering more companies with strong growth trajectories and high insider ownership, now is a great time to discover fast growing stocks with high insider ownership

With AECOM’s share price nearing analyst targets and the company winning landmark projects, investors may be considering whether the current valuation is an entry point for further gains or if the market has already accounted for the anticipated growth.

Most Popular Narrative: 5.6% Undervalued

With AECOM closing at $133.80 and the narrative’s fair value projection at $141.75, there is a visible valuation gap that has captured attention. This difference suggests the numbers behind the target price are ambitious, driven by more than just headline growth.

Accelerating global and U.S. government-backed infrastructure spending, especially in transportation, water, energy, and data centers, provides multi-year revenue visibility and a record backlog that should support top-line growth and backlog-driven earnings expansion.

Intensifying investment and client demand for climate resilience, sustainability, and energy transition projects positions AECOM to win higher-margin advisory and environmental contracts, supporting margin expansion and higher average contract values.

Curious how analysts build a price forecast above the current market? The key factors are major upgrades to future revenue velocity, margin potential, and ambitious profit targets. Want a snapshot of what these bullish projections mean for AECOM’s long-term value? Dive in to see the numbers and logic driving this eye-catching fair value.

Result: Fair Value of $141.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as shifting government infrastructure spending or rising operational costs could quickly change AECOM’s outlook and challenge current growth assumptions.

Find out about the key risks to this AECOM narrative.

Another View: SWS DCF Model Weighs In

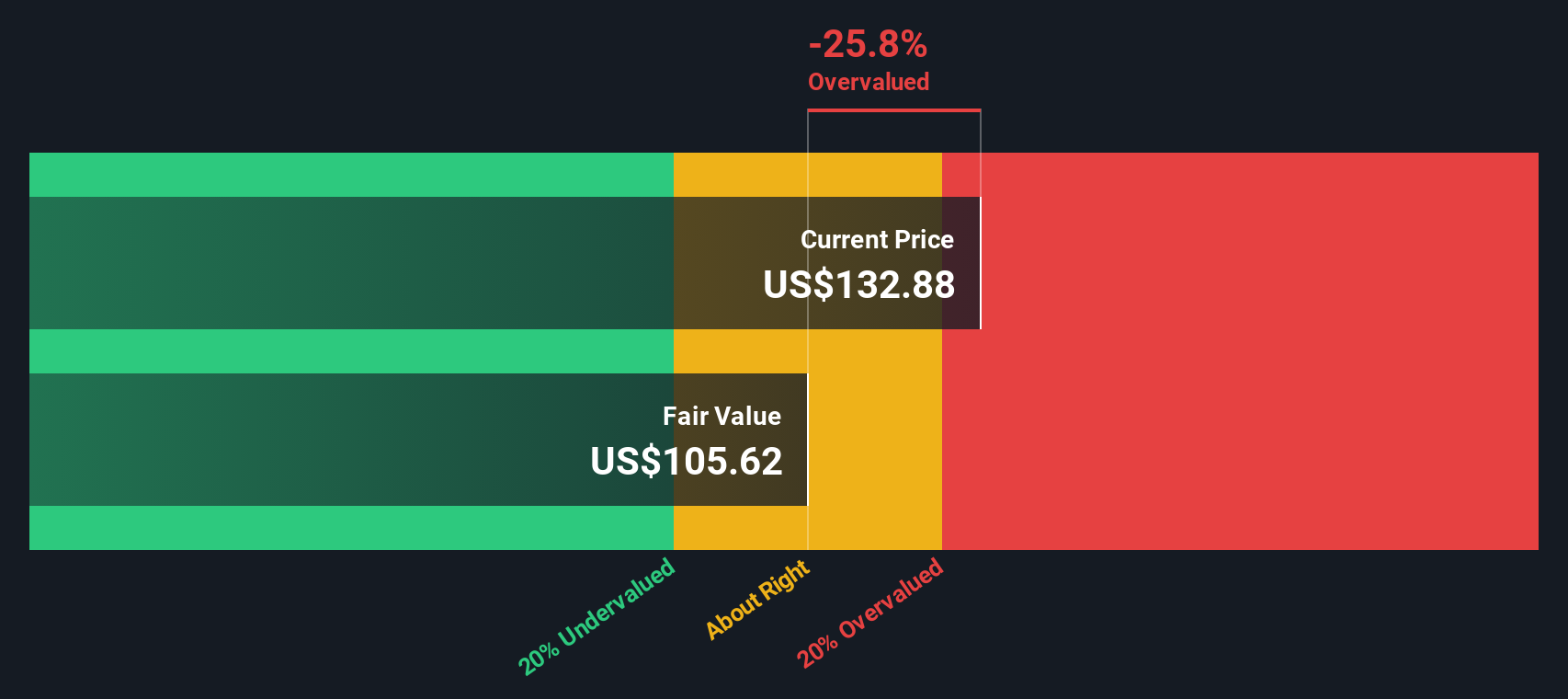

While the consensus target suggests AECOM is undervalued, our SWS DCF model sees things differently. Based on projected future cash flows, the DCF model values shares at $103.09, which is well below the current price and indicates the stock may be overvalued if these assumptions play out. Could the market's optimism for growth be outpacing realistic expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AECOM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AECOM Narrative

If you have a different perspective or want your own take on the numbers, crafting your personal narrative is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AECOM.

Looking for More Actionable Investment Ideas?

Smart investors know opportunity rarely knocks twice. Don’t wait for the next headline. Expand your playbook right now by targeting themes and sectors with major upside potential.

- Charge ahead with high-potential digital assets by checking out these 82 cryptocurrency and blockchain stocks dominating innovation in decentralized finance and blockchain technology.

- Capture steady and reliable returns by reviewing these 15 dividend stocks with yields > 3% delivering attractive income yields above 3% and strong financial foundations.

- Stay ahead of the curve in artificial intelligence by considering these 28 AI penny stocks disrupting traditional markets with transformational tech and scalable business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACM

AECOM

Provides professional infrastructure consulting services for governments, businesses, and organizations worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives