- United States

- /

- Building

- /

- NasdaqGS:UFPI

Will EvoTrim's Award-Winning Durability Strengthen UFPI's Edge in Exterior Building Materials?

Reviewed by Sasha Jovanovic

- Earlier this month, EvoTrim™, the high-performance engineered wood trim from Edge, was recognized as a 2026 Good Housekeeping Home Reno Awards winner in the Exterior Enhancements category for its exceptional durability and protection features.

- This industry recognition highlights UFP Industries' commitment to innovation and reinforces its competitive position in exterior building materials.

- We'll now examine how this award for EvoTrim, a product known for its innovation and durability, impacts UFP Industries' investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

UFP Industries Investment Narrative Recap

Investors considering UFP Industries are often drawn to the company’s focus on innovation in high-value building products and its efforts to expand margin through new offerings and operational efficiencies. While EvoTrim’s recent Good Housekeeping award supports UFP’s innovation credentials, it does not meaningfully shift the immediate catalyst of margin recovery, nor does it reduce the top risk from ongoing demand and pricing pressures in U.S. housing and construction markets. For near-term performance, the biggest factors remain end-market stabilization and the ability to sustain price discipline.

Among recent developments, the October 2025 launch of ProWood’s TrueFrame Joist is most directly related to the EvoTrim recognition, as both announcements showcase UFP’s emphasis on product quality, durability, and differentiated solutions for residential exteriors. These ongoing product rollouts are intended to spur greater interest from builders and remodelers, supporting the company’s push toward higher-margin, engineered materials as a primary growth lever.

However, it is important for investors to stay mindful that despite the innovation highlights, ongoing price competition and a still-soft demand backdrop continue to challenge...

Read the full narrative on UFP Industries (it's free!)

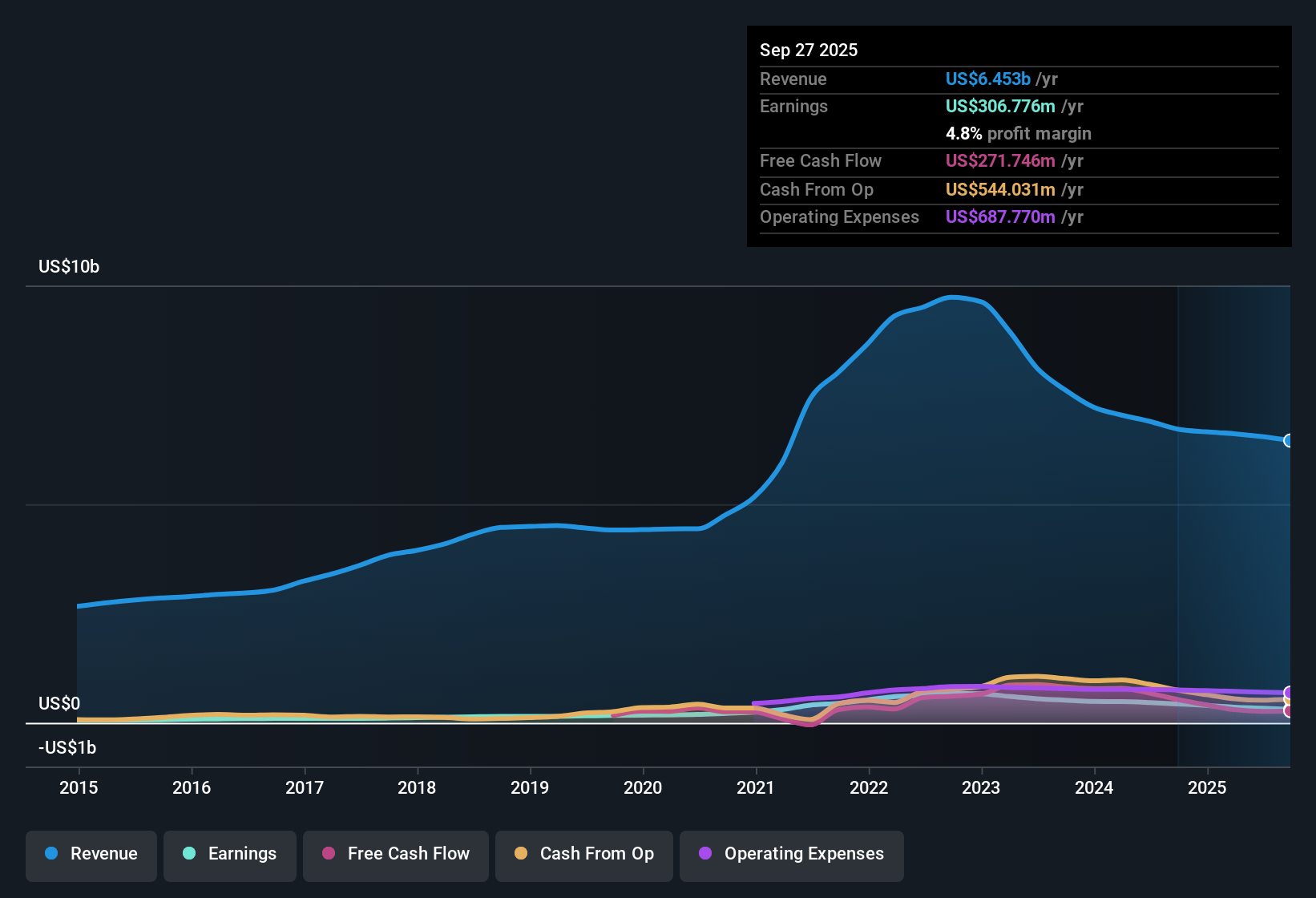

UFP Industries' outlook points to $7.1 billion in revenue and $443.8 million in earnings by 2028. This is based on an expected annual revenue growth rate of 2.8% and a $109.6 million increase in earnings from the current level of $334.2 million.

Uncover how UFP Industries' forecasts yield a $113.17 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members estimate UFP Industries’ fair value between US$68 and US$120 per share. The strongest recent catalyst, ongoing innovation in engineered products, is key as some market participants see value with risk from softer sector demand.

Explore 4 other fair value estimates on UFP Industries - why the stock might be worth as much as 35% more than the current price!

Build Your Own UFP Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UFP Industries research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free UFP Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UFP Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives