- United States

- /

- Construction

- /

- NYSE:ACM

AECOM (ACM): Valuation Check After Winning Brisbane 2032 Olympic Infrastructure Program Management Role

Reviewed by Simply Wall St

AECOM (ACM) just landed a marquee role for the Brisbane 2032 Olympics, helping lead nearly $5 billion in infrastructure projects through its Unite32 joint venture, creating a long-duration project pipeline that could be significant for the stock.

See our latest analysis for AECOM.

Despite landing a string of long dated contracts with Brisbane 2032, the FAA and the U.S. government, AECOM’s share price return has slid in recent months. Its five year total shareholder return remains strongly positive, suggesting longer term momentum is intact while near term sentiment cools.

If this kind of infrastructure story has you thinking more broadly about capital intensive opportunities, it might be worth exploring aerospace and defense stocks as a fresh hunting ground for ideas.

With AECOM now trading well below its one year highs, despite a rich pipeline and a near 40 percent discount to consensus targets, is this simply sentiment lagging fundamentals, or is the market already baking in future growth?

Most Popular Narrative Narrative: 32.3% Undervalued

With AECOM closing at 96.72 dollars versus a narrative fair value near 142.83 dollars, the valuation case leans heavily on multi year earnings power.

Strategic, ongoing investment in digital solutions and AI is already showing positive margin impact and is projected to materially enhance operational efficiency, boost utilization, and further support earnings growth in the next 2 to 3 years.

Curious how steady infrastructure demand, richer margins, and a surprisingly assertive earnings multiple combine into that valuation gap? The full narrative reveals the math behind it.

Result: Fair Value of $142.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, AECOM’s reliance on government contracts and the industry wide adoption of AI could pressure pricing power and margins if budgets tighten or competitors leapfrog technologically.

Find out about the key risks to this AECOM narrative.

Another Angle on Valuation

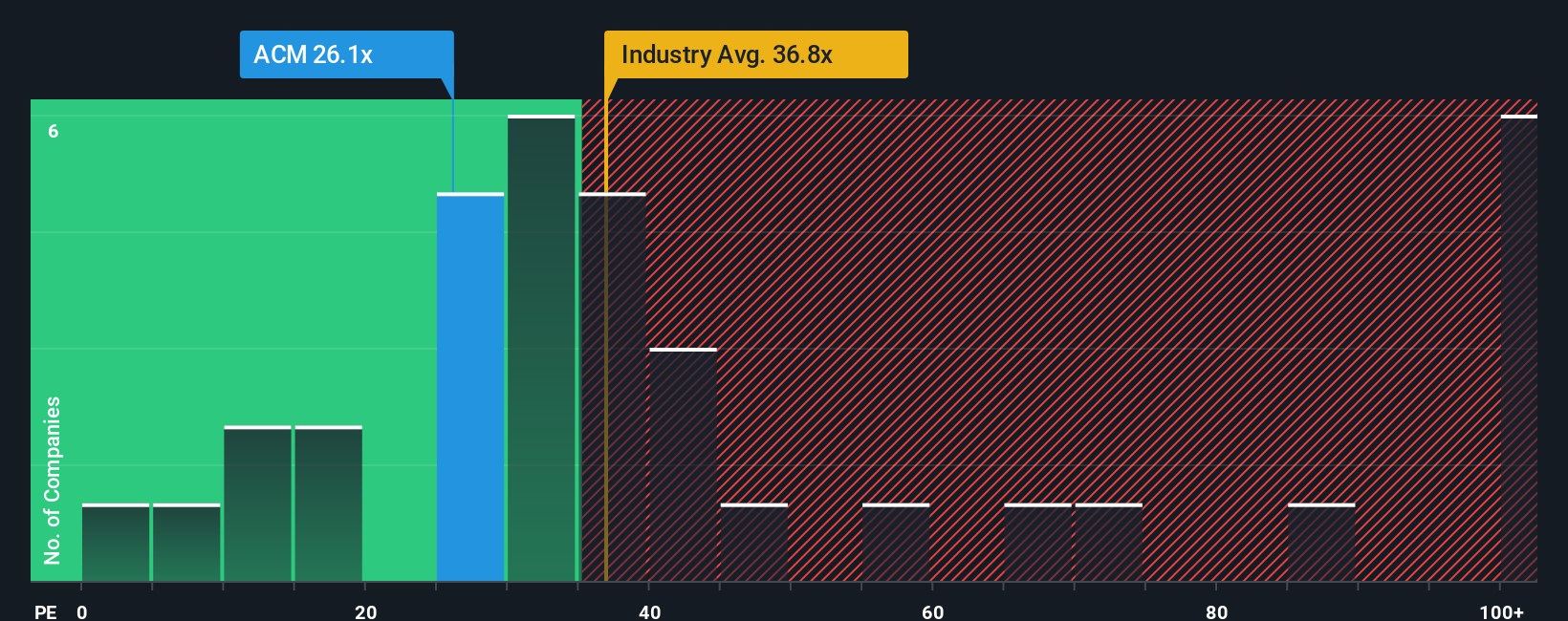

While the narrative fair value points to AECOM being 32.3 percent undervalued, its 20x price to earnings ratio paints a more measured picture. That is well below both the construction industry’s 32x and a 23.5x fair ratio, which hints at potential upside while also raising the question of why the discount persists.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AECOM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AECOM Narrative

If you see the story differently or want to lean on your own analysis, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding AECOM.

Looking for more investment ideas?

Do not stop with one compelling story when you can uncover a broader line up of opportunities tailored to your strategy using the Simply Wall Street Screener today.

- Capture potential bargains early by scanning these 914 undervalued stocks based on cash flows that may be trading below their long term cash flow potential.

- Ride structural growth trends by targeting these 24 AI penny stocks at the forefront of real world artificial intelligence adoption.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% that could complement capital gains with ongoing cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACM

AECOM

Provides professional infrastructure consulting services for governments, businesses, and organizations internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion