- United States

- /

- Construction

- /

- NasdaqGS:ROAD

How Investors May Respond To Construction Partners (ROAD) Surging Revenue Growth and Strategic Texas Acquisition

Reviewed by Sasha Jovanovic

- Earlier this week, Loomis Sayles highlighted Construction Partners, Inc. in an investor letter, emphasizing the company's strong revenue growth in the southern and southeastern U.S. through organic expansion and large-scale acquisitions, most recently a significant deal in Texas.

- An important insight from this coverage is the positive investor reaction to Construction Partners' consistent revenue growth and successful integration of acquisitions in high-growth regions, which underscores its appeal for those focused on expanding market share.

- We'll now examine how investor enthusiasm for recent acquisition successes and robust earnings outlook may alter Construction Partners' investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Construction Partners Investment Narrative Recap

Shareholders in Construction Partners, Inc. are likely confident in the company's ability to capture infrastructure spending, deliver consistent revenue growth in sunbelt states, and execute on acquisitions like their recent Texas expansion. This week's investor enthusiasm, driven by proven acquisition integration and a positive earnings outlook, reinforces that the main near-term catalyst remains robust public infrastructure funding, while the greatest risk continues to be a pullback in government spending, neither of which has materially shifted following the news.

Among recent developments, the August 7 earnings call stands out, as management reaffirmed guidance for fiscal 2025 with projected revenue between US$2.77 billion and US$2.83 billion, underlining their confidence in sustained contract flow and integration of Texas operations, points that align with market optimism around growth catalysts.

However, contrasting with surging optimism, investors should be mindful that Construction Partners’ reliance on public funding means...

Read the full narrative on Construction Partners (it's free!)

Construction Partners' narrative projects $4.1 billion revenue and $286.4 million earnings by 2028. This requires 18.3% yearly revenue growth and a $211.9 million earnings increase from $74.5 million today.

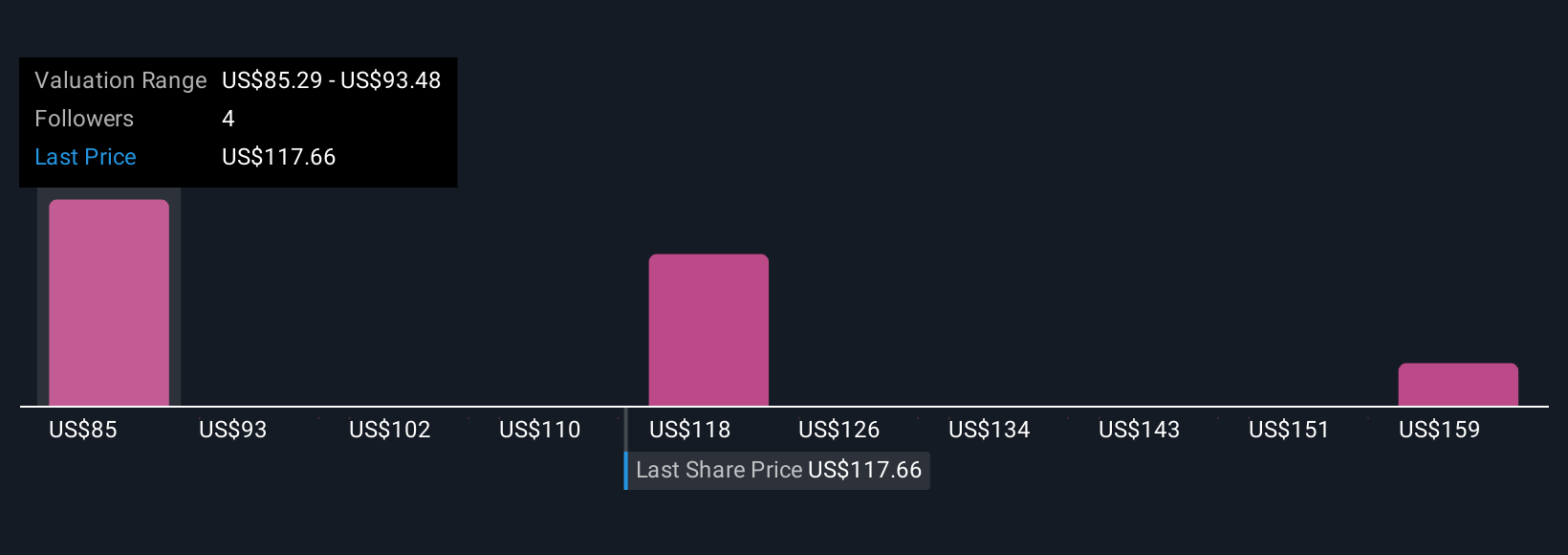

Uncover how Construction Partners' forecasts yield a $120.17 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced two fair value estimates for Construction Partners ranging from US$74.39 to US$120.17 per share. While opinions diverge, ongoing dependence on government infrastructure commitments may weigh heavily on future returns, consider these different viewpoints carefully.

Explore 2 other fair value estimates on Construction Partners - why the stock might be worth 41% less than the current price!

Build Your Own Construction Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Construction Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Construction Partners' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives