- United States

- /

- Construction

- /

- NasdaqGS:ROAD

Construction Partners (ROAD): Assessing Valuation After Q4 Earnings Growth and Quarterly EPS Miss

Reviewed by Simply Wall St

Construction Partners (ROAD) just posted its fiscal fourth-quarter earnings, revealing strong year-over-year growth in both sales and net income. However, quarterly earnings per share missed analyst expectations.

See our latest analysis for Construction Partners.

Despite robust annual growth from recent acquisitions and a record backlog, Construction Partners’ share price has pulled back, down 14.3% over the past month. A quarterly earnings miss appears to have cooled some of the earlier momentum. However, the company’s strong three- and five-year total shareholder returns of 245% and 293% respectively highlight its long-term growth story.

If this shift in sentiment has you wondering what else is catching investors’ attention, consider expanding your search and discover fast growing stocks with high insider ownership

With shares recently pulling back despite record growth and upbeat guidance, investors are left wondering if ROAD’s current valuation offers a compelling entry point or if the market has already accounted for the company’s future prospects.

Most Popular Narrative: 17% Undervalued

Construction Partners' latest fair value is pegged at $122.50, well above the last close of $101.16. This suggests investors are at a crossroads, as market skepticism is evident despite stronger financial guidance and strategic acquisitions.

Ongoing vertical integration, through investment in owned asphalt plants and material sourcing, combined with increasing scale, is already enhancing operational efficiencies and margin expansion, as shown by record adjusted EBITDA margins despite weather disruptions. This should drive higher net margins and improved earnings resilience going forward.

Ever wondered what bold growth projections and operating upgrades are powering this aggressive valuation? The underlying numbers may reveal a pattern that shapes the company’s next major move. Secrets behind the margin expansion and ambitious bottom-line targets are just a click away. See what sets this narrative apart from conventional forecasts.

Result: Fair Value of $122.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on public infrastructure funding and regional economic swings could quickly change the company’s outlook if conditions shift unexpectedly.

Find out about the key risks to this Construction Partners narrative.

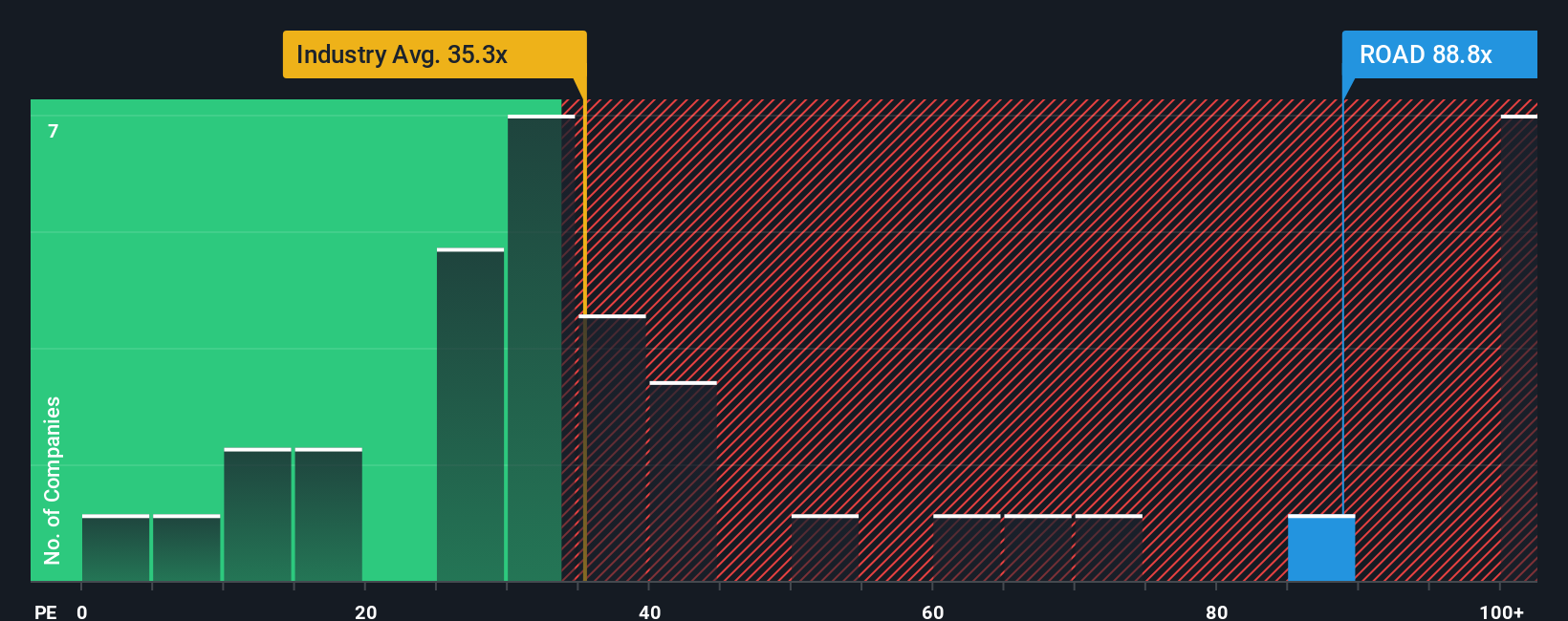

Another View: Market-Based Multiples Signal Stretch

Looking through a market-based lens, ROAD’s current price-to-earnings ratio is 55.6x. That is significantly higher than both the sector average of 31.2x and what our fair ratio analysis suggests. This gap hints at a higher valuation risk if growth doesn’t accelerate as expected. Is the market pricing in too much optimism or simply rewarding execution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Construction Partners Narrative

If you want a fresh perspective or believe there is more to the story, dive into the data and piece together your own Construction Partners thesis in just minutes. Do it your way

A great starting point for your Construction Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game by searching beyond the obvious. There are opportunities you could be missing in sectors shaping tomorrow’s market leaders. Use these screeners to discover your next smart move before others do:

- Capture powerful growth trends by reviewing these 30 healthcare AI stocks, which are transforming patient care with artificial intelligence and predictive analytics.

- Unlock opportunities for steady income by checking out these 16 dividend stocks with yields > 3%, offering reliable yields over 3% and robust payout histories.

- Catch game-changing potential early with these 26 quantum computing stocks, pushing the boundaries of computing power and breakthrough technology development.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives