- United States

- /

- Aerospace & Defense

- /

- NYSE:ACHR

Assessing Archer Aviation’s Valuation After Recent FAA Certification Progress and 231.5% Stock Surge

Reviewed by Bailey Pemberton

If you have been following Archer Aviation lately or are just now considering a position, you are certainly not alone. The company has been turning heads with its remarkable 1-year return of 231.5%, outpacing even the most optimistic expectations. It is not just a flash in the pan either. Over the past three years, the stock has soared more than 300%. But, as always, the story goes deeper than price charts alone.

Recently, much of the buzz has centered around Archer’s announcements of expanded partnerships and progress toward FAA certification. These milestones remind investors the business is in a rapidly evolving and high-stakes sector. While this momentum brings the potential for outsized growth, it also injects a new set of risks and raises questions about how to value a company that blends aviation know-how with a vision for urban mobility that could transform how people travel.

Of course, excitement comes with some volatility. You might have noticed that Archer has given back a bit over the last week, with the stock down 2.4%. Still, over the past month, it is up a healthy 20%, and it has gained 16.4% year-to-date. There is clearly something compelling here, but is the stock undervalued or priced for perfection? Using a six-point checklist, Archer currently scores a 3, meaning it shows signs of undervaluation in half of our key metrics.

Let us dive into the valuation approaches, one by one, to see where Archer stacks up. Stay tuned because there is an even more insightful way to judge the company’s worth that you will not want to miss.

Approach 1: Archer Aviation Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) analysis is a method that estimates a company's value by projecting its future cash flows and then discounting them back to today’s dollars. This provides a sense of what the business is fundamentally worth right now.

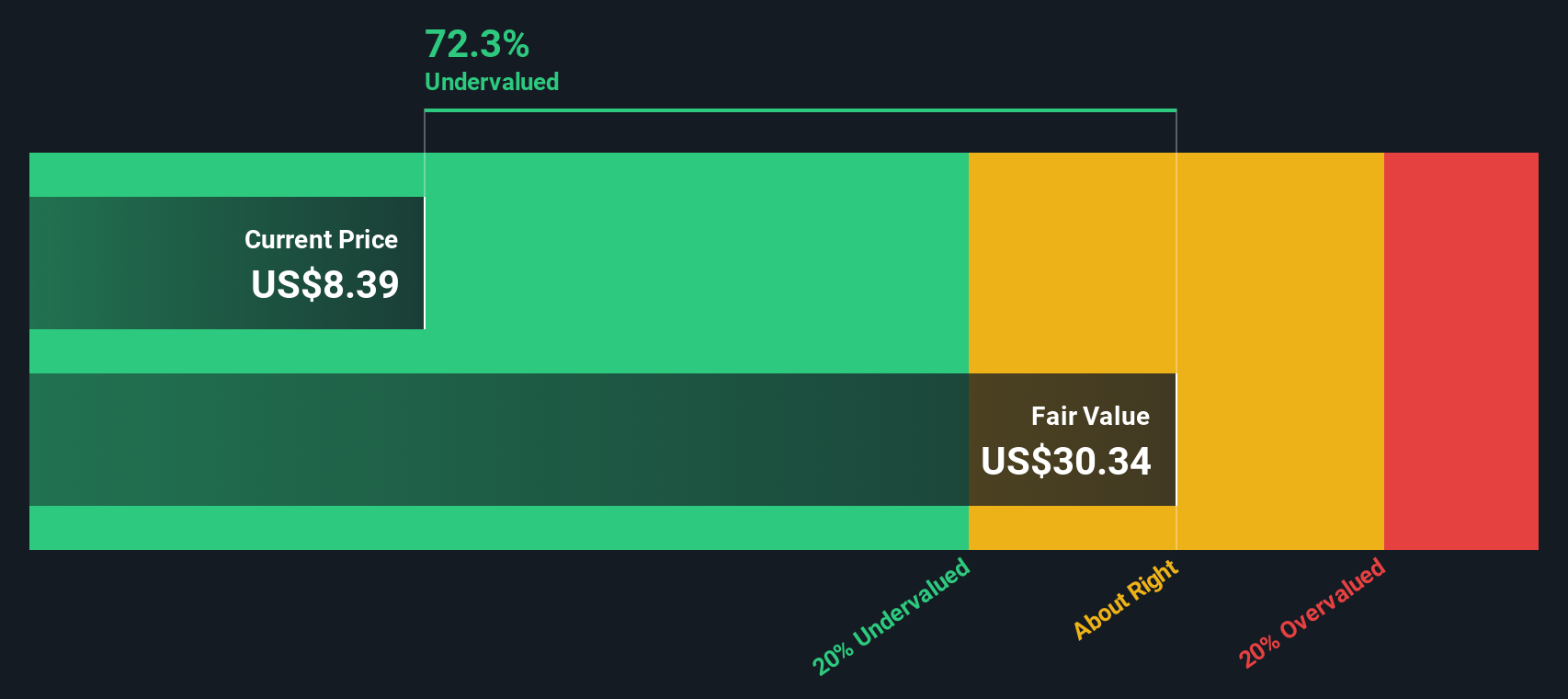

For Archer Aviation, the most recent reported Free Cash Flow stands at -$472.3 million, reflecting heavy investment in growth and development. Analysts predict cash flows will turn positive in the coming years, with projections expecting about $286 million in Free Cash Flow by 2029. More distant estimates, extrapolated beyond analyst forecasts, suggest even stronger performance with potential Free Cash Flow climbing as high as approximately $1.53 billion by 2035 if the growth path holds.

Based on this two-stage DCF approach, the intrinsic, or “fair,” value per share is calculated at $29.60. Compared to the current market price, this suggests Archer Aviation is trading at a 62.4% discount to its theoretical value. This signals a notable undervaluation according to these cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Archer Aviation is undervalued by 62.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

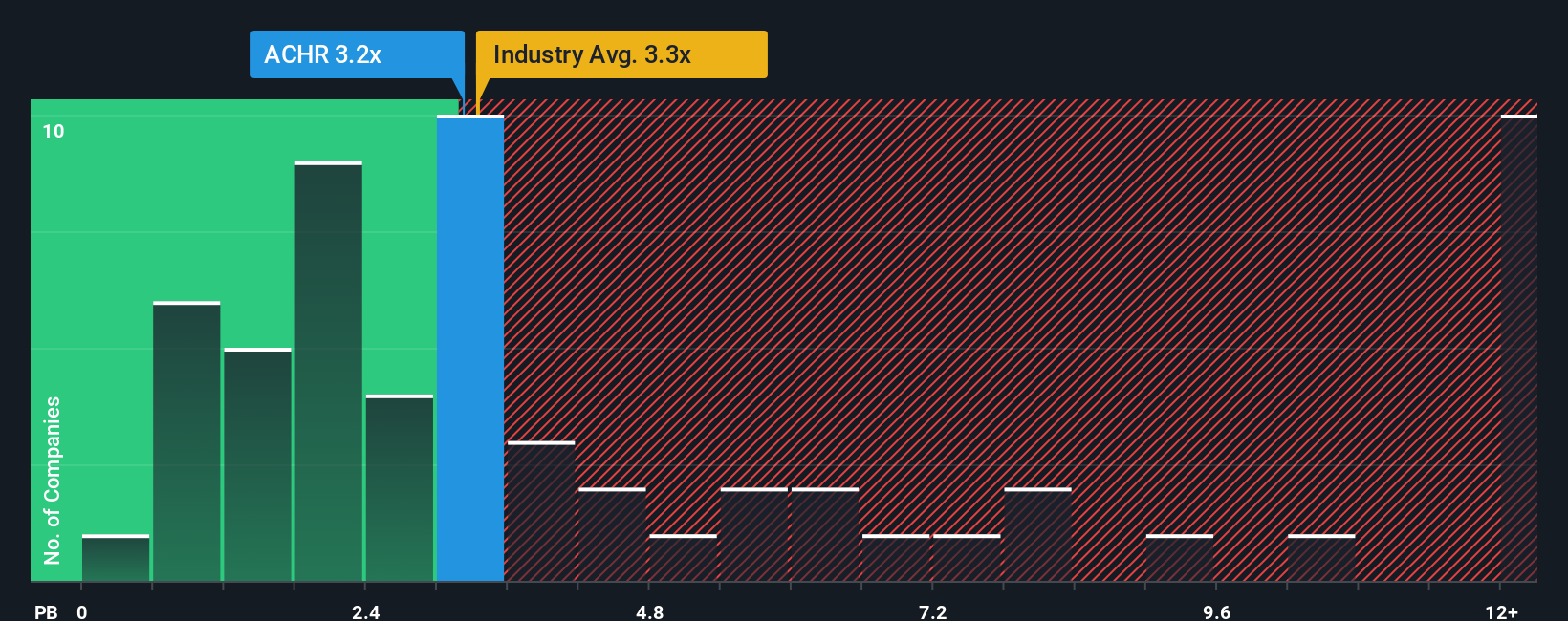

Approach 2: Archer Aviation Price vs Book

The Price-to-Book (P/B) ratio is often a preferred metric for valuing companies in asset-heavy sectors or early-stage businesses that have yet to achieve consistent profitability. Since Archer Aviation is still investing heavily in growth and has not reached sustained positive earnings, the P/B ratio offers a clearer lens for comparison than profit-based metrics like Price-to-Earnings.

Investors generally expect companies with stronger growth potential and lower risk profiles to trade at higher P/B multiples. Conversely, riskier or slower-growing businesses tend to command lower values. What counts as a "fair" P/B ratio depends not only on the industry but also on company-specific factors such as future profitability, margins, and the potential to scale.

Archer Aviation’s current P/B ratio sits at 4.27x, which is just below the peer group’s average of 4.39x and notably higher than the broader Aerospace & Defense industry average of 3.70x. While comparing with peers and the sector can give useful context, Simply Wall St's proprietary "Fair Ratio" combines these benchmarks with data on Archer's growth outlook, risk level, profit margins, and market capitalization. This offers a more tailored assessment of what the company truly deserves to trade at.

Our analysis shows Archer's actual P/B ratio is closely aligned with its Fair Ratio, indicating that the stock is valued about where it should be given its current fundamentals and future outlook.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Archer Aviation Narrative

Earlier we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple way to tell your view of a company’s future by linking its story to a financial forecast and, ultimately, to a fair value. Instead of just relying on ratios or models, Narratives let you explain and test your perspective, from revenue growth and profit margins down to the price you think is fair for the stock.

Narratives are an easy and flexible tool, available to everyone on Simply Wall St’s Community page, used by millions of investors. They help you decide when to buy or sell by putting your forecasted Fair Value side-by-side with today’s market price. This keeps things dynamic as new information, like news or earnings, emerges. Narratives make it practical to invest according to what you believe. For example, if one investor thinks Archer Aviation will dominate urban flight and assigns a $45 fair value while another sees major challenges and chooses $12, both views are immediately visible and up to date for smarter decision making.

Do you think there's more to the story for Archer Aviation? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACHR

Archer Aviation

Designs and develops aircraft and related technologies and services in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives