- United States

- /

- Machinery

- /

- NasdaqGM:SYM

Symbotic (SYM) Is Up 18.2% After Deepening Automation Partnership With Walmart

Reviewed by Simply Wall St

- Earlier this year, Symbotic acquired Walmart's advanced systems and robotics unit to develop and build automation solutions, with Walmart agreeing to pay US$520 million for these services.

- An interesting aspect of this collaboration is that it deepens Symbotic's integration into Walmart's supply chain automation, positioning the company as a central technology partner for one of the world's largest retailers.

- We'll explore how Symbotic's expanded partnership with Walmart may shape its investment narrative by enhancing long-term growth opportunities.

Find companies with promising cash flow potential yet trading below their fair value.

Symbotic Investment Narrative Recap

To be a shareholder in Symbotic today, you need to believe that warehouse automation driven by robotics and AI will remain in strong demand as retail giants like Walmart upgrade their logistics infrastructure. The recent deepening of ties with Walmart, including the acquisition of its advanced robotics unit, bolsters Symbotic’s position as a core tech provider; however, this integration does not immediately resolve the biggest short-term risk: customer project delays and timing uncertainty tied to the rollout of next-generation storage solutions.

In this context, the August launch of Symbotic’s next-generation storage technology stands out. With targeted improvements in storage density, deployment speed, and operational efficiency, this technology supports one of Symbotic’s key growth catalysts, its ability to win new business and compress deployment timelines, both of which are critical to sustaining momentum with major customers like Walmart.

Yet, while growth prospects appear strong at the surface, investors should remember that heavy reliance on a small number of large customers can expose Symbotic to concentrated revenue risks if...

Read the full narrative on Symbotic (it's free!)

Symbotic's outlook projects $4.1 billion in revenue and $348.5 million in earnings by 2028. This assumes a 23.0% annual revenue growth rate and a $359 million increase in earnings from the current level of -$10.5 million.

Uncover how Symbotic's forecasts yield a $48.60 fair value, a 20% downside to its current price.

Exploring Other Perspectives

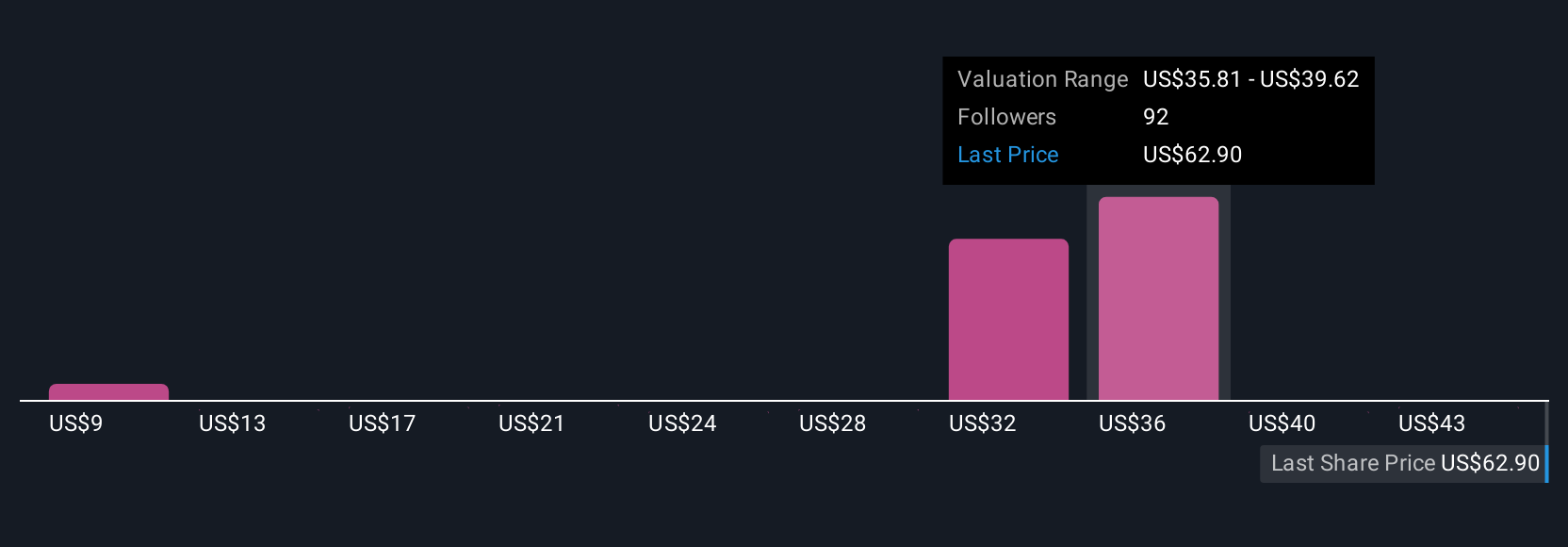

Simply Wall St Community members offer 28 unique fair value views on Symbotic, ranging from US$9.12 to US$60 per share. As you consider this wide spectrum, keep in mind that short-term project delays or changes in Walmart's automation strategy could suddenly affect earnings visibility and sentiment.

Explore 28 other fair value estimates on Symbotic - why the stock might be worth as much as $60.00!

Build Your Own Symbotic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Symbotic research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Symbotic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Symbotic's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026