- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab (RKLB): Evaluating Valuation After Record Revenue, New Contracts, and Accelerating Launch Milestones

Reviewed by Simply Wall St

Rocket Lab (RKLB) is turning heads this quarter after announcing record Q3 2025 revenue and sharing a steady stream of launch milestones. New contracts with JAXA and U.S. defense agencies signal the company’s expanding influence.

See our latest analysis for Rocket Lab.

Despite a year-to-date share price return of 61.74%, Rocket Lab’s stock has encountered recent turbulence, falling 35.9% in the past month following a series of rapid launches and new partnerships. Even so, long-term investors remain significantly ahead, with a total shareholder return of 909.25% over three years. While momentum appears to be easing in the short term, operational achievements and strong demand indicate that growth prospects remain.

If fast-moving aerospace news has you thinking bigger, you’ll want to see what’s happening across the entire sector. See the full list for free.

With strong growth, headline contracts, and impressive technical momentum, the key debate now is whether Rocket Lab’s recent pullback presents a buying opportunity or if the market has already priced in its future gains.

Most Popular Narrative: 38.5% Undervalued

Rocket Lab’s widely tracked narrative puts its fair value well above the latest closing price, implying substantial upside if ambitious targets are hit. The narrative’s projection depends on a bold shift to integrated solutions and rapid scaling of launch operations.

Rocket Lab's move toward end-to-end space solutions, including the acquisition of Geost and expanding vertically integrated payload, satellite, and launch service capabilities, uniquely positions the company to capture larger, national security and defense contracts like the Golden Dome and SDA constellations. This supports significant top-line growth and enhanced gross margins in future quarters.

Curious about what powers such a confident fair value? The story behind this calculation includes bold projections for top-line growth and a margin turnaround that few would bet on without insider insights. If you want to see how these pivotal financial forecasts fit together, the full narrative will leave you rethinking what’s possible for Rocket Lab’s valuation.

Result: Fair Value of $65.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it is worth noting that delays in Neutron’s development or setbacks in integrating new programs could quickly undermine the current optimism surrounding Rocket Lab.

Find out about the key risks to this Rocket Lab narrative.

Another View: The Price-to-Sales Premium

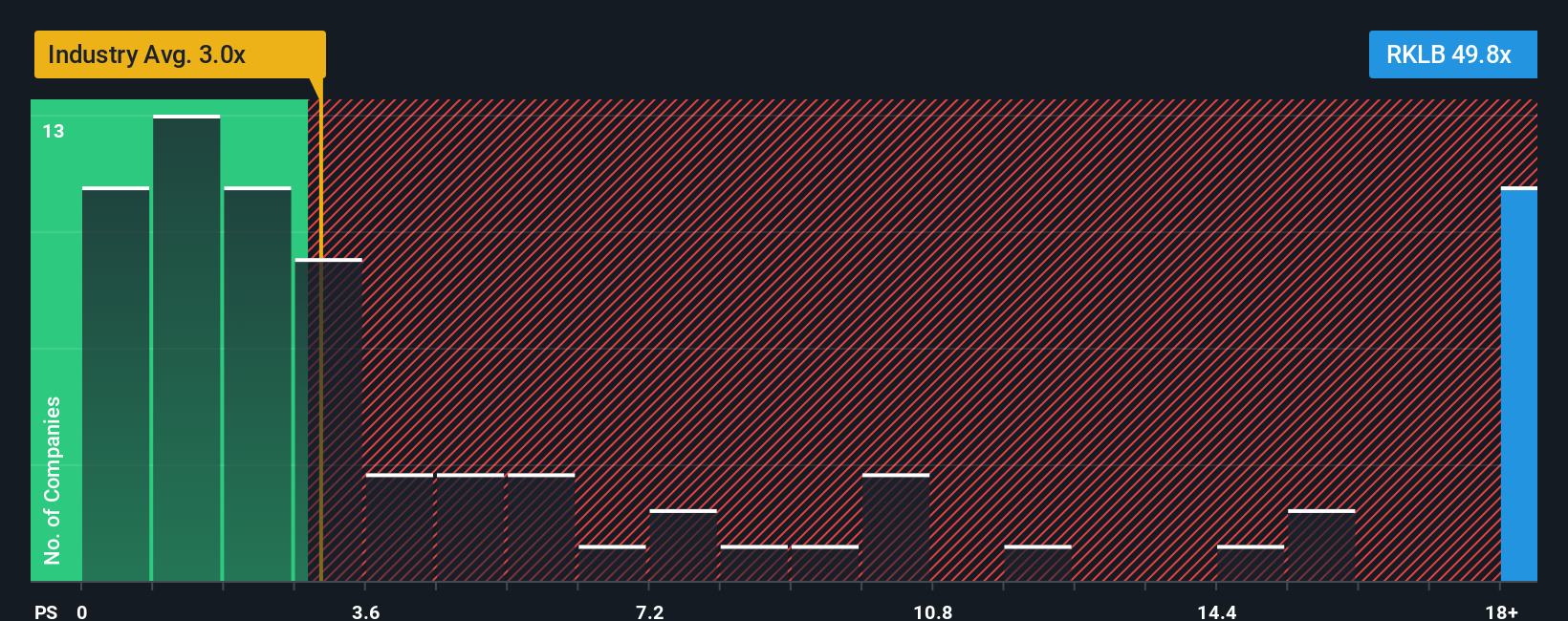

While narrative-driven valuation suggests Rocket Lab has room to run, the current price-to-sales ratio tells a different story. At 38.9x, it far exceeds the US Aerospace & Defense industry average of 2.9x, the peer group’s 8.2x, and even the fair ratio estimate of 6.8x. This significant gap means investors may be paying a steep premium for future potential. Will the company’s rapid growth justify this level over time, or is valuation risk starting to outweigh opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Lab Narrative

If you see things differently or enjoy digging into the details firsthand, you can generate your own Rocket Lab story in just a few minutes. Do it your way.

A great starting point for your Rocket Lab research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors don’t wait around. Try the powerful Simply Wall Street screener to find fast-moving stocks, overlooked value, and unique opportunities you might otherwise miss.

- Boost your income strategy by checking out these 14 dividend stocks with yields > 3%, which offers yields above the market and solid fundamentals for steady returns.

- Spot tomorrow’s tech leaders by searching through these 25 AI penny stocks, positioned at the forefront of artificial intelligence innovation.

- Find exceptional value by browsing these 929 undervalued stocks based on cash flows, which stands out for strong fundamentals and attractive pricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026