- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Is Rocket Lab’s 71% Rise Justified After New Government Contracts and Volatility in 2025?

Reviewed by Bailey Pemberton

- Curious if Rocket Lab's meteoric share price actually matches the company's real long-term value? You're definitely not alone, and this deep dive aims to clear things up.

- Despite an impressive 71.4% gain so far this year and an eye-catching 881.2% return over the last three years, the last week and month have seen sharp drops of -16.5% and -35.4%, adding a dose of volatility to the story.

- Much of this action has been tied to recent news around fresh government contract wins and the company's expanding launch schedule. These developments have fueled both optimism and caution among investors. Headlines highlighting increasing competition and regulatory scrutiny have also contributed to the recent swings.

- With Rocket Lab scoring 0 out of 6 possible checks for undervaluation, the numbers certainly spark debate. Before settling on a conclusion, let's compare the usual valuation approaches and preview a smarter way to judge value at the end of this article.

Rocket Lab scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rocket Lab Discounted Cash Flow (DCF) Analysis

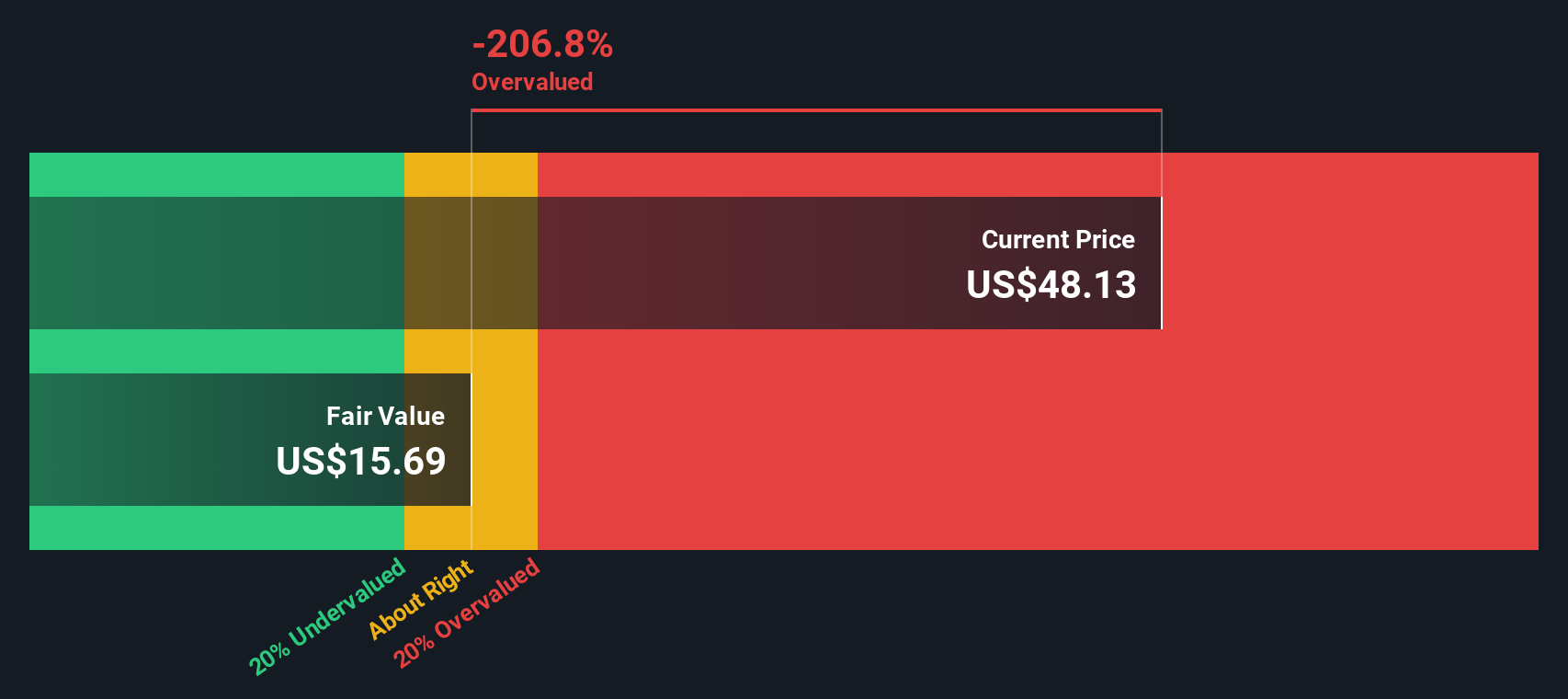

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today. This approach provides an intrinsic value based on anticipated performance. For Rocket Lab, DCF analysis uses cash flow projections based on both analyst estimates and further extrapolations.

Rocket Lab's latest twelve-month Free Cash Flow (FCF) stands at negative $220.3 Million. Looking forward, analysts expect positive momentum, projecting FCF to shift into positive territory by 2027 and rise to $612 Million by 2029. Further long-term projections, extrapolated by Simply Wall St, estimate FCF to reach about $1.3 Billion by 2035. All figures are in USD, aligning with share price reporting.

Based on these assumptions and discounting, Rocket Lab’s estimated fair value is $38.07 per share. However, according to the DCF model, the stock currently trades at about 12.4 percent above this intrinsic value, implying it is somewhat overvalued at current prices.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rocket Lab may be overvalued by 12.4%. Discover 904 undervalued stocks or create your own screener to find better value opportunities.

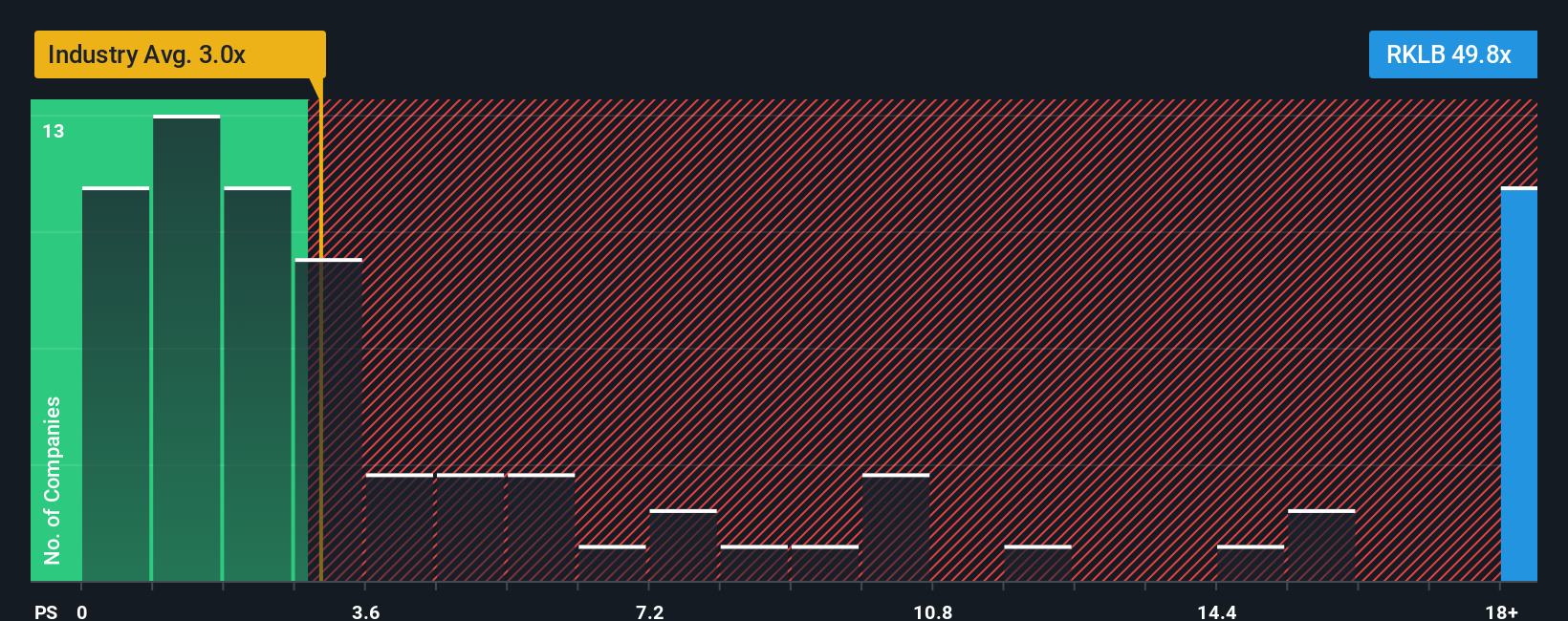

Approach 2: Rocket Lab Price vs Sales

When valuing companies, the Price-to-Sales (P/S) multiple is often the go-to metric for those that are not yet profitable, which is the case with Rocket Lab. This ratio helps investors understand how much the market is currently valuing each dollar of the company's sales. While the Price-to-Earnings ratio is ideal for established, profitable businesses, P/S is better suited for companies where earnings are negative or volatile but revenue growth is expected.

Growth expectations and company risk both play a major role in determining what P/S ratio should be considered "normal." Fast-growing, innovative companies may command higher P/S multiples due to their future potential, but come with added risk, so investors balance optimism with caution.

Rocket Lab currently trades at a P/S ratio of 41.21x. For reference, the average for the Aerospace & Defense industry is 2.94x, while close peers average about 11.31x. However, rather than relying solely on these broad benchmarks, Simply Wall St calculates a proprietary “Fair Ratio.” This Fair Ratio (7.49x for Rocket Lab) takes into account specific growth forecasts, company size, profit margins, risk factors, and sector standards, making it a more nuanced and tailored measure than simple peer or industry comparisons.

Comparing Rocket Lab’s actual P/S (41.21x) to its Fair Ratio (7.49x), the stock trades significantly above what would be justified given its unique profile and prospects. This suggests Rocket Lab shares may be overvalued based on the current Price-to-Sales approach.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rocket Lab Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple, intuitive tool that combines your perspective on Rocket Lab’s story with the numbers, such as future revenues, earnings, and margins, to estimate fair value. Narratives connect what you believe about a company’s future with the math that drives its valuation, giving you a personalized fair value based on your own expectations.

Available right on Simply Wall St’s Community page and used by millions of investors, Narratives make investing more accessible by letting you see, build, or compare the journeys that matter to you, not just what the market or analysts think. As news or earnings drop, Narratives update automatically, keeping your view aligned with the latest developments. By comparing your fair value to today’s price, you can assess whether it’s time to buy, hold, or sell, based on your own logic.

For example, one investor might believe Rocket Lab will capture a huge share of the growing space economy and reach $6B in revenue by 2035. This sets their fair value above $58. Another, more cautious perspective might value the company as low as $20, leading to very different decisions.

For Rocket Lab, we'll make it really easy for you with previews of two leading Rocket Lab Narratives:

Analyst Consensus Narrative Fair Value: $58.67

Current Price vs. Fair Value: 27.0% below fair value

Projected Revenue Growth Rate: 37.36%

- Expanded vertical integration and a growing end-to-end space solutions business position Rocket Lab to win major national security and government contracts. This could enable future top-line and margin growth.

- Continued innovation in rocket reusability and high launch cadence, together with proprietary satellite production, support multi-year revenue expansion and improved predictability.

- While near-term R&D spending and contract lumpiness could pressure results, the consensus expects rapid revenue and margin improvement to justify higher valuations. Most analysts see current pricing as fair to undervalued based on future execution.

Long-Term Value Estimate: $31.72

Current Price vs. Fair Value: 34.9% above fair value

Projected Revenue Growth Rate: 30.0%

- Achieving ambitious $6B revenue targets depends on the successful scale-up of Neutron launches and maintaining a high margin in Space Systems. Significant operational, financial, and execution risks remain.

- Space flight is a high-risk, capital-intensive frontier, and Rocket Lab must manage working capital and avoid shareholder dilution while pursuing aggressive growth, all with an eye on looming competition, especially from SpaceX.

- While vertical integration opens opportunity, true scale and profitability are distant. Current valuations leave little margin for error if Neutron underperforms or market dynamics shift unfavorably.

Do you think there's more to the story for Rocket Lab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives