- United States

- /

- Building

- /

- NasdaqGS:UFPI

Dividend Hike and Buybacks Amid Weak Results Might Change the Case for Investing in UFP Industries (UFPI)

Reviewed by Sasha Jovanovic

- On October 23, 2025, UFP Industries’ Board of Directors approved a quarterly cash dividend of US$0.35 per share, a 6% increase year over year, payable December 15, 2025, and completed a repurchase of 2,800,000 shares for US$291 million under its July 2025 buyback program.

- Despite boosting shareholder returns through dividend growth and buybacks, the company’s latest quarter saw weaker demand and profitability, leading to financial results below analyst expectations.

- With UFP Industries raising its dividend while reporting a 5.4% year-on-year sales decline and lower margins, we'll explore the implications for its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

UFP Industries Investment Narrative Recap

To be a shareholder in UFP Industries, you have to believe in its ability to drive long-term value through innovation, market expansion, and operational efficiency, despite the current headwinds in its end-markets. The latest quarterly dividend increase and share buybacks reflect management’s confidence, but with sales down 5.4% and margins under pressure, sustained weak demand in the U.S. housing sector remains the most meaningful short-term risk. The recent news itself does not materially change this near-term risk or alter the company’s main catalyst of executing on cost reductions and innovation efforts.

The most relevant announcement to the recent earnings results is UFP Industries’ completion of a US$291 million share repurchase, equivalent to nearly 5% of its outstanding shares. By returning capital to shareholders, the company is acting to offset weaker earnings performance and support shareholder returns in a period of tepid demand, yet the real question is whether cost savings and product innovation will be enough to counter ongoing sales and margin pressures.

Yet while UFP Industries continues to raise its dividend, the persistent risk of prolonged volume and pricing pressure in key construction segments is something investors should be aware of...

Read the full narrative on UFP Industries (it's free!)

UFP Industries' narrative projects $7.1 billion revenue and $443.8 million earnings by 2028. This requires 2.8% yearly revenue growth and a $109.6 million earnings increase from $334.2 million today.

Uncover how UFP Industries' forecasts yield a $114.50 fair value, a 24% upside to its current price.

Exploring Other Perspectives

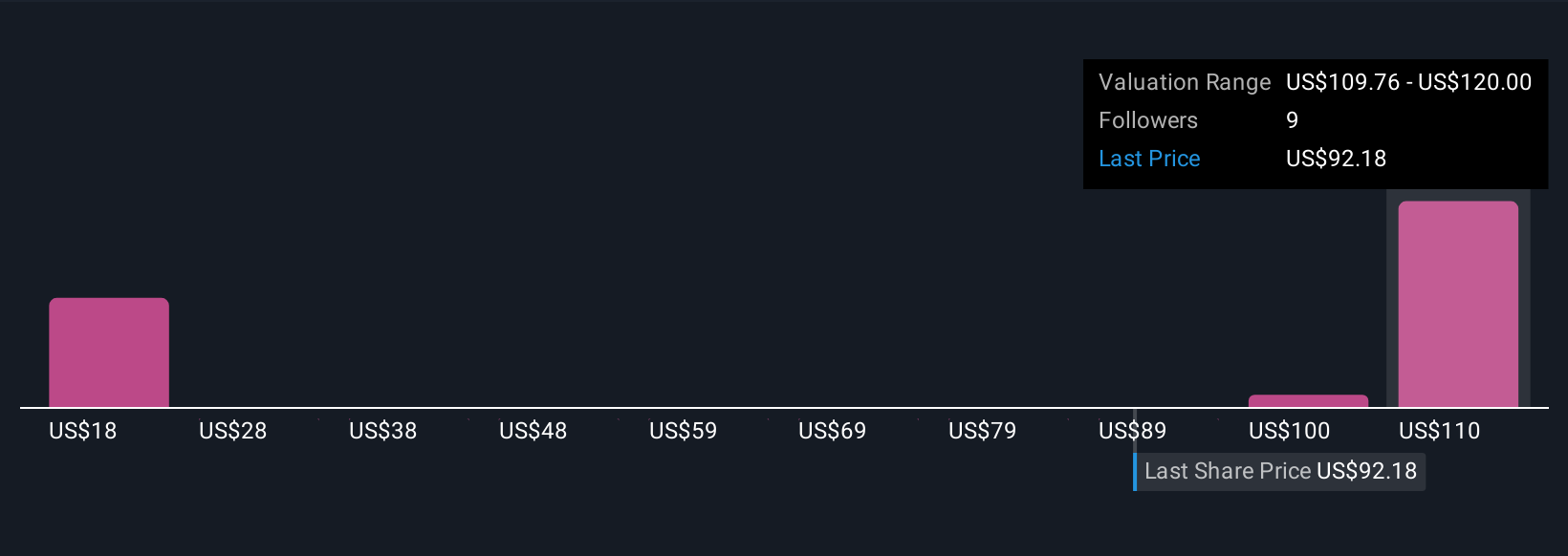

Four fair value estimates from the Simply Wall St Community span from US$69.81 to US$120 per share. While market participants express a wide spectrum of views, the potential for ongoing margin pressure remains a central issue for the company’s performance.

Explore 4 other fair value estimates on UFP Industries - why the stock might be worth as much as 30% more than the current price!

Build Your Own UFP Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UFP Industries research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free UFP Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UFP Industries' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives