- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Will Powell Industries' (POWL) Utility Tailwinds Sustain Its Momentum Amid Grid and Data Center Growth?

Reviewed by Sasha Jovanovic

- Carillon Tower Advisers highlighted Powell Industries in its third-quarter 2025 investor letter, citing the company’s strong performance amid a positive outlook for the utility end market and increased opportunities linked to grid upgrades and data center expansion.

- Recent macroeconomic factors, such as softer inflation and enhanced capital investment in electrical infrastructure, are enhancing the company’s potential to benefit from broader industry growth trends.

- To understand how continued momentum in utility and grid-related investments could shift Powell Industries’ outlook, we’ll examine the investment narrative in light of this news.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Powell Industries Investment Narrative Recap

To be a Powell Industries shareholder, you need confidence in continued demand for electrical infrastructure, particularly from utilities and data centers, and believe the company can convert its sizable backlog into profitable growth. Recent news of softer inflation boosted optimism for rate cuts, which could support capital-intensive projects, but does not fundamentally shift the primary short-term catalyst: ongoing momentum in grid modernization and utility spending. The biggest immediate risk remains if order flow slows or project mix leads to less favorable margins, which this news does not appear to materially impact.

Powell’s recent announcement to expand its Jacintoport facility in Houston, a $12.4 million investment increasing production capacity by 62%, underscores a commitment to meeting anticipated demand from utility and data center customers. This significant capacity boost aligns with the company’s strategy to capitalize on strong end-market trends, yet also raises the stakes for maintaining high utilization rates to support recent margin gains.

By contrast, investors should be aware that if Powell’s project mix reverts to longer-cycle or less profitable work, pressures on earnings could arise...

Read the full narrative on Powell Industries (it's free!)

Powell Industries' narrative projects $1.3 billion revenue and $169.4 million earnings by 2028. This requires 5.7% yearly revenue growth and a $6 million decrease in earnings from the current $175.4 million level.

Uncover how Powell Industries' forecasts yield a $269.26 fair value, a 30% downside to its current price.

Exploring Other Perspectives

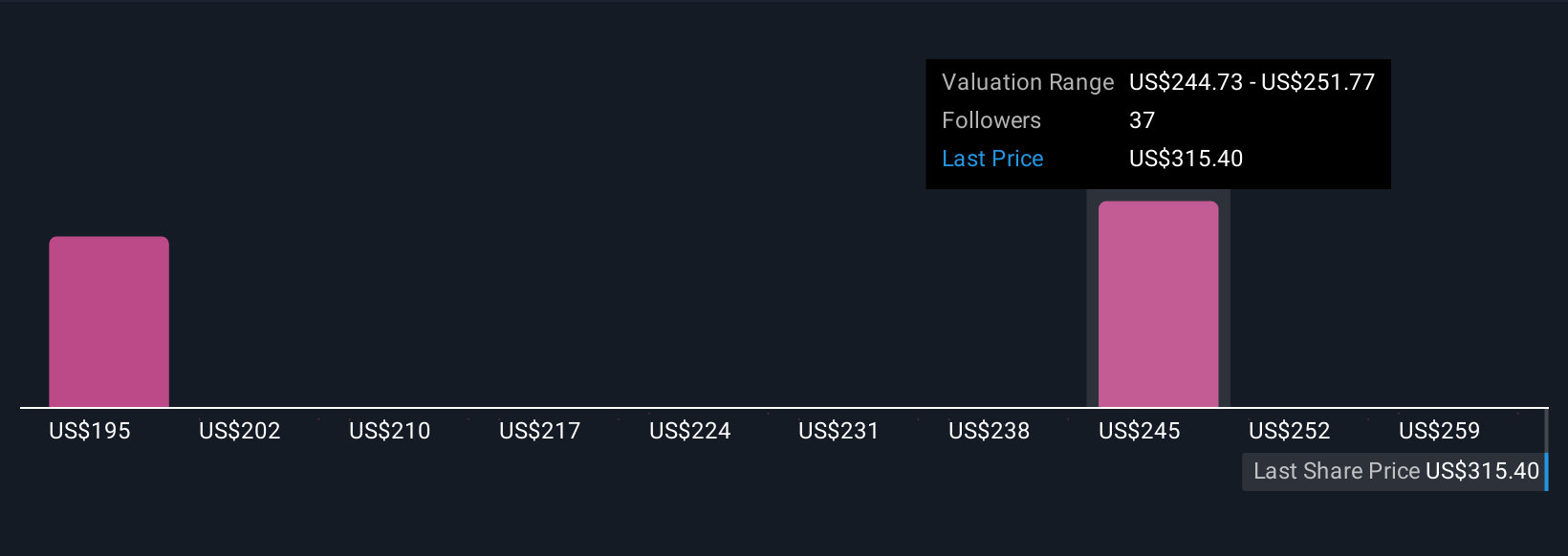

Simply Wall St Community members offered 4 individual fair value estimates for Powell ranging from US$191.73 to US$269.26 per share. While opinions vary widely, much of the optimism relates to Powell’s recent backlog growth and exposure to secular electrification trends, but any moderation in order momentum could shift sentiment considerably.

Explore 4 other fair value estimates on Powell Industries - why the stock might be worth as much as $269.26!

Build Your Own Powell Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Powell Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Powell Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Powell Industries' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives