- United States

- /

- Aerospace & Defense

- /

- NYSE:ACHR

Is Archer Aviation Stock Set for Growth After United Airlines Aircraft Order?

Reviewed by Simply Wall St

Wondering what to make of Archer Aviation stock lately? You are not the only one. The last year has been a whirlwind for ACHR, and it has caught the eye of investors questioning whether the elevated price action is signaling true growth potential or just a change in risk appetite. After a massive run-up—up more than 150% over the past year—ACHR has also taken a breather in recent weeks, dipping nearly 15% in the last month. Still, the stock is trading at a notable discount to many analyst targets, which should be enough to get valuation-focused investors excited.

But how undervalued is Archer actually? Using a straightforward set of six valuation checks, the company scores a three—not bad, but with room for improvement before it leaps into true value territory. That said, numbers only tell part of the story about a company like Archer, which is riding industry momentum and weathering short-term swings as it builds out its vision for the future of air mobility.

Let us break down the different valuation approaches investors are using to assess Archer Aviation today, and see what each method really reveals about its current price. I will also share a different perspective at the end—a way to think about value here that most models might totally miss.

Archer Aviation delivered 153.1% returns over the last year. See how this stacks up to the rest of the Aerospace & Defense industry.Approach 1: Archer Aviation Cash Flows

The Discounted Cash Flow (DCF) model tries to estimate a company's fair value by projecting what its future cash flows will look like, then adjusting those numbers back to the present using an appropriate discount rate. This method aims to capture the value of a business based on its expected ability to generate cash for shareholders.

For Archer Aviation, the most recent twelve months show free cash flow at -$472.3 million, reflecting the heavy upfront investment needed to build out its operations. Analysts currently expect this figure to swing positive in the coming years. By 2029, forecasts suggest free cash flow could rise to $286 million. Looking further ahead, projections see free cash flows climbing steadily, with annual FCF in 2035 estimated at roughly $1.53 billion, supported by anticipated scaling and margin improvements.

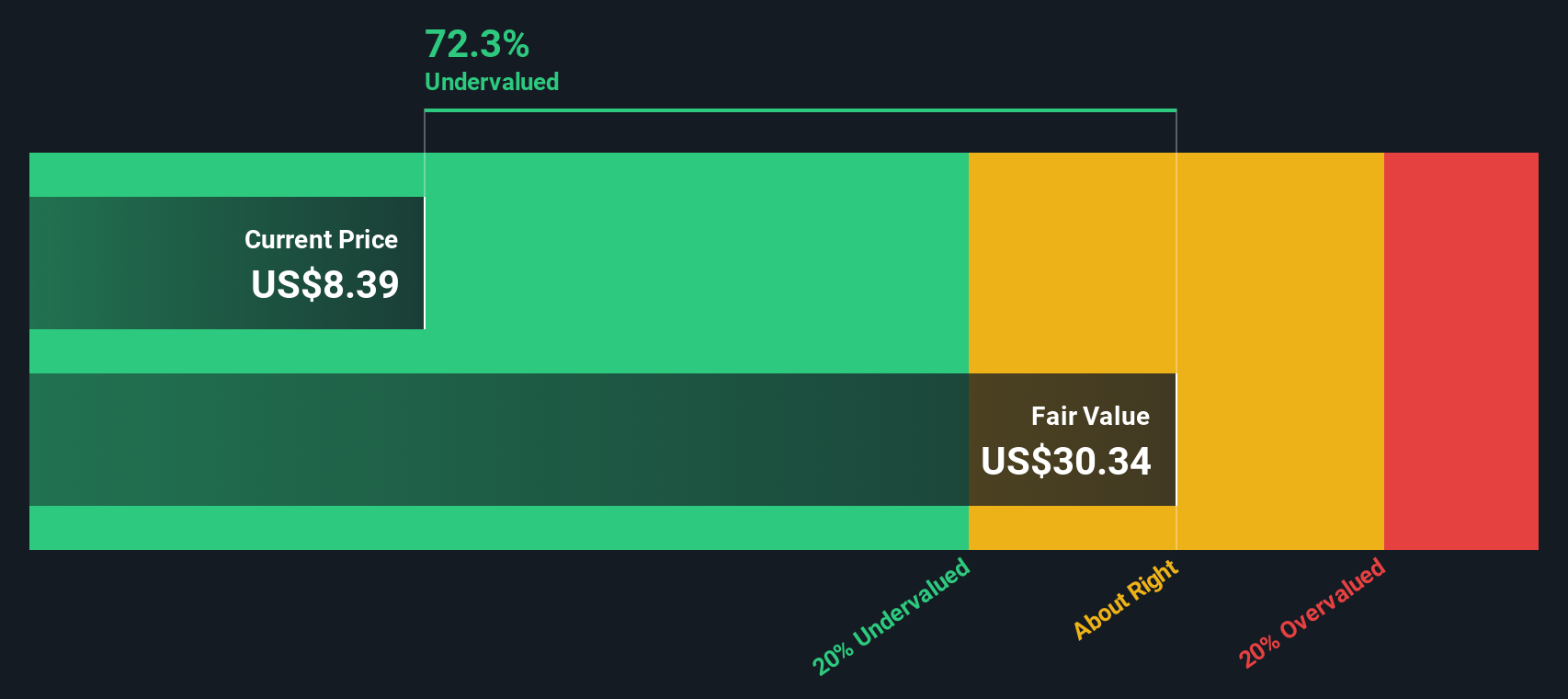

When all of these future cash flows are modeled and discounted back using the two-stage Free Cash Flow to Equity approach, Archer's intrinsic value is calculated at $30.49 per share. This represents a meaningful premium compared to today’s price, indicating Archer stock is trading at a 68.3% discount to its estimated fair value. This discount points to significant potential based on cash flow fundamentals alone.

Result: UNDERVALUED

Approach 2: Archer Aviation Price vs Book

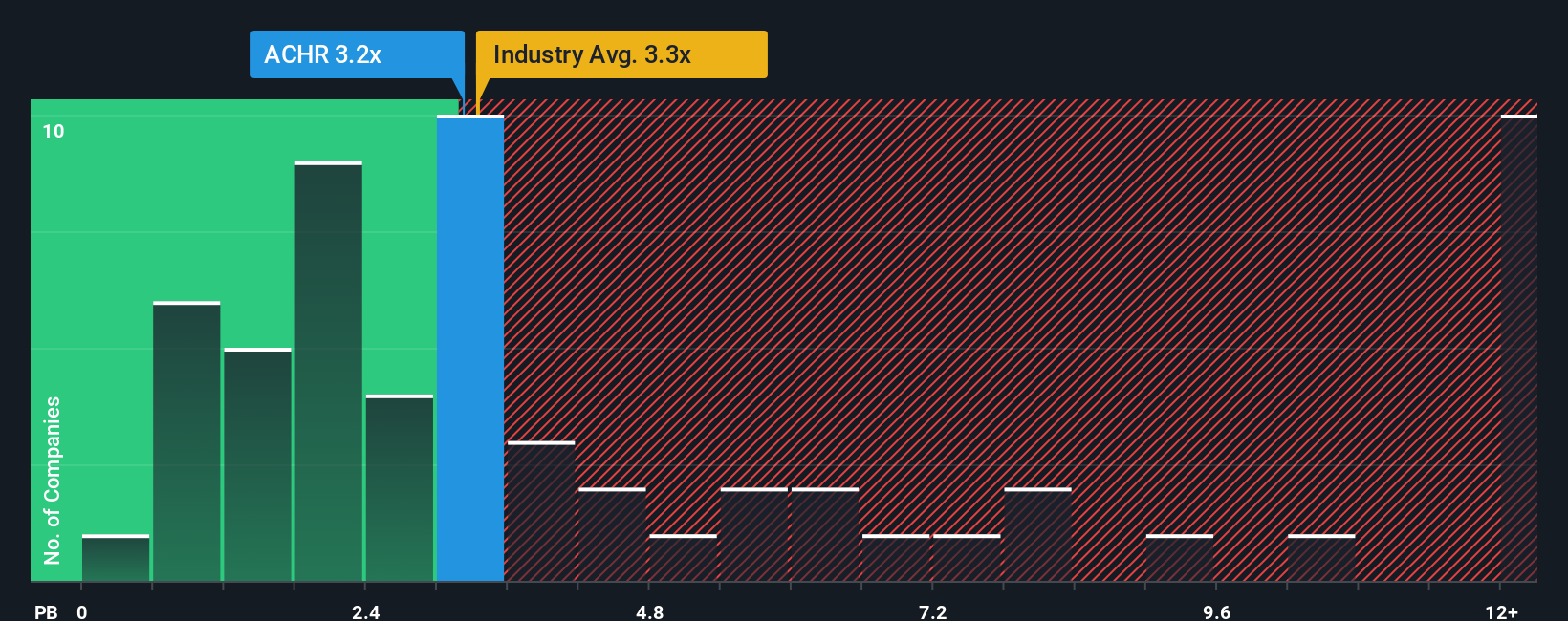

The price-to-book (P/B) ratio is a popular tool for valuing companies, especially those that are not yet consistently profitable, like Archer Aviation. This metric compares a company's market value to its net assets, making it particularly useful for businesses in capital-intensive industries or those still early in their growth trajectory.

Growth expectations and risk factors play a critical role in what counts as a "normal" P/B ratio. Fast-growing, innovative firms tend to command higher P/B multiples, as investors anticipate greater future returns. More established or riskier companies generally trade closer to or below their book value. Context is important: industry averages and peer comparisons can help clarify whether a stock's multiple is justified.

Currently, Archer Aviation trades at a P/B ratio of 3.71x. This is just above the broader Aerospace & Defense industry average of 3.31x, but well below the peer group average of 7.90x. Simply Wall St’s proprietary Fair Ratio, which considers factors such as company growth, sector trends, profitability, and risk, places Archer’s fair P/B close to its actual figure. When the Fair Ratio and the actual multiple are within 0.10 of each other, it suggests the market price is accurately reflecting Archer’s true value relative to its assets.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Archer Aviation Narrative

A Narrative is simply your story behind a company, linking what you believe about its business, future growth, and profitability directly to financial forecasts and a fair value. This approach allows you to define your assumptions about Archer Aviation’s future revenue, margins, or market share, and see how that outlook drives a price estimate.

Within the Simply Wall St platform and its community of millions, Narratives are an accessible tool. You can adjust your view with a few clicks, see your scenario instantly compared to others, and confidently decide whether Archer is undervalued or overhyped based on current Fair Value versus today’s Price.

The real power of Narratives is that they update automatically as new information appears. If Archer announces a breakthrough or delivers a disappointing earnings report, your Narrative and its fair value adjust in real time. For example, one investor might see Archer’s future fair value as high as $60 due to rapid industry adoption. Another, focused on regulatory risks, could set it closer to $12, with both perspectives easily modeled and tracked.

Do you think there's more to the story for Archer Aviation? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACHR

Archer Aviation

Designs and develops aircraft and related technologies and services in the United States and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives