- United States

- /

- Building

- /

- NasdaqGS:UFPI

UFP Industries (UFPI): Assessing Valuation Following Q3 Earnings Miss and Margin Decline

Reviewed by Simply Wall St

UFP Industries (UFPI) just released its third-quarter results. Revenue and earnings per share both fell short of expectations. The company also saw its operating margin decline compared to last year, raising questions about its near-term profit outlook.

See our latest analysis for UFP Industries.

Despite recent news of a dividend hike and share buyback completion, the big story for UFP Industries is how its weaker-than-expected earnings have weighed on sentiment. After a choppy year, the stock now trades at $92.13 and momentum has clearly faded, with a 17.1% year-to-date share price return and a 24.2% total shareholder return over twelve months, even as longer-term investors have still booked sizable 3- and 5-year gains.

If UFP Industries’ shifting momentum has you curious about what else is happening in the market, now is a logical time to broaden your search and discover fast growing stocks with high insider ownership.

With shares now trading well below analyst price targets and the company pursuing growth initiatives, the question for investors is clear: is UFP Industries undervalued after its recent stumble, or is the market already anticipating improved results ahead?

Most Popular Narrative: 19.5% Undervalued

With a fair value of $114.50 estimated by the most popular narrative, UFP Industries' last close at $92.13 suggests the stock offers considerable upside if these assumptions prove accurate. The stage is set for a deeper look behind the numbers fueling this fair value.

Recent and ongoing investments in innovative, higher-margin, sustainable building products like the Surestone composite decking are expected to enable UFP Industries to capitalize on the growing consumer demand for eco-friendly materials. The company has set a goal to double composite decking and railing market share over the next 5 years, positively impacting revenue and margins.

Want to uncover the unique earnings trends and margin assumptions that drive this bullish scenario? The forecast powering this value hinges on one headline-making financial leap, a change that could catch many by surprise. Dive in to reveal how these projections add crucial fuel to the price target debate.

Result: Fair Value of $114.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in housing and construction, as well as ongoing pricing pressures, could undermine UFP Industries’ long-term growth and margin expansion story.

Find out about the key risks to this UFP Industries narrative.

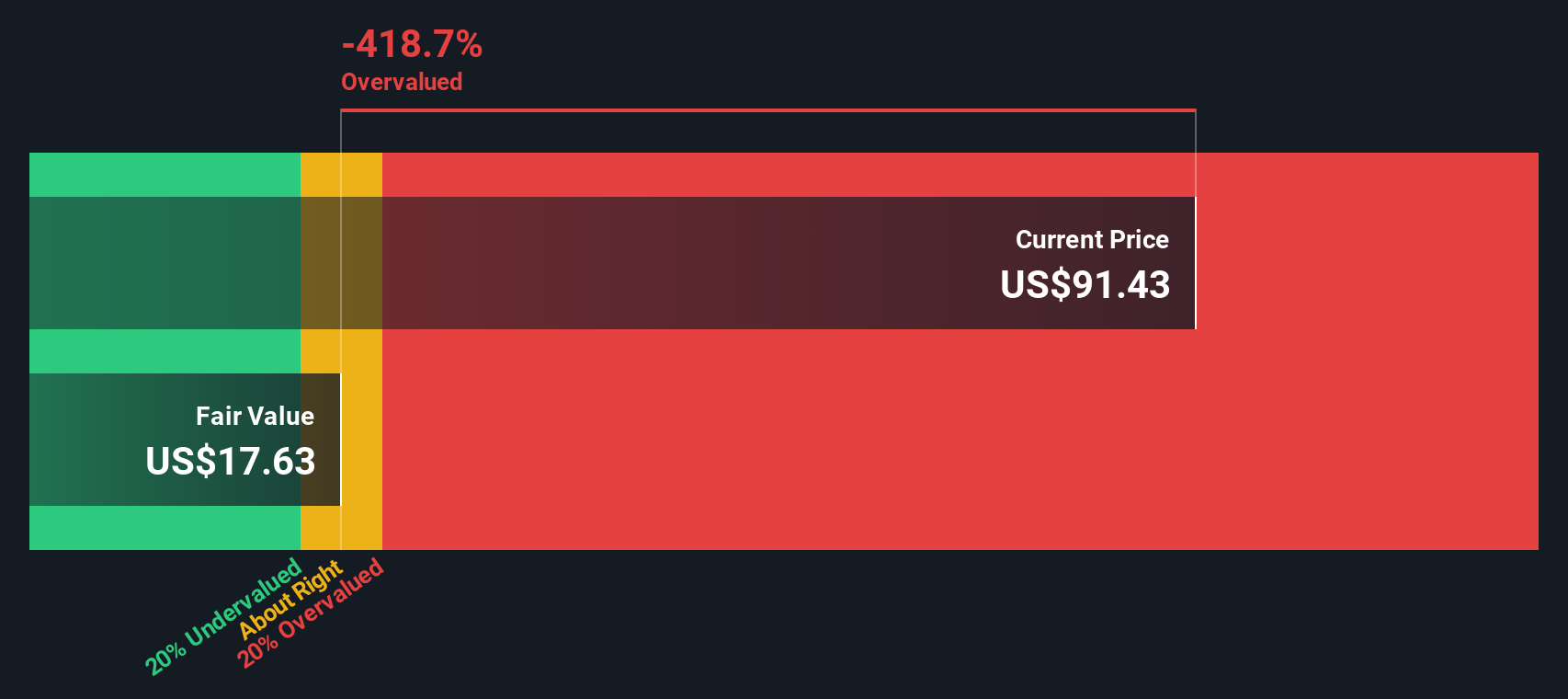

Another View: SWS DCF Model Offers a Different Take

While analysts see UFP Industries as undervalued based on earnings projections and industry multiples, our SWS DCF model tells a different story. According to the DCF approach, the stock is trading above its estimated fair value, indicating it could be overvalued if cash flow assumptions turn out to be optimistic. Does this model signal caution ahead, or is the market looking past short-term headwinds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UFP Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UFP Industries Narrative

If you want a different perspective or like to form your own view from the data, you can build your own narrative in just minutes, so why not Do it your way?

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding UFP Industries.

Looking for more investment ideas?

Smart investors know that opportunities go far beyond one company. Stay ahead by tapping into hand-picked stocks on Simply Wall Street’s free screeners before the crowd catches on.

- Tap into potential by checking out these 832 undervalued stocks based on cash flows which is backed by strong cash flow fundamentals.

- Uncover leading-edge opportunities through these 28 quantum computing stocks, a screener at the forefront of next-generation computing and innovation.

- Supercharge your portfolio with passive income possibilities by exploring these 22 dividend stocks with yields > 3%, a screener offering yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives