- United States

- /

- Building

- /

- NasdaqGS:UFPI

UFP Industries (UFPI): Slower Revenue Growth Reinforces Cautious Narrative Despite Value Signals

Reviewed by Simply Wall St

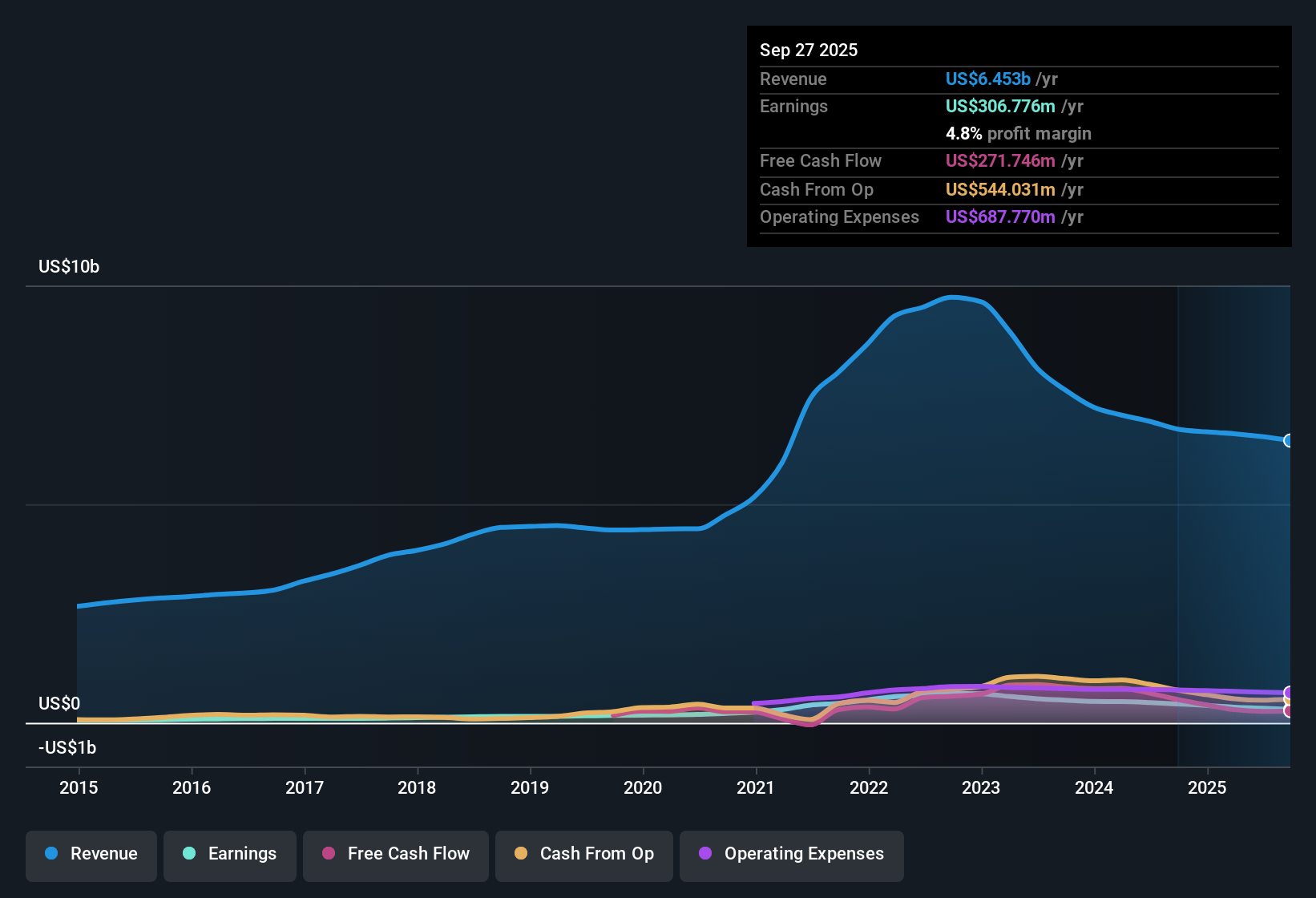

UFP Industries (UFPI) is forecasting annual revenue growth of 3.5%, which trails the broader US market’s 10.3% pace. Earnings are expected to grow at 10.89% per year, also below the US market average of 15.7%. The net profit margin narrowed to 4.8% from last year’s 6.4%. Despite a track record of 0.6% yearly earnings growth over five years, the most recent year saw negative earnings growth, signaling persistent headwinds for the business. Still, investors will note that the company’s price-to-earnings ratio is lower than both peer and industry averages. Reward factors such as attractive dividends, profit growth, and a share price below analyst targets create a mixed but intriguing value proposition.

See our full analysis for UFP Industries.Up next, we will see how these results stack up against some of the most widely followed narratives about UFP Industries, where the numbers back up expectations, and where the story might be shifting.

See what the community is saying about UFP Industries

Buybacks and Dividends Drive EPS

- Analysts project that UFP Industries will reduce its share count by 3.55% annually for the next three years, supporting further earnings per share (EPS) growth even if total profits rise more moderately.

- According to the analysts' consensus view, strong balance sheet flexibility supports accelerated share repurchases and consistent dividend growth. These factors are aimed at boosting total returns even as organic revenue growth lags sector averages.

- Share buybacks, backed by robust free cash flow, are expected to increase EPS potential, provided market conditions allow for continued deployment of capital.

- Dividend increases and flexible capital allocation are cited as key reasons analysts believe shareholder returns could remain attractive, despite a slower top-line trajectory.

- To see what’s behind these expectations for buybacks, dividends, and more, read the full consensus narrative. 📊 Read the full UFP Industries Consensus Narrative.

Margin Expansion as Costs Fall

- Profit margins are forecast by analysts to rise from 5.1% today to 6.3% within three years, driven by a $60 million cost reduction program and automation investments.

- Consensus narrative highlights that material cuts to underperforming facilities and strategic automation should help counteract cyclical pressures, directly supporting margin growth through 2026.

- Consolidation and targeted restructuring are positioned as levers to drive higher and more stable margins within the next few years, which could potentially offset market softness in segments like Site Built.

- Analysts point to recent margin compression but indicate that ongoing cost initiatives and efficiency gains may enable UFP Industries to outperform more volatile peers over time.

Valuation Compelling Despite Slower Growth

- With a price-to-earnings ratio of 17.5x, UFP Industries trades below both its peer average (29.8x) and US building industry average (19.1x), offering relative value even as shares trade at a premium to the DCF fair value of $70.09.

- According to the analysts' consensus view, while UFP Industries’ revenue growth and profit margins lag broader market leaders, its lower-than-average P/E and positive reward indicators, including a share price below the analyst target of 114.5, help balance concerns about growth momentum.

- Critics highlight that the company’s share price recently reached $91.80, which is above DCF fair value but still well below the analyst price target. This leaves room for upside if margin improvements and share buybacks materialize.

- Consensus narrative notes that valuation could remain attractive if management delivers on cost discipline and capital returns, as discounted P/E and the analyst price target imply further investor confidence in underlying fundamentals.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UFP Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own perspective on the data? Craft your unique take and build a personalized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding UFP Industries.

See What Else Is Out There

UFP Industries is facing headwinds with sluggish revenue growth and patchy earnings momentum, which trails the more consistent performance of top industry peers.

If you want steadier results, use stable growth stocks screener (2112 results) to spot companies delivering reliable revenue and profit growth even when the market slows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives