- United States

- /

- Building

- /

- NasdaqGS:UFPI

UFP Industries (UFPI): Exploring Valuation After EvoTrim Wins at Good Housekeeping 2026 Home Reno Awards

Reviewed by Simply Wall St

UFP Industries (UFPI) just received a noteworthy nod as its EvoTrim product won the Exterior Enhancements category at the Good Housekeeping 2026 Home Reno Awards. This recognition highlights the company’s continuous focus on product durability and innovation.

See our latest analysis for UFP Industries.

While UFP Industries’ latest product win certainly spotlights its strengths in innovation, the share price has not kept pace, sliding roughly 19% year-to-date and ending recently at $89.87. Investors have seen a 1-year total shareholder return of -34.5%, so despite long-term gains, momentum has been fading as the market digests shifts in sentiment and recent recognition may take time to translate into sustained value for shareholders.

If the spotlight on home-renovation trends has you curious about what else is out there, now is a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

So with UFP Industries’ shares lagging despite recent recognition and analyst targets suggesting upside, is this a window for investors to buy into unrealized value, or has the market already accounted for future growth?

Most Popular Narrative: 20.6% Undervalued

With UFP Industries last closing at $89.87 per share, the most widely followed narrative sees fair value well above this level, projecting significant room for upside if its future unfolds as anticipated.

Recent and ongoing investments in innovative, higher-margin, sustainable building products like the Surestone composite decking are expected to enable UFP Industries to capitalize on the growing consumer demand for eco-friendly materials. The company has a goal to double composite decking and railing market share over the next 5 years, which could positively impact revenue and margins.

Want to uncover what’s fueling this bullish outlook? The secret behind this narrative is a mix of bold product bets, long-term profitability shifts, and calculated market share moves. Curious which critical assumptions are embedded in these forecasts? Dive in to see the data driving the fair value call.

Result: Fair Value of $113.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering weakness in home improvement spending or persistent pressure in new residential construction could quickly change the long-term upside narrative for UFP Industries.

Find out about the key risks to this UFP Industries narrative.

Another View: How Do the Numbers Stack Up?

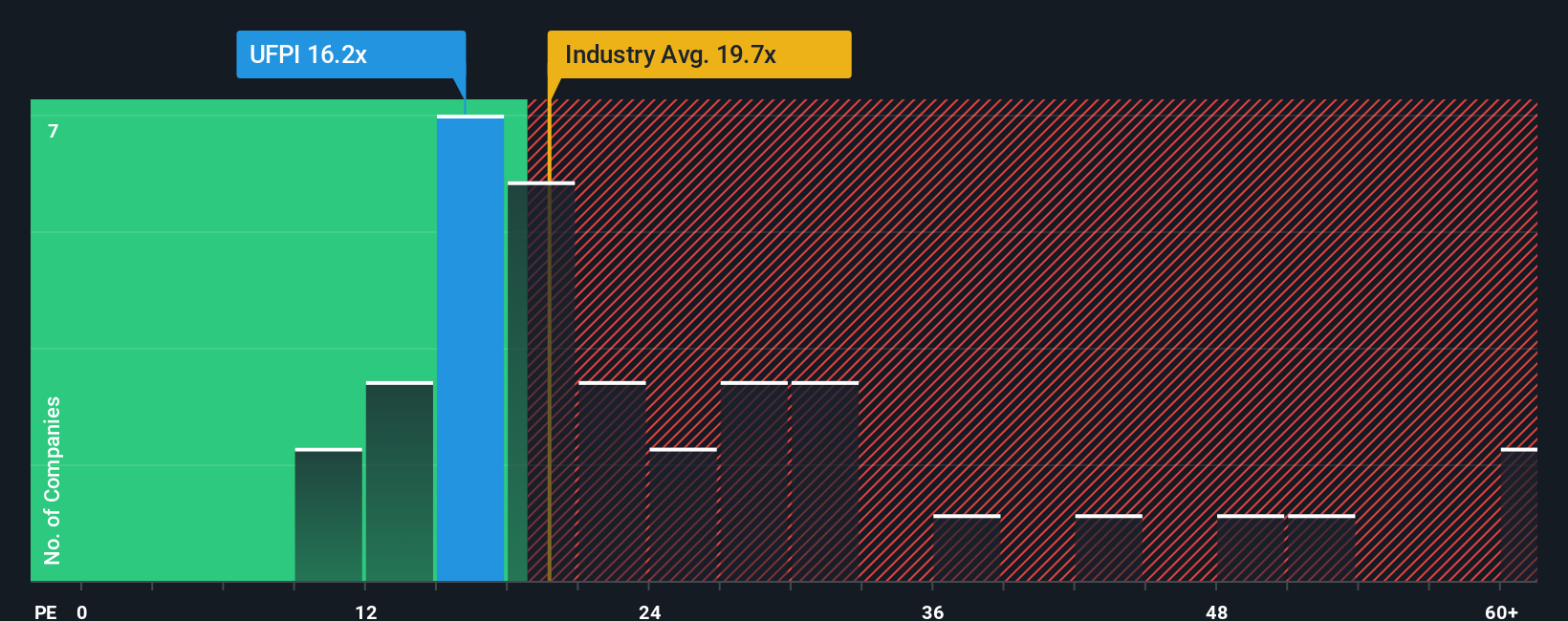

When we look at UFP Industries through the lens of company earnings, the share trades at roughly 16.8 times its earnings, which is markedly lower than its industry average of 17.3 and far below peers at 31.7. The fair ratio sits even higher at 21.1, suggesting there could be more room for the market to catch up. But does this discount point to an undervalued stock or warn of future headwinds for the business?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UFP Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UFP Industries Narrative

If the prevailing story does not resonate with your own analysis, consider examining the underlying numbers and developing a perspective of your own in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding UFP Industries.

Looking for More Investment Ideas?

Why limit your opportunities to just one stock? Take the next step and supercharge your portfolio by targeting trends that can actually make a difference to your returns.

- Accelerate your growth potential by tapping into these 924 undervalued stocks based on cash flows, which are poised to unlock serious upside based on their cash flow fundamentals.

- Generate consistent income by choosing from these 14 dividend stocks with yields > 3%, which offer attractive yields that can boost your portfolio's resilience over time.

- Seize the advantage in cutting-edge technologies by evaluating these 26 AI penny stocks, which are powering the future of automation and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success