- United States

- /

- Machinery

- /

- NasdaqGM:SYM

Why Symbotic (SYM) Is Up 6.6% After Landing Walmart Robotics Deal and 12-Year Supply Pact

Reviewed by Simply Wall St

- Earlier in 2025, Symbotic completed the acquisition of Walmart’s robotics division and secured a 12-year exclusive robotics supply agreement for Walmart’s pickup and delivery centers.

- This deal, alongside rapid revenue growth and operational improvements, underscores Symbotic’s strong position to expand its presence in retail automation and improve margins.

- We'll examine how the combination of the Walmart deal and deployment efficiencies could impact Symbotic's future growth expectations and risks.

Find companies with promising cash flow potential yet trading below their fair value.

Symbotic Investment Narrative Recap

To be a shareholder in Symbotic today, you have to believe the company can accelerate the automation of retail supply chains at scale and manage the integration of major acquisitions such as Walmart's robotics unit. While the exclusive Walmart agreement provides a substantial growth driver, it does not materially reduce the largest near-term risk: effectively deploying and integrating these advanced systems fast enough to protect margins and capture the backlog opportunity. The headlines on revenue growth and partnership are promising, but the company’s execution risk, especially with this rapid scale, remains a central concern. Among recent announcements, the commercial rollout of Symbotic’s next-generation storage technology is closely related to the Walmart news. This innovation offers up to a 40% reduction in storage footprint and could play a major role in meeting Walmart’s efficiency and deployment goals, serving as a concrete example of how product advancements can support new contracts and help drive the expected margin improvements. However, investors should also be alert to how rapid expansion brings complex operational risks that could challenge cash flow...

Read the full narrative on Symbotic (it's free!)

Symbotic's narrative projects $3.8 billion in revenue and $515.3 million in earnings by 2028. This requires 26.2% annual revenue growth and a $529.4 million increase in earnings from the current -$14.1 million.

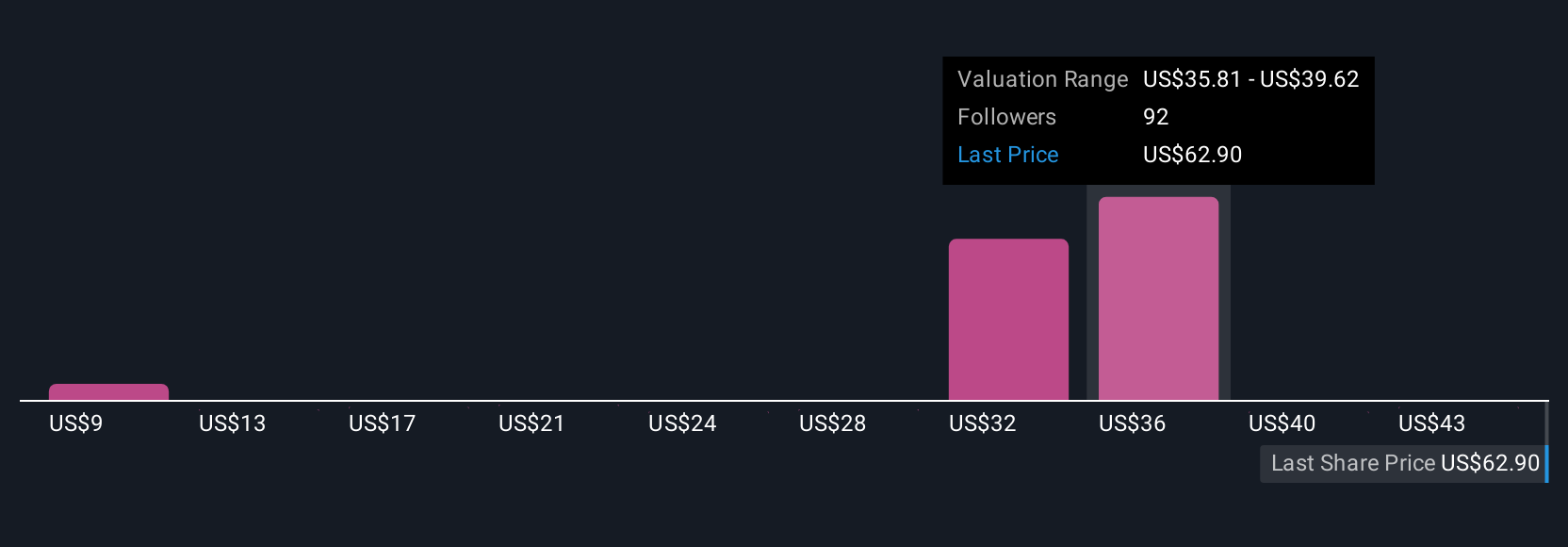

Uncover how Symbotic's forecasts yield a $39.07 fair value, a 31% downside to its current price.

Exploring Other Perspectives

Twenty-six private investors in the Simply Wall St Community estimate Symbotic’s fair value from US$9.11 to US$47.25 per share. Despite this broad range, many are focusing on Symbotic’s ability to capture benefits from the Walmart deal, relating it to ongoing execution and integration challenges that could shape its financial results.

Explore 26 other fair value estimates on Symbotic - why the stock might be worth less than half the current price!

Build Your Own Symbotic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Symbotic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Symbotic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Symbotic's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives