- United States

- /

- Construction

- /

- NasdaqGS:ROAD

Is the Construction Partners Rally Justified After Major Infrastructure Wins?

Reviewed by Bailey Pemberton

- Wondering if Construction Partners is worth your hard-earned cash right now? You are not alone, especially with everyone keeping an eye on which stocks might be undervalued in today's market.

- The share price is up a whopping 30.8% year-to-date and has delivered a stellar 377.3% in five years, though it is down a notch this month.

- Investors are still buzzing about the company's recent project wins and ongoing infrastructure spending across the nation. Headlines highlighting new contracts and ambitious transportation initiatives have helped fuel optimism, giving the stock extra momentum despite some short-term volatility.

- Interestingly, Construction Partners scores just 0/6 on our valuation checks. This suggests the market may be pricing in a lot of good news already. Stick around as we compare the usual valuation approaches and reveal a smarter way to evaluate if the current price makes sense.

Construction Partners scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Construction Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of Construction Partners by projecting the company’s future cash flows and discounting them back to today, using the time value of money. This method helps investors judge what a stock should truly be worth, based on its likely ability to generate cash in the future.

Currently, Construction Partners reports Free Cash Flow (FCF) of $142.96 million. Analyst forecasts see steady growth over the next five years, with projected FCF climbing to $259.41 million by 2027. Beyond that, projections by Simply Wall St estimate FCF could reach about $365.85 million by 2035, reflecting continued but moderating annual growth.

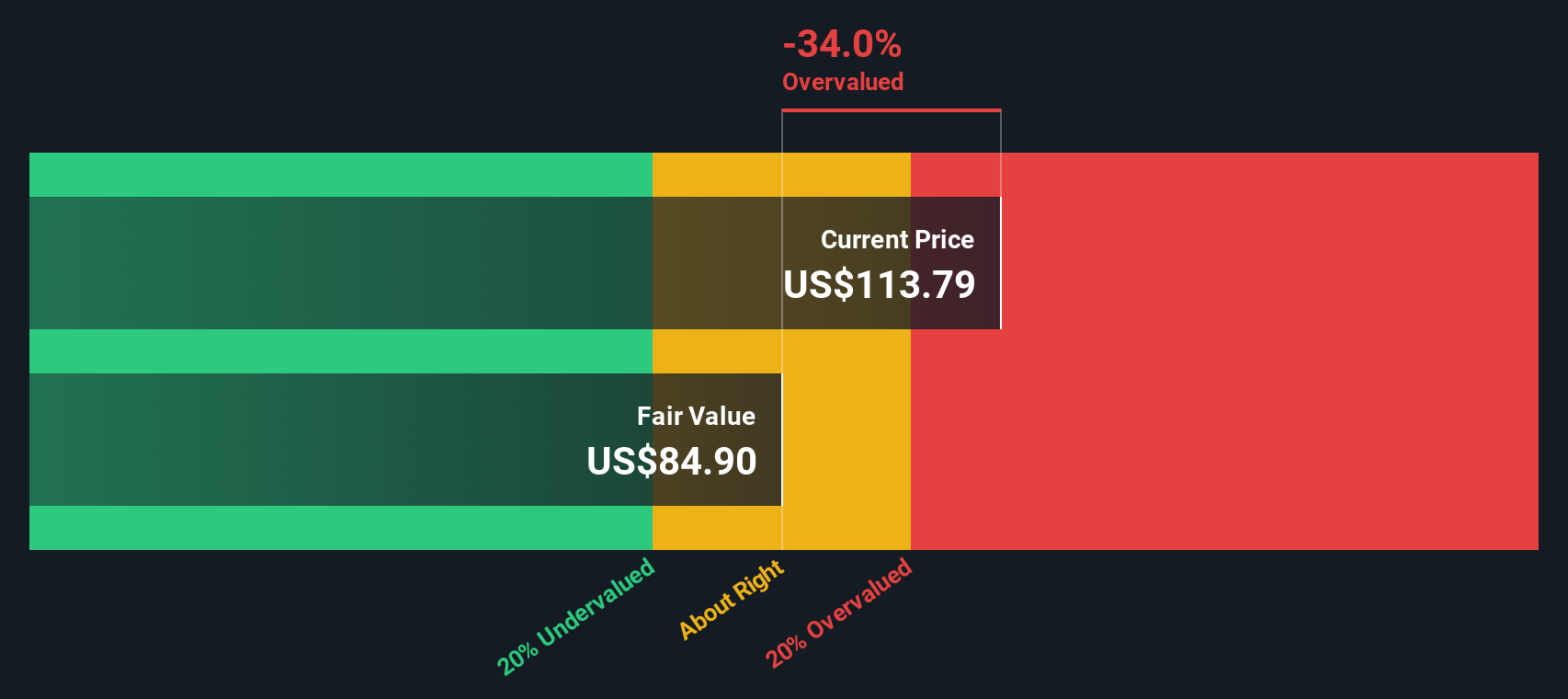

Based on these numbers, the DCF fair value is $83.75 per share. However, with the recent market price running about 37.1% above this value, the stock appears meaningfully overvalued according to these cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Construction Partners may be overvalued by 37.1%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Construction Partners Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation tool, especially for profitable companies like Construction Partners. It reflects how much investors are willing to pay for each dollar of earnings, making it a useful benchmark when earnings are positive and relatively stable.

Typically, a higher PE ratio might signal anticipation of faster growth or lower risk, while a lower PE implies slower growth or more uncertainty. What constitutes a "fair" PE, however, depends on factors like expected earnings growth, industry conditions, company size, profit margins, and risk profile.

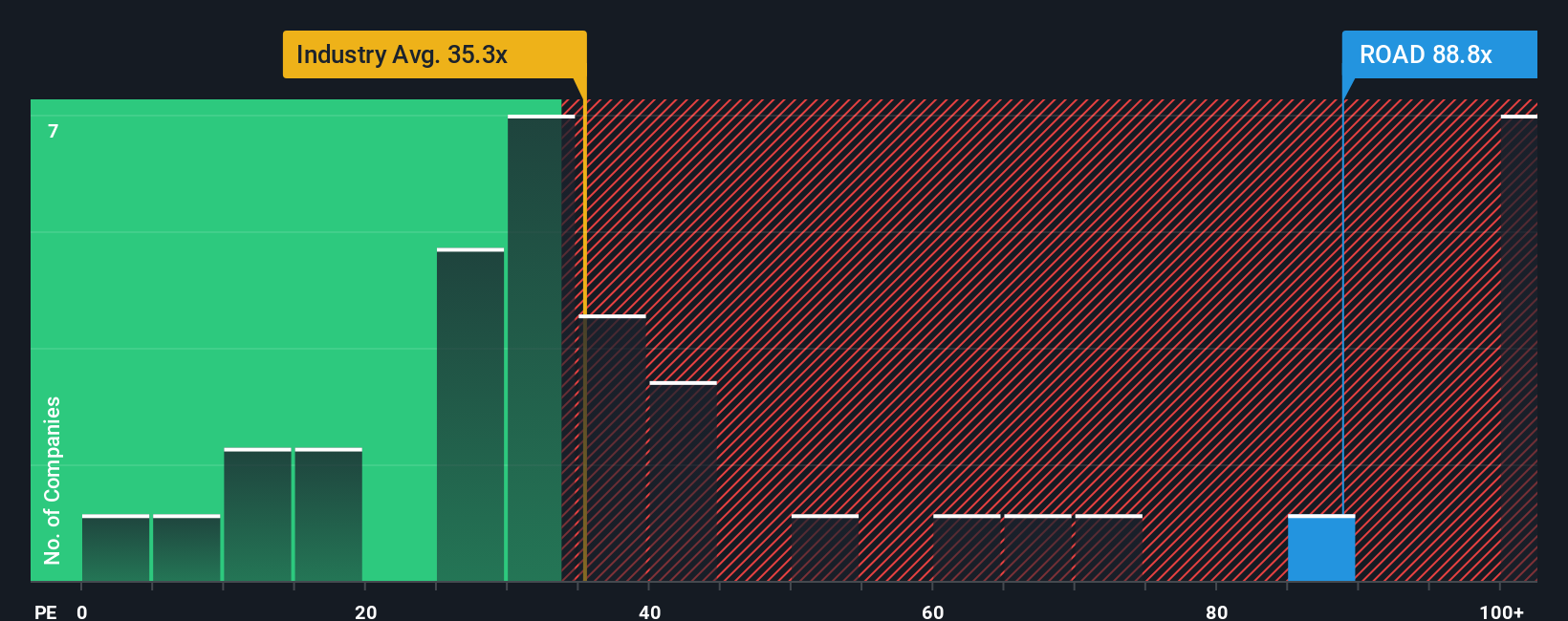

Construction Partners currently trades at a PE ratio of 86.4x. For context, this is substantially higher than the construction industry average of 34.5x and its peers’ average of 22.5x. However, Simply Wall St’s proprietary Fair Ratio for the company is 35.8x, which incorporates additional factors including Construction Partners’ growth prospects, margins, and risk profile, rather than focusing solely on basic peer or industry comparisons.

Using the Fair Ratio provides a more accurate assessment than simple benchmarks, since it weighs the company’s specific strengths and risks. Comparing the actual PE of 86.4x to the Fair Ratio of 35.8x, Construction Partners appears significantly overvalued when using this robust, company-tailored metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Construction Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a tool that brings your perspective to life by turning a company's story into a financial forecast and a fair value. On Simply Wall St's Community page, millions of investors are already using Narratives to blend their view of a company’s future, such as revenue, earnings, and margin trends, with the numbers that matter. This helps answer the question, “Is now a good time to buy or sell?” Narratives link what is happening in the real world, such as new contracts, acquisitions, or policy shifts, directly to updated forecasts. This way, you can see if the current price still makes sense after fresh news or earnings are released.

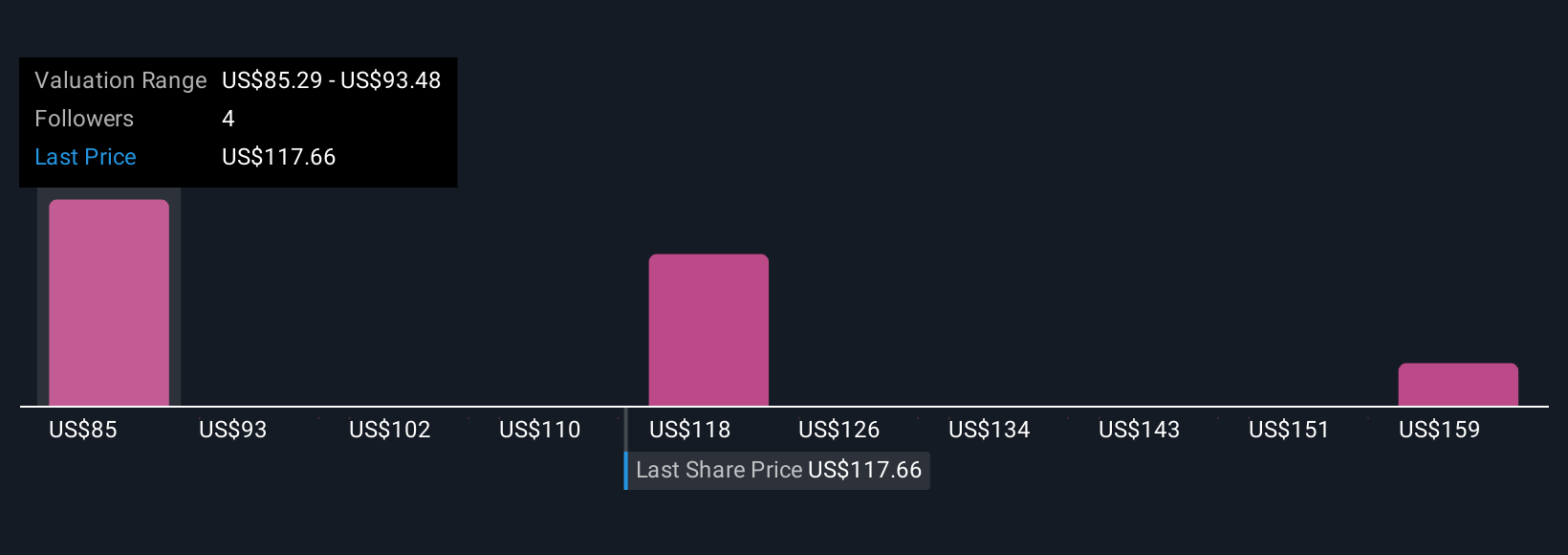

This approach is accessible to everyone. Just choose or create a Narrative that matches your outlook, and you will immediately see how your assumptions stack up against the market price and other investors’ views. For instance, some Construction Partners Narratives are highly optimistic, projecting double-digit growth, analyst consensus price targets of $131, and strong margin expansion from recent Texas acquisitions. Others are more conservative, flagging risks around public funding and profitability, resulting in fair values as low as $120 based on lower growth and margin estimates.

Do you think there's more to the story for Construction Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives