- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Powell Industries (POWL): Evaluating Current Valuation After Strong Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Powell Industries.

Momentum around Powell Industries is building, with a 12.73% 1-month share price return and the stock now up more than 55% year-to-date. While short-term moves have been volatile, the company’s three- and five-year total shareholder returns of 1,365% and 1,408%, respectively, are nothing short of exceptional. This hints at long-term value recognition beyond recent headlines.

If strong sustained runs like this have you curious about what else could be next, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares soaring well above analyst price targets, is Powell Industries undervalued and primed for more upside, or has the market already anticipated all of its future growth potential?

Most Popular Narrative: 32% Overvalued

With the last close at $356.23 a share and a narrative fair value of $269.26, the current market price sits far above what the most widely tracked storyline believes the stock is worth. The stage is set for debate on whether investor optimism has run too far ahead of the fundamentals.

The market may be pricing in sustained outsized revenue growth and backlog conversion driven by robust order activity in electric utility, data center, and offshore energy infrastructure. These sectors are benefiting from the accelerating buildout of electrification and grid modernization, which could result in potentially over-optimistic top-line expectations.

Curious what punchy financial projections power this high-flying narrative? Behind that headline figure are bullish revenue targets, future profit margin bets, and assumptions on sector demand that few would dare stake. Just which numbers make such a headstrong valuation credible? Dive into the narrative to see the bold case broken down.

Result: Fair Value of $269.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong growth in electrification markets or successful entry into high-margin automation could quickly validate higher expectations and challenge the overvaluation narrative.

Find out about the key risks to this Powell Industries narrative.

Another View: Multiples Tell a Different Story

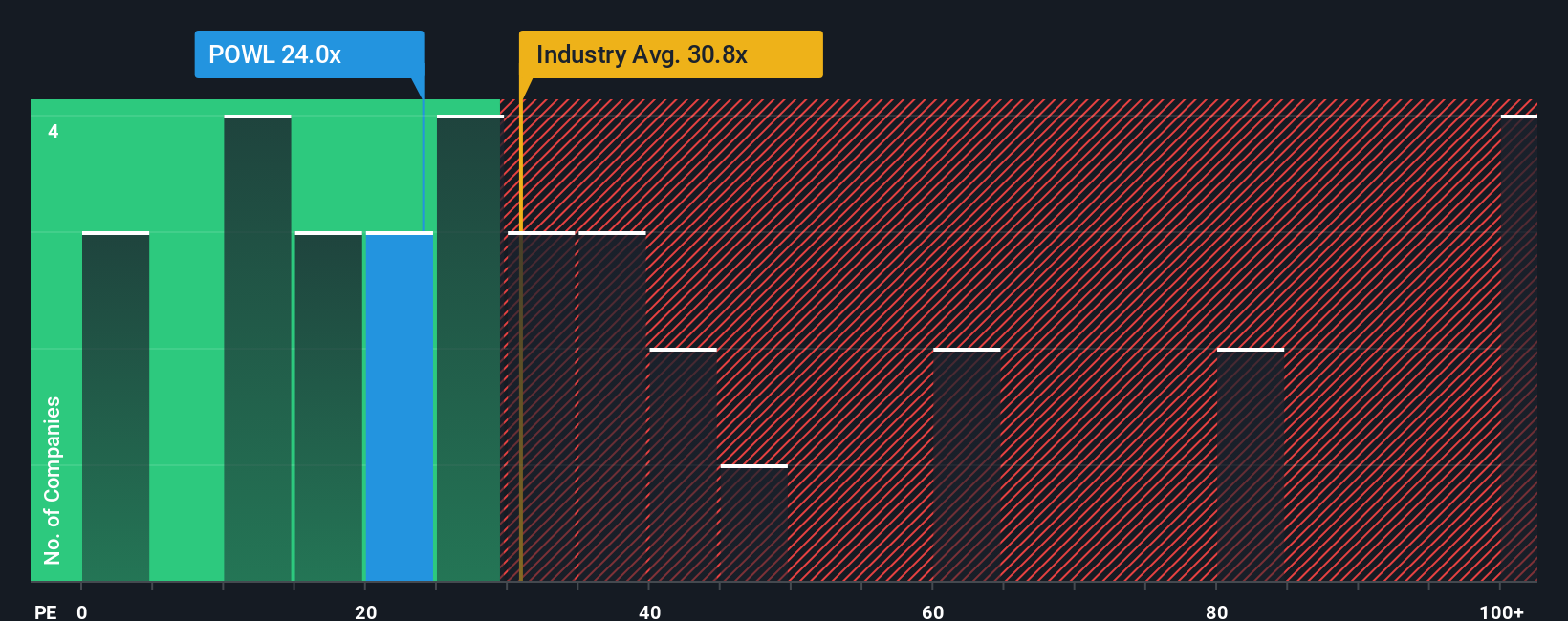

Looking beyond narrative fair value, current market pricing suggests a more complicated picture when compared to similar companies. Powell Industries trades at a price-to-earnings ratio of 24.5x, lower than the US Electrical industry average of 29.5x and well under the peer average of 51.8x. The fair ratio sits close by at 25x, so there is little disconnect between price and this benchmark. While these numbers appear to signal reasonable value now, any move by the market toward the higher average could hint at missed opportunity or could signal risk if investor sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Powell Industries Narrative

If this perspective does not quite match your own or you prefer hands-on analysis, you can chart your own narrative in just minutes. Do it your way

A great starting point for your Powell Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Let’s make your next move count. Explore exclusive opportunities the market often overlooks and give yourself an edge by checking these timely ideas:

- Capture untapped growth by starting with these 27 AI penny stocks. These are reshaping industries through advanced automation and intelligent data solutions.

- Put your money to work with income potential. Review these 14 dividend stocks with yields > 3% that offer attractive yields above 3% for reliable cash flow.

- Ride the wave of the rapidly evolving digital economy by targeting these 82 cryptocurrency and blockchain stocks, which are driving new trends in blockchain innovation and fintech disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives