- United States

- /

- Construction

- /

- NasdaqGS:STRL

Sterling Infrastructure (STRL): Assessing Valuation After Strong Q3 Earnings and Upgraded 2025 Guidance

Reviewed by Simply Wall St

Sterling Infrastructure (STRL) caught investor attention after reporting strong third quarter results, with sales and net income both rising compared to last year. The company also raised its full-year 2025 earnings outlook.

See our latest analysis for Sterling Infrastructure.

Despite surging to new highs earlier this quarter, Sterling Infrastructure’s share price has recently pulled back, dropping 14% in a single day and nearly 16% over the past week. That said, even with this volatility and some index reshuffling, the momentum is still remarkable. So far in 2025, the share price return is up almost 95%, and the three-year total shareholder return tops 940%. This demonstrates there has been serious long-term wealth creation for committed holders.

If Sterling’s wild ride has you curious about what drives strong market moves, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With such rapid gains and upgraded forecasts, the big question for investors is whether Sterling Infrastructure’s current valuation leaves room for further upside or if the stock is already factoring in all its future growth potential.

Most Popular Narrative: 16.3% Undervalued

With Sterling Infrastructure’s fair value estimate raised to $390 per share, the prevailing narrative puts this target comfortably above the recent close of $326.6. This positions the stock as an attractive opportunity based on current analyst frameworks.

The company’s expanding backlog, especially in the e-infrastructure segment, positions it to capture significant growth opportunities in mission-critical fields such as data centers and advanced manufacturing.

Want to know what makes this higher valuation tick? The fair value relies on projections for rapid sales growth and a robust margin profile, which are unusual figures for this sector. Are you interested in a look behind the scenes at the numbers that make analysts so optimistic? The quantitative targets that drive this estimate might surprise you.

Result: Fair Value of $390 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant risks remain, including possible slowdowns in mega-project activity and execution challenges. These factors could limit Sterling’s ability to maintain its margin expansion.

Find out about the key risks to this Sterling Infrastructure narrative.

Another View: What Does the SWS DCF Model Say?

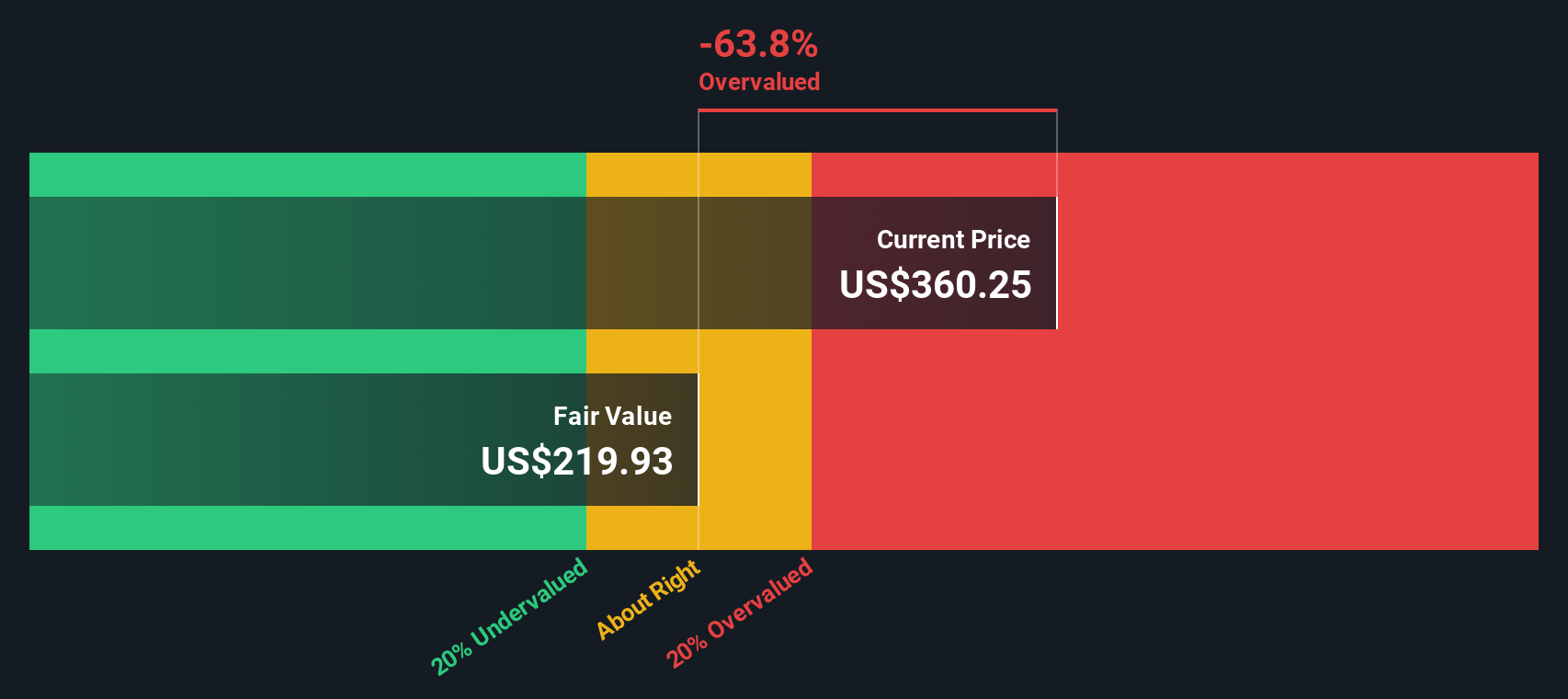

While analyst price targets suggest Sterling Infrastructure is significantly undervalued, our SWS DCF model tells a more cautious story. It currently shows the stock trading slightly above its fair value estimate, indicating that growth expectations may already be built into the price. Could this mean limited upside, or is the market still underestimating Sterling’s future potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sterling Infrastructure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sterling Infrastructure Narrative

If the current consensus doesn’t match your personal outlook or you prefer a hands-on approach, you can craft your own view in under three minutes with Do it your way.

A great starting point for your Sterling Infrastructure research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your strategy to just one company. Powerful investment opportunities are waiting. Expand your watchlist right now using the Simply Wall Street Screener.

- Boost your portfolio’s income potential by reviewing these 15 dividend stocks with yields > 3%. This tool features standout stocks with yields above 3% and reliable track records.

- Uncover tech-driven growth by checking out these 27 AI penny stocks. These are focused on artificial intelligence advancements with impressive performance metrics.

- Pinpoint rare value by targeting these 870 undervalued stocks based on cash flows, which includes stocks trading below intrinsic worth based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STRL

Sterling Infrastructure

Engages in the provision of e-infrastructure, transportation, and building solutions in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives