- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Can Shoals Technologies Group’s (SHLS) New Australia Project Redefine Its Global Growth Narrative?

Reviewed by Simply Wall St

- On August 18, 2025, Shoals Technologies Group announced its role in supplying EBOS components for the Maryvale Solar and Energy Storage Project in New South Wales, Australia, partnering with PCL Construction and Gentari to deliver 243 MW of solar capacity with 172 MW of battery storage.

- This project marks the introduction of eastern Australia's first utility-scale DC-coupled solar and battery hybrid system, highlighting Shoals Technologies Group's growing presence in international clean energy infrastructure.

- We'll examine how Shoals' involvement in Australia's Maryvale project influences its investment narrative and supports international growth ambitions.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Shoals Technologies Group Investment Narrative Recap

To be a Shoals Technologies Group shareholder, you need to believe in the accelerating shift to utility-scale solar and storage, with the company’s expertise in EBOS solutions driving future growth. The Maryvale project is a strong proof point for Shoals’ international expansion ambitions, supporting its near-term catalyst of broadening its global customer base, but this announcement does not materially offset the largest risks of compressed margins and legal expenses, which continue to constrain profitability and free cash flow.

Among Shoals’ recent announcements, the July 2025 contract with CJR Renewables in Chile directly aligns with the company’s push into international markets. Like the Maryvale project, this move reinforces Shoals’ efforts to secure non-US revenue streams, which are increasingly key to earnings expansion while offsetting reliance on North American policy and customer concentration.

However, even with these international wins, investors must be aware that prolonged margin pressures and continued legal costs could...

Read the full narrative on Shoals Technologies Group (it's free!)

Shoals Technologies Group is projected to reach $586.7 million in revenue and $76.4 million in earnings by 2028. This outlook assumes a 13.6% annual revenue growth rate and an increase in earnings of $55.3 million from the current $21.1 million.

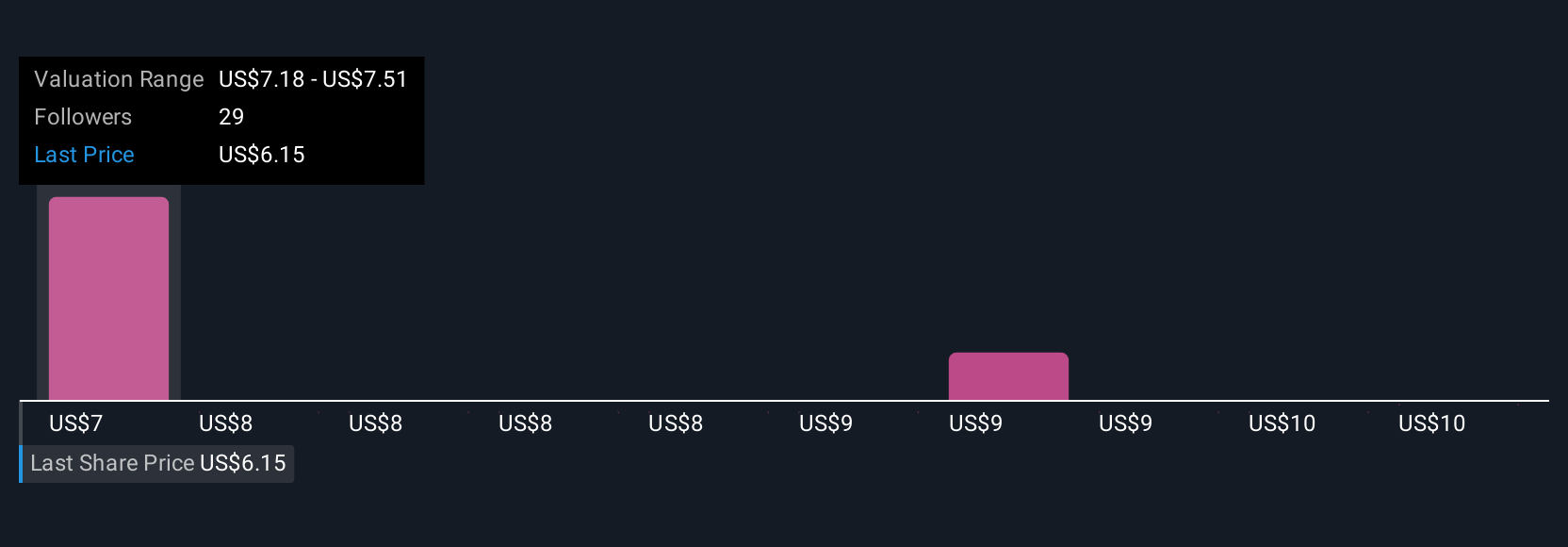

Uncover how Shoals Technologies Group's forecasts yield a $7.18 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members span US$7.18 to US$10.42 per share, reflecting broad differences in outlooks. With recent overseas project wins stirring optimism, ongoing margin pressure and legal spending may sway performance more than many expect, explore these varied viewpoints to better assess your next step.

Explore 3 other fair value estimates on Shoals Technologies Group - why the stock might be worth as much as 52% more than the current price!

Build Your Own Shoals Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shoals Technologies Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shoals Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shoals Technologies Group's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives