- United States

- /

- Electrical

- /

- NasdaqCM:PPSI

Benign Growth For Pioneer Power Solutions, Inc. (NASDAQ:PPSI) Underpins Its Share Price

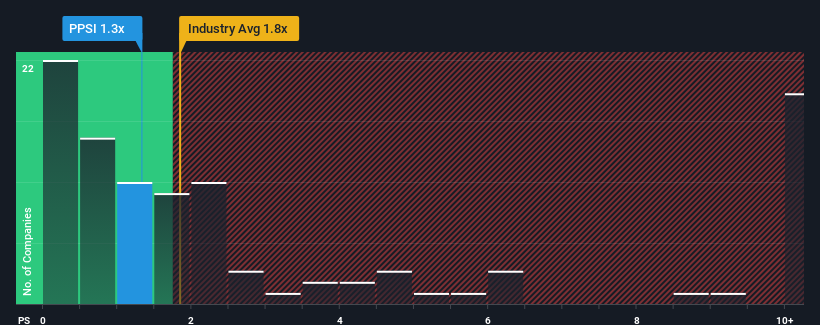

Pioneer Power Solutions, Inc.'s (NASDAQ:PPSI) price-to-sales (or "P/S") ratio of 1.3x might make it look like a buy right now compared to the Electrical industry in the United States, where around half of the companies have P/S ratios above 1.8x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Pioneer Power Solutions

How Has Pioneer Power Solutions Performed Recently?

Pioneer Power Solutions could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pioneer Power Solutions.Is There Any Revenue Growth Forecasted For Pioneer Power Solutions?

In order to justify its P/S ratio, Pioneer Power Solutions would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 69% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 3.9% per annum during the coming three years according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 22% per year, which is noticeably more attractive.

In light of this, it's understandable that Pioneer Power Solutions' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Pioneer Power Solutions' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 2 warning signs for Pioneer Power Solutions that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PPSI

Pioneer Power Solutions

Pioneer Power Solutions, Inc., together with its subsidiaries, design, manufacture, integrate, refurbish, distribute, sell, and service electric power systems, distributed energy resources, power generation equipment, and mobile EV charging solutions.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026